Headquartered in Atlanta, Georgia, The Southern Company (SO) operates through multiple subsidiaries to supply electricity and natural gas across the southern United States. Its key electric utilities, Alabama Power, Georgia Power, and Mississippi Power, deliver energy within their states.

The company has other businesses, such as Southern Power, which manages a diverse portfolio of generation assets for wholesale customers, including renewable energy and storage. Southern Company Gas distributes natural gas through regulated utilities in Illinois, Georgia, Virginia, and Tennessee, while supporting affiliated energy operations. It has a market capitalization of $100.69 billion.

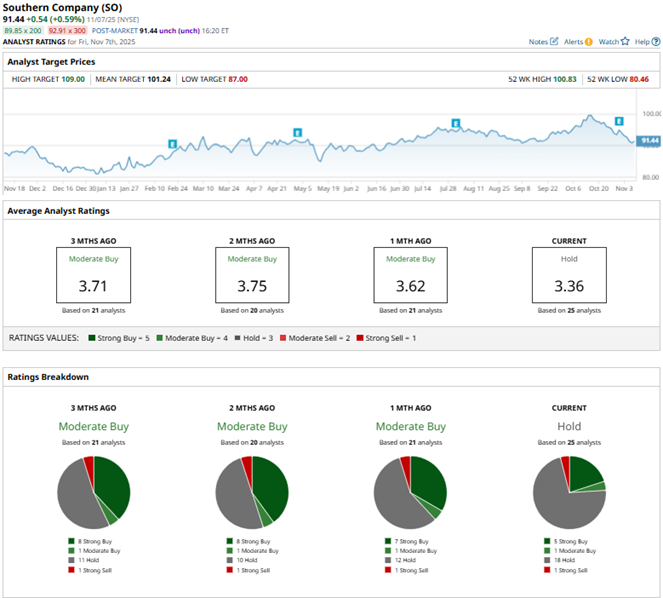

While the company’s stock has been up over the past year, the gains have been modest. Over the past 52 weeks, Southern Company’s stock has gained 5.2%, while it has been down marginally over the past six months. It had reached a 52-week high of $100.83 in October, but is down 9.3% from that level.

In contrast, the S&P 500 Index ($SPX) has gained 12.7% and 19.5% over the same periods, respectively, indicating that the stock has underperformed the broader market. Southern Company’s business falls under the utilities sector. Comparing it with the Utilities Select Sector SPDR Fund (XLU), we see that the ETF is up 15.5% over the past 52 weeks and 11.1% over the past six months, reflecting the same trend as with the broader market.

On Oct. 30, Southern Company reported its third-quarter results, which were better than what analysts had expected. The company’s total operating revenues increased by 7.5% year-over-year (YOY) to $7.82 billion, surpassing the $7.54 billion that Wall Street analysts had expected.

This was predicated upon non-fuel retail electric revenues increasing 6.1% from the prior year’s period to $4.44 billion. Its adjusted EPS were $1.60, up 11.9% YOY and higher than the expected $1.50. On Oct. 30, Southern Company’s stock gained 1.7% intraday.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Southern Company’s EPS to grow 5.9% YOY to $4.29 on a diluted basis. Moreover, EPS is expected to increase 7% annually to $4.59 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in three of the four trailing quarters.

Among the 25 Wall Street analysts covering Southern Company’s stock, the consensus is a “Hold.” That’s based on five “Strong Buy” ratings, one “Moderate Buy,” 18 “Holds,” and one “Strong Sell.” The ratings configuration has become less bullish over the past month, with five “Strong Buy” ratings now, down from the previous seven, and the overall rating slipping from “Moderate Buy” to “Hold.”

This month, analysts from Jefferies downgraded the stock from “Buy” to “Hold.” While still seeing growth opportunities for Southern Company’s business, the firm also anticipates a stricter power rate-setting process in Georgia and a more rigorous resource certification process in the wake of a Democratic majority on Georgia’s Public Service Commission (PSC) election.

Southern Company’s mean price target of $101.24 indicates a 10.7% upside over current market prices. The Street-high price target of $109 implies a potential upside of 19.2%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart