Washington, the District Of Columbia-based Danaher Corporation (DHR) is a global leader in science and technology focused on driving innovation in life sciences, diagnostics, and biotechnology. Valued at a market cap of $152.4 billion, the company designs, manufactures, and markets instruments, consumables, and services that support drug discovery, genomics, molecular diagnostics, and lab automation.

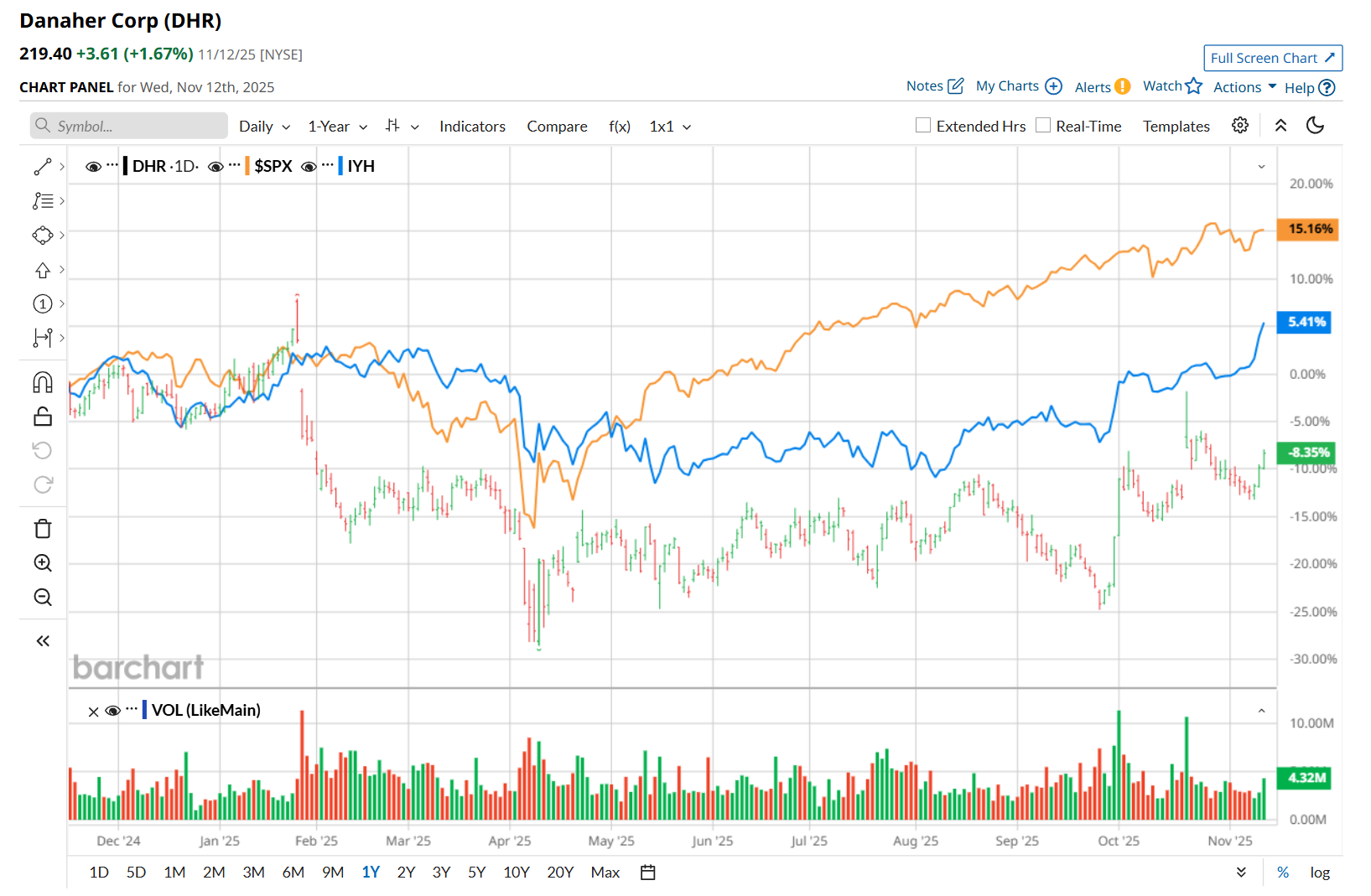

This healthcare company has considerably underperformed the broader market over the past 52 weeks. Shares of DHR have declined 8.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, on a YTD basis, the stock is down 4.4%, compared to SPX’s 16.5% return.

Narrowing the focus, DHR has also lagged behind the iShares U.S. Healthcare ETF’s (IYH) 3.4% uptick over the past 52 weeks and 10.3% YTD rise.

DHR’s shares rose 5.9% after it delivered its impressive Q3 results. The company’s revenue increased 4.4% year-over-year to $6.1 billion, surpassing consensus estimates by a small margin. Moreover, its adjusted EPS of $1.89 improved 10.5% from the year-ago quarter, topping analyst expectations of $1.71. DBS-driven execution, paired with continued momentum in its bioprocessing business and better-than-anticipated respiratory revenue at Cepheid, contributed to its upbeat performance.

For the current fiscal year, ending in December, analysts expect DHR’s EPS to grow 3.2% year over year to $7.72. The company’s earnings surprise history is mixed. It topped consensus estimates in three of the last four quarters, while missing the mark on another occasion.

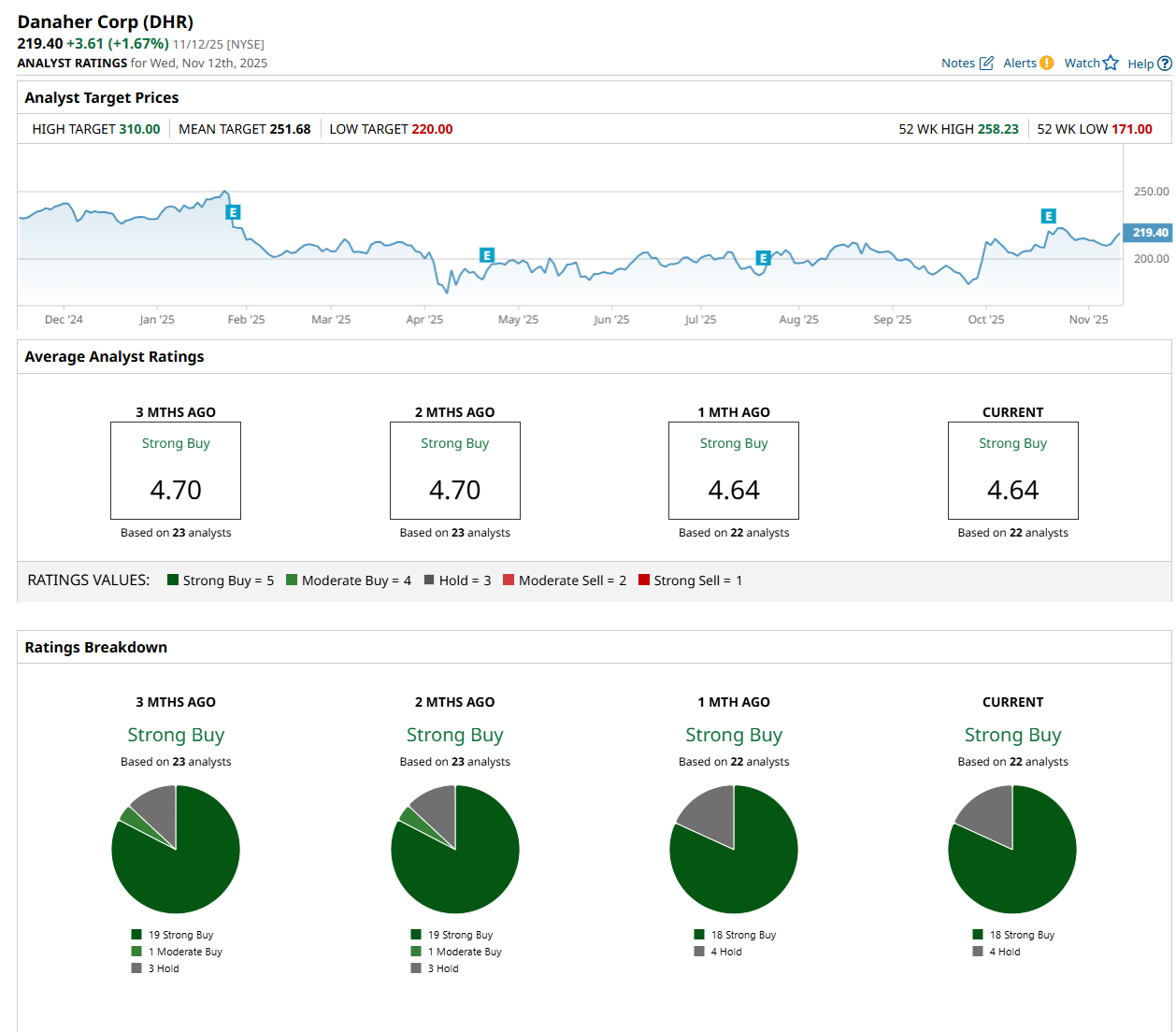

Among the 22 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 18 “Strong Buy” and four “Hold” ratings.

This configuration is less bullish than two months ago, with 19 analysts suggesting a “Strong Buy” rating.

On Oct. 23, Wells Fargo & Company (WFC) maintained an “Equal Weight” rating on DHR and raised its price target to $230, indicating a 4.8% potential upside from the current levels.

The mean price target of $251.68 represents a 14.7% premium from DHR’s current price levels, while the Street-high price target of $310 suggests an ambitious 41.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Dividend Stock a Buy for 2026 After More Than Doubling This Year?

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?