What if you could lend money to the safest borrower on the planet and collect interest for decades?

That’s exactly what you’re doing when you buy U.S. Treasury securities.

In his latest video, “7 Ways to Make Money From Your Investments (Beyond Dividends),” Rick Orford breaks down how Treasury Bills, Treasury Bonds, and bond laddering strategies can help you build predictable, low-risk income — even as markets stay volatile.

What Are Treasurys?

U.S. Treasurys are debt securities issued by the federal government, used to fund everything from infrastructure to defense. When you buy a Treasury, you’re effectively lending money to the U.S. government in exchange for interest payments known as coupons.

Here’s how it works:

- T-Bills: Mature in a few weeks to a year.

- T-Notes: Mature in 2–10 years.

- T-Bonds: Mature in up to 30 years.

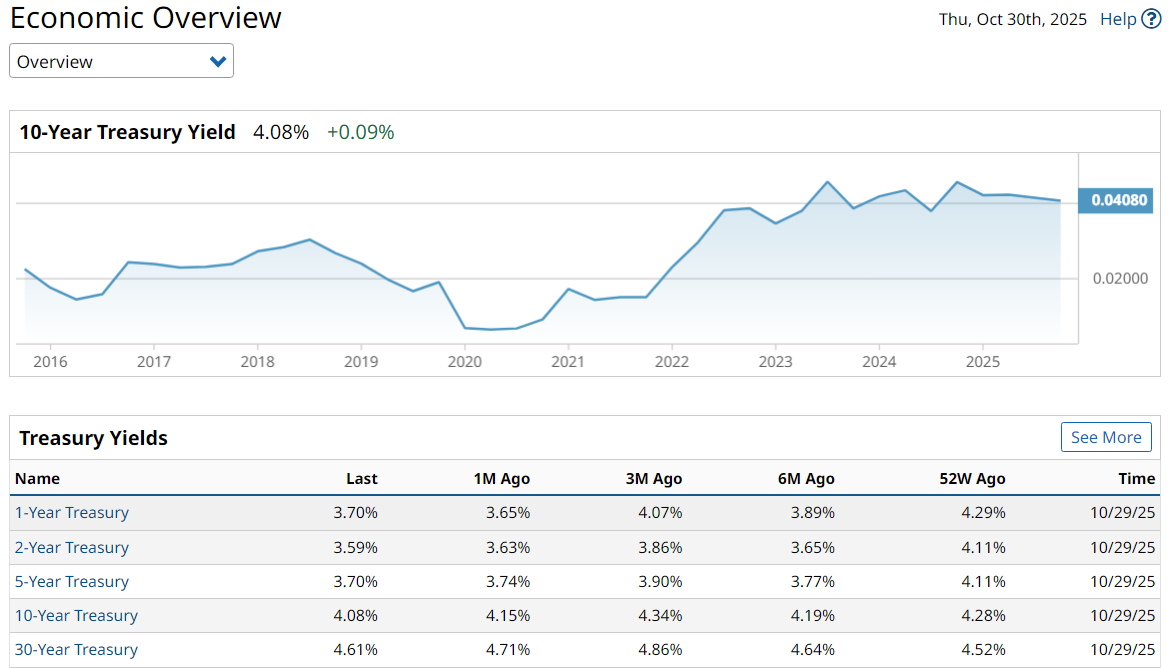

The U.S. currently pays bondholders a fixed interest rate around 4.0%–4.6% on long-term Treasurys. The bond’s value may fluctuate, but at maturity you’ll receive your full principal back — plus all your interest payments along the way.

“Treasurys won’t make you rich overnight,” Rick explains, “but they’ll give you safety, stability, and predictable income. That’s something few assets can match.”

Why Treasurys Matter Now

In a market where investors are still adjusting to higher interest rates, Treasurys have re-emerged as one of the few assets offering meaningful yield with near-zero default risk.

Consider this:

- The U.S. government has never defaulted on its debt.

- Coupon payments arrive twice per year, right on schedule.

- Treasurys are backed by the full faith and credit of the U.S.

That combination of security and steady income makes them especially attractive for retirees, conservative investors, and those looking to park cash while earning more than a savings account.

The Problem: Locking Up Cash for 30 Years

There’s a catch, of course. Locking up your money for decades can feel like forever.

Enter the Bond Ladder: a simple, flexible strategy to invest in Treasurys without sacrificing liquidity or yield.

How a Bond Ladder Works

A bond ladder means buying multiple Treasurys with staggered maturity dates. As each bond matures, you roll the proceeds into a new bond — creating the next “rung” on the ladder.

Here’s an example of how it can work in practice:

- Buy one Treasury that matures in 1 year, another that matures in 2 years, and a third that matures in 3 years.

- When the first matures after a year, reinvest that cash into a new 3-year bond.

This creates a rolling cycle where:

- You collect steady interest payments.

- You always have a bond maturing each year.

- You can reinvest at newer, higher rates if yields rise.

“Laddering gives you flexibility,” Rick says. “You’re never stuck. You’re always earning income and staying ready for new opportunities.”

How to Track Treasurys at Barchart

Barchart makes it simple to explore and monitor Treasury markets in real-time.

You can:

- Check current Treasury yields on the Economic Overview page.

- Compare short-term vs. long-term maturities under Financials Futures.

- Use the Interest Rates page to see how rates are shifting over time.

For those building income portfolios, these tools can help identify the best maturities and yields for constructing your own ladder, or deciding when to roll over positions.

The Takeaway

Treasurys may not be flashy — but when it comes to safety, income, and predictability, few investments come close.

“You’re lending to the U.S. government,” Rick says. “Short of the country ceasing to exist, you’ll get paid — on time, every time.”

By laddering your bonds, you can earn a steady stream of interest while keeping part of your portfolio liquid and ready for whatever the market throws your way.

Watch the clip to see T-bills, Treasury bonds & laddering explained →

- Watch the Full Video: 7 Ways to Make Money From Your Investments

- Track Treasury Yields & Rates on Barchart

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Use This Treasury Strategy to Invest in US Bonds for Steady Income

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G