Yum! Brands, Inc. (YUM), headquartered in Louisville, Kentucky, is a global quick-service restaurant company and franchisor behind iconic brands such as KFC, Pizza Hut, and Taco Bell. The company operates and franchises restaurants in over 155 countries and territories, leveraging its multi-brand platform for global growth. Yum! Brands has a market cap of approximately $41.2 billion.

Shares of this fast-food company have underperformed the broader market. Over the past year, YUM has gained 8.1%, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. Also, YUM’s stock rose 10.5% on a year-to-date (YTD) basis, compared to SPX’s 16.2% gains.

But narrowing the focus, YUM has outperformed the AdvisorShares Restaurant ETF (EATZ) as the ETF has declined 13.7% over the past year and 10.1% on a YTD basis.

Yum! Brands’ share price has been buoyed this year by a combination of strong operating performance and strategic initiatives. YUM is ramping up its digital and technology initiatives via its “Byte by Yum!” platform to improve efficiency, boost customer engagement and support franchisee economics. Also, the company announced a strategic review of its Pizza Hut brand, raising hopes for value-enhancing moves that the market is rewarding.

For the current fiscal year, ending in December 2025, analysts expect YUM’s EPS to grow 10.8% to $6.07. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on one other occasion.

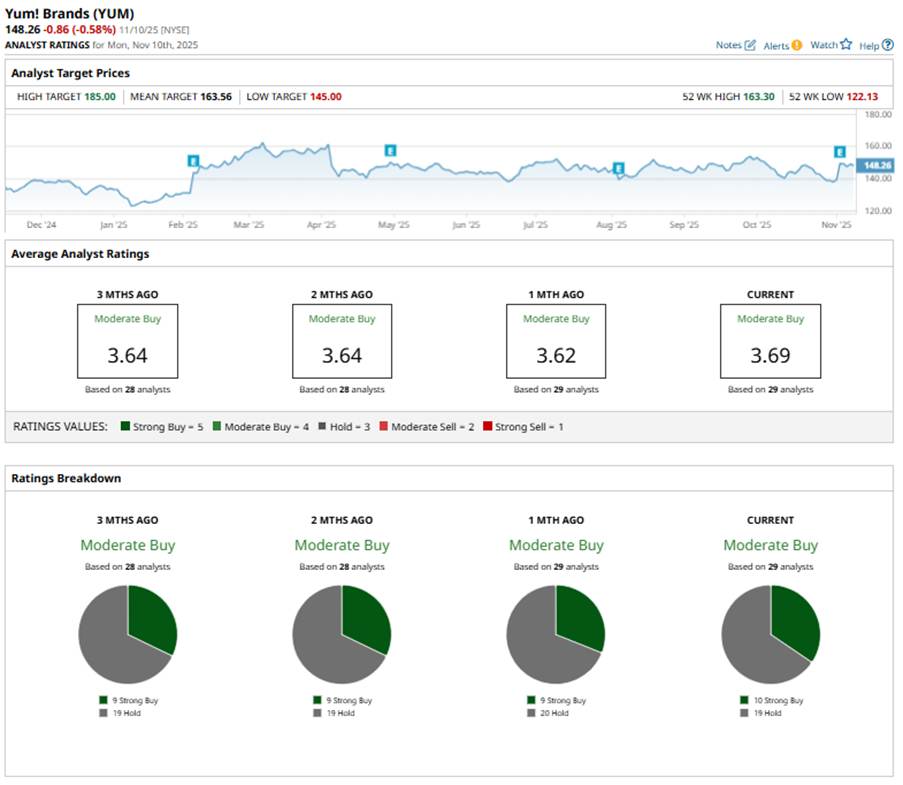

Among the 29 analysts covering YUM stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings and 19 “Holds.”

This configuration is slightly more bullish than one month ago, when there were nine “Strong Buy” ratings.

Earlier this month, Oppenheimer reaffirmed its “Outperform” rating on Yum! Brands with a $185 price target, calling it its top large-cap pick for 2025.

The mean price target of $163.56 represents a 10.3% premium to YUM’s current price levels. The Street-high price target of $185 suggests an upside potential of 24.8%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart