Tesla (TSLA) is one of the best-known automakers in the world. With a market cap of more than $1 trillion, Elon Musk’s company dwarfs Toyota (TM), Ford (F), and the rest of the competition.

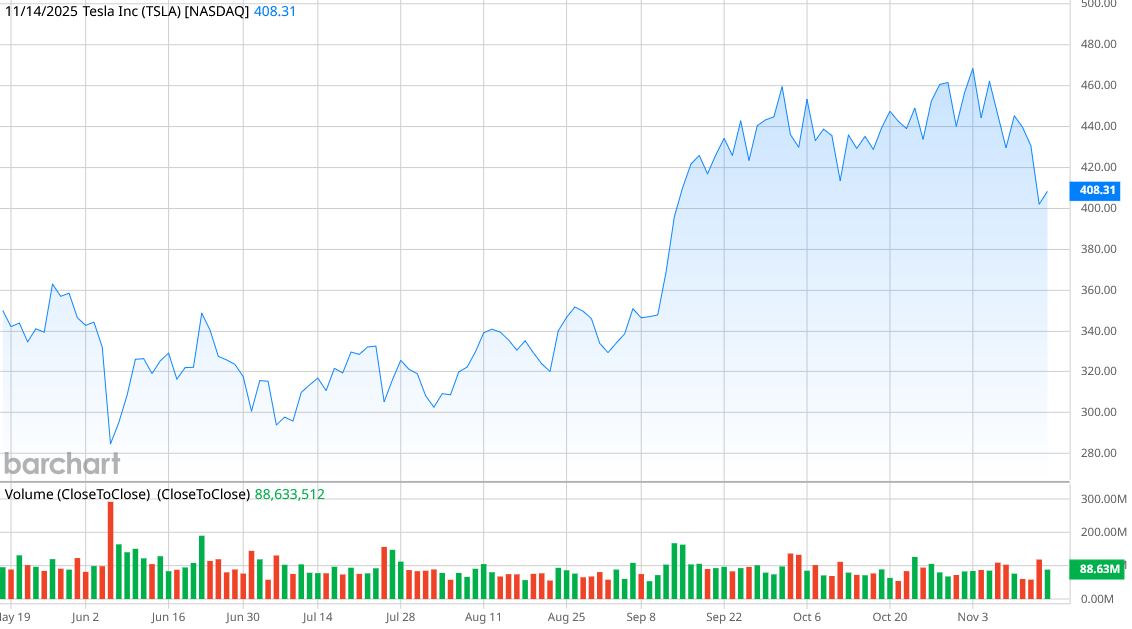

But these are fascinating times for the automaker—its electric vehicle sales are collapsing more than 20% from a year ago, and there are concerns about the company’s fourth-quarter deliveries—particularly in overseas markets. You would think that this would put TSLA stock in serious trouble, but the opposite is true. The stock topped $440 this month and, despite a recent drop, is still only 17% off its all-time high. Shareholders, meanwhile, rewarded Musk with a massive compensation package that could be valued as much as $1 trillion as the company leans hard into artificial intelligence.

How should you be thinking about Tesla stock today? Wells Fargo analyst Charles Langan has a “Sell” rating on TSLA stock and warns that it’s at risk of tumbling by 70% in the near future.

About Tesla Stock

Headquartered in Texas, Tesla is an electric vehicle company that is also playing a leading role in artificial intelligence. Tesla is focused on the development of autonomous driving in hopes of turning its Tesla fleet into robotaxis and is also developing a fully autonomous taxi called the Cybercab. It’s also working on the Optimus robot, which is a humanoid robot that Musk says will eventually be able to perform daily tasks, including cooking and cleaning. The company currently has a market capitalization of $1.33 trillion.

Tesla shares are up a mere 1% year-to-date (YTD), following a massive run-up late last year when there was some hope Musk’s ties with the White House and incoming Trump administration would pave the way for his companies to receive preferential treatment. But that didn’t happen, and Musk noisily split with President Donald Trump in June, becoming one of the most vocal opponents of Trump’s primary domestic spending package, dubbed the “Big, Beautiful Bill.” TSLA stock is badly trailing the Nasdaq Composite ($NASX), which is up 19% this year, and it’s the worst-performing stock of the Magnificent Seven.

Tesla’s valuation has always been problematic, as it attracts a lot of attention, and investors tend to buy in based on Musk’s vision and appeal. It has a price-to-earnings ratio of 268.3 right now, which is just over its five-year mean of 254.5.

Tesla Misses on Earnings

Tesla had a worse-than-expected third-quarter earnings report, with revenue of $28.09 billion, better than the $25.18 billion a year ago, but profit margins were down substantially. The company posted net income of $1.95 billion, down from $2.18 billion a year ago, and earnings per share of $0.37 per share were below expectations of $0.41 per share.

Tesla’s revenues were up because the company was heavily promoting the expiration of a $7,500 federal EV tax credit, and it worked—customers bought in the third quarter before the credit expired. So, it’s not a surprise that October sales slumped badly. North American October sales were 45,000 vehicles, according to data tracked by Langan. That’s a decline of 25% from September sales. The company also saw substantial drops in Europe, China, and South Korea, Langan said.

“We expected to see the payback on U.S. October deliveries after the Inflation Reduction Act credits ran out; however, foreign markets continue to show weakness,” Langan wrote in a research note.

However, Musk was much more focused on Tesla’s AI progress and what he referred to as a “robot army” of Optimus units in the earnings call with analysts.

“I think it's important to emphasize that Tesla really is the leader in real-world AI. No one can do what we can do with real-world AI,” he said. “I have pretty good insight into AI in general. I think that Tesla has the highest intelligence density of any AI out there in the car, and that is only going to get better. We're really just at the beginning of scaling quite massively full self-driving and robotaxi, and fundamentally changing the nature of transport. I think people just don't quite appreciate the degree to which this will take off.”

What Do Analysts Expect for TSLA Stock?

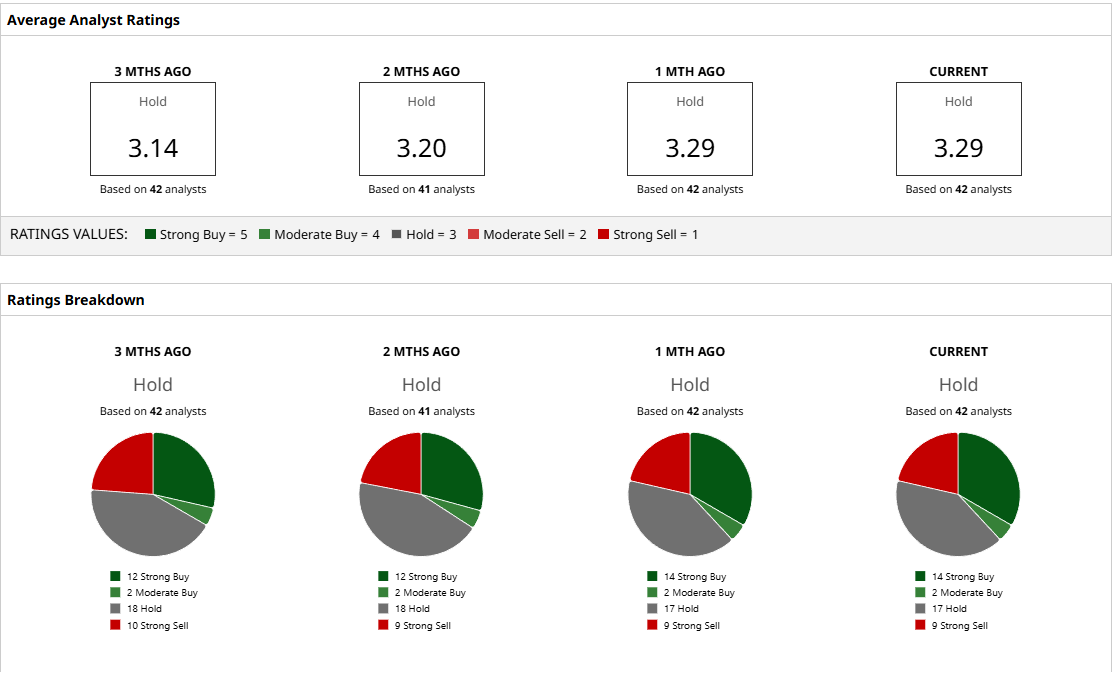

Musk has always been a polarizing figure, and Tesla has some of that weight as well. Forty-two analysts currently cover the stock, with 17 suggesting investors “Hold.” Sixteen analysts have “Buy” ratings, and nine have “Sell” ratings.

Langan’s $120 price target represents the most bearish stance, with a potential 70% drop, while the most bullish price target of $600 indicates a possible gain of 48%. The mean target of $385 is roughly 5% higher than Tesla’s stock price.

So, when evaluating TSLA stock, it’s really a question of fundamentals versus belief. Tesla’s deliveries are falling, the margins are compressed, and it won’t make massive profits from selling individual vehicles like it used to.

But for Musk and Tesla shareholders, it’s all about AI, self-driving vehicles, and robots. If Musk can really flip the switch and bring the world into a future of robot personal assistants and self-driving cars, then Tesla is a bargain at any price.

But for me, it’s still a hold. I need to see more before I buy in.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Bullish Shares Are Down 35% in the Past Month. Should You Buy the Dip in BLSH Stock?

- MicroStrategy Falls Below Net Asset Value Amid Crypto Crash. Should You Buy the Dip in MSTR Stock?

- This Rare Earths Stock Is Expanding Its Footprint. Should You Buy Shares Now?

- This Analyst Warns Tesla Stock Could Plunge 70% Despite Elon Musk’s $1 Trillion Pay Package Win