Altria Group, Inc. (MO), headquartered in Richmond, Virginia, manufactures and sells smokeable and oral tobacco products. Valued at $104.1 billion by market cap, the company offers cigarettes primarily under the Marlboro brand, large cigars and pipe tobacco under the Black & Mild brand, moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands, and more.

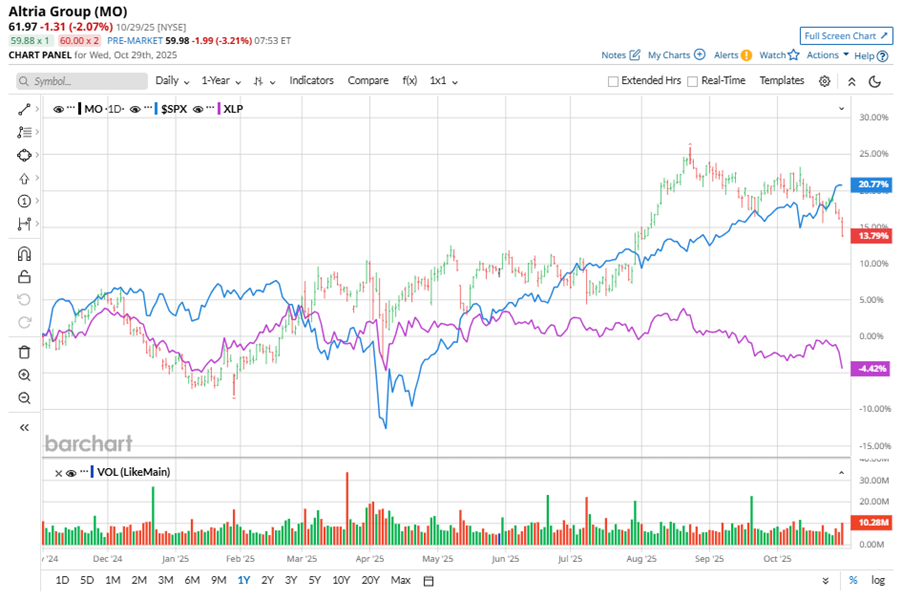

Shares of this leading tobacco company have outperformed the broader market over the past year. MO has gained 24.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.1%. In 2025, MO stock is up 18.5%, surpassing the SPX’s 17.2% gains on a YTD basis.

Zooming in further, MO’s outperformance is also apparent compared to the Consumer Staples Select Sector SPDR Fund (XLP). The exchange-traded fund has declined about 4.8% over the past year. Moreover, MO’s double-digit returns on a YTD basis outshine the ETF’s 2.6% dip over the same time frame.

On Oct. 30, MO reported its Q3 results. Its adjusted EPS of $1.45 beat Wall Street expectations of $1.44. The company’s adjusted revenue was $5.25 billion, missing Wall Street's $5.32 billion forecast. Altria expects full-year adjusted EPS in the range of $5.37 to $5.45.

For the current fiscal year, ending in December, analysts expect MO’s EPS to grow 6.1% to $5.43 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

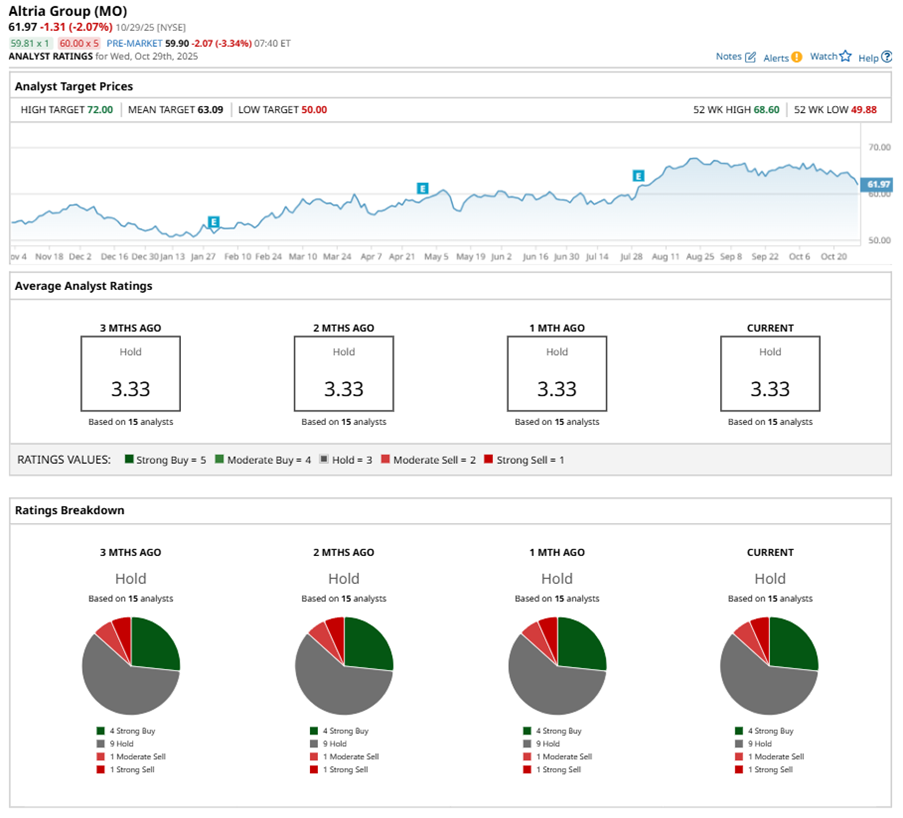

Among the 15 analysts covering MO stock, the consensus is a “Hold.” That’s based on four “Strong Buy” ratings, nine “Holds,” one “Moderate Sell,” and one “Strong Sell.”

The configuration has been consistent over the past three months.

On Oct. 2, The Goldman Sachs Group, Inc. (GS) analyst Bonnie Herzog maintained a “Buy” rating on MO and set a price target of $72, the Street-high price target, implying a potential upside of 16.2% from current levels.

The mean price target of $63.09 represents a 1.8% premium to MO’s current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Fall Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit