Headquartered in Baltimore, Maryland, T. Rowe Price Group, Inc. (TROW) is a multinational investment manager with a significant presence in equity and fixed income mutual funds. It supports individuals, institutional investors, retirement plans, financial intermediaries, and large institutions with a disciplined approach to asset management. Valued at a market capitalization of nearly $22.2 billion, it generally invests between $3 million and $5 million in late-stage venture capital projects.

Despite the exposure, TROW stock has had a challenging run. Its shares fell almost 15.1% over the past 52 weeks while the S&P 500 Index ($SPX) advanced 13.2% in the same stretch. The weakness continued into the current year with a 10.1% year-to-date (YTD) decline against the benchmark gain of 14.5%.

The scenario in the financial sector remained equally harsh. TROW trailed behind the S&P 500 Financials Sector SPDR (XLF), which climbed 5.7% over the past year. The YTD comparison offered no comfort either, as XLF rallied by 8.5% and outpaced TROW.

Nov. 12 delivered a welcome change of pace when the stock moved higher by nearly 1.1% during the trading session. The firm reported preliminary assets under management of $1.79 trillion as of Oct. 31. Equity assets were at $902 billion, fixed income at $210 billion, with net outflows of $5.9 billion for the month.

Retirement-related assets constituted about two-thirds of total holdings, with multi-asset and alternatives assets at $622 billion and $56 billion, respectively, demonstrating steady growth and strategic investment focus.

For the fiscal year 2025, ending in December, analysts forecast a 4.5% YoY growth in EPS, estimating $9.75 on a diluted basis. The firm exceeded analyst expectations for three straight quarters, while missing on one other occasion.

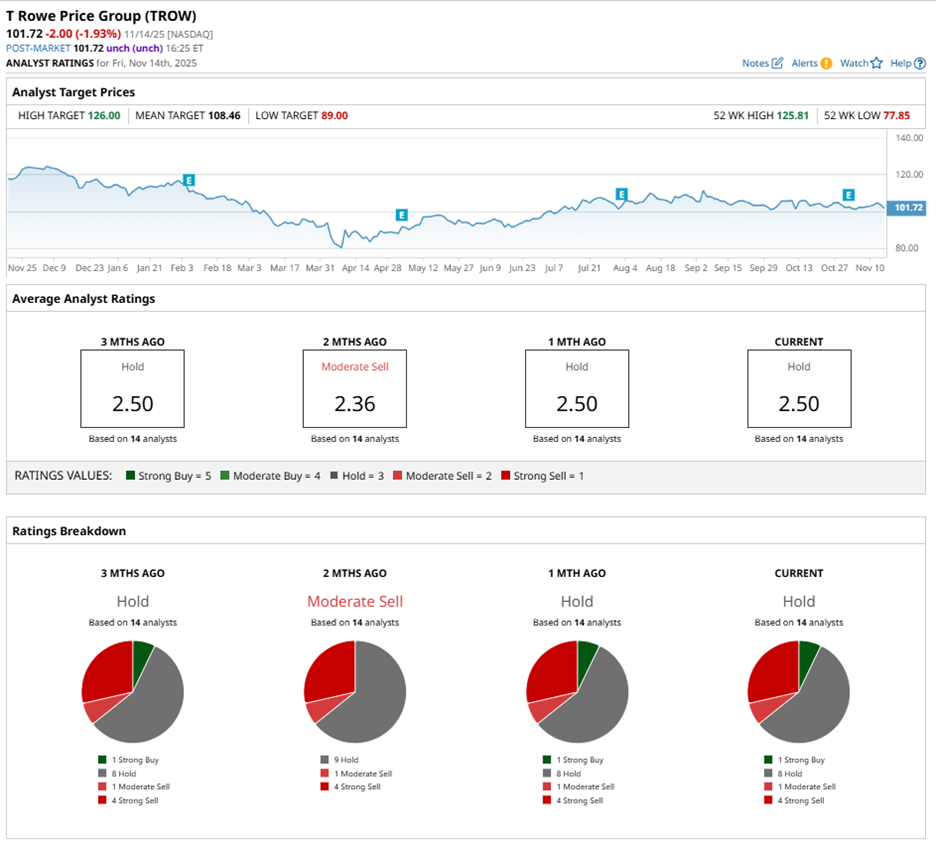

Among 14 analysts covering TROW, the consensus rating stands at “Hold.” That’s an upgrade from the “Moderate Sell” rating two months ago. The current rating comprises one “Strong Buy” rating, eight “Holds,” one “Moderate Buy” rating, and four “Strong Sell” recommendations.

The current configuration is slightly bullish from two months back, when TROW had no “Strong Buy” rating.

Craig Siegenthaler, a BofA Securities analyst, increased his price target for TROW on Nov. 3 from $97 to $105 while keeping an “Underperform” rating. His forecast came after the company's third-quarter report. Assets under administration increased by $90.4 billion in that period, reaching a record $1.77 trillion as of Sept. 30.

TROW currently trades above the average analyst price target of $108.46. The Street-high target of $126 suggests room for potential upside of 23.9%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart