Netflix (NFLX) began trading Monday, Nov. 17 on a split adjusted basis, after enacting a 10-for-1 split that makes its shares more affordable for individual investors. Shares of the streaming giant have risen 33% in the last year, 130% in the last five years, and 973% over the past decade. If we expand the investment horizon to 15 years, NFLX stock has returned a staggering 4,440%.

Valued at a market cap of $471 billion, Netflix closed trading at $1,112.17 on Friday. Under the stock split corporate action, shareholders received nine additional shares for every Netflix stock they currently own. Post-split, the tech stock now trades around $110.

This move aims to make shares more accessible to employees in its stock option program. It is essential to understand that stock splits do not change the value of existing holdings. However, a lower price will enhance liquidity and attract capital from retail investors.

Is Netflix Stock Still a Good Buy Right Now?

Netflix shares fell roughly 10% following its Q3 results after the streaming giant missed third-quarter earnings expectations due to an unexpected tax dispute in Brazil. It reported earnings of $5.87 per share, which was well below the $6.97 that analysts had forecast. Revenue came in at $11.51 billion, matching Wall Street estimates and marking a 17% increase from the prior year.

The earnings miss stemmed from a Brazilian tax issue that Netflix hadn’t previously factored into its forecast. The tax applies a 10% charge on certain payments Brazilian entities make to operations outside the country.

Netflix decided to book the expense in the third quarter after determining it would likely lose a legal challenge over the assessment. Chief Financial Officer Spence Neumann emphasized the tax isn't specific to Netflix or even to streaming companies, and the company doesn't expect it to materially impact future results. Without this charge, Netflix would have beaten its operating income and margin forecasts for the quarter.

Despite the earnings disappointment, Netflix demonstrated strong underlying business momentum. The company posted net income of $2.55 billion, up from $2.36 billion in the same period last year. Revenue growth was fueled by membership gains, price increases implemented in January, and a surging advertising business.

Netflix said it achieved its best quarter ever for ad sales and remains on track to more than double its ad revenue for the year, although it hasn't disclosed specific figures for the size of its advertising business.

Looking ahead, Netflix projects fourth-quarter revenue to grow 17% year-over-year (YoY) as these positive trends continue. For 2025, it estimates sales to rise by 16% YoY to $45.1 billion. The only adjustment to previous guidance was the operating margin forecast, which dropped to 29% from 30% due to the Brazilian tax charge.

Netflix’s content slate remains a key driver of long-term growth as the platform continues to benefit from KPop Demon Hunters, which has become its most-watched film ever with over 325 million views.

The company also announced partnerships with Hasbro (HAS) and Mattel (MAT) to create toys and games based on the animated hit, set to launch in spring 2026. The upcoming quarter features highly anticipated releases, including the final season of Stranger Things and new films from acclaimed directors.

Is NFLX Stock Still Undervalued?

Analysts tracking Netflix forecast revenue to increase from $39 billion in 2024 to $68 billion in 2029. In this period, adjusted earnings are forecast to expand to a split-adjusted $5.43 in 2029.

In the last five years, Netflix increased its earnings by 36% annually and traded at an average forward price-earnings multiple of 38x. If NFLX stock trades at 25x earnings, which is closer to its five-year earnings forecast growth of 22x, it should be priced around $135.80 in late 2028, indicating upside potential of over 20% from current levels.

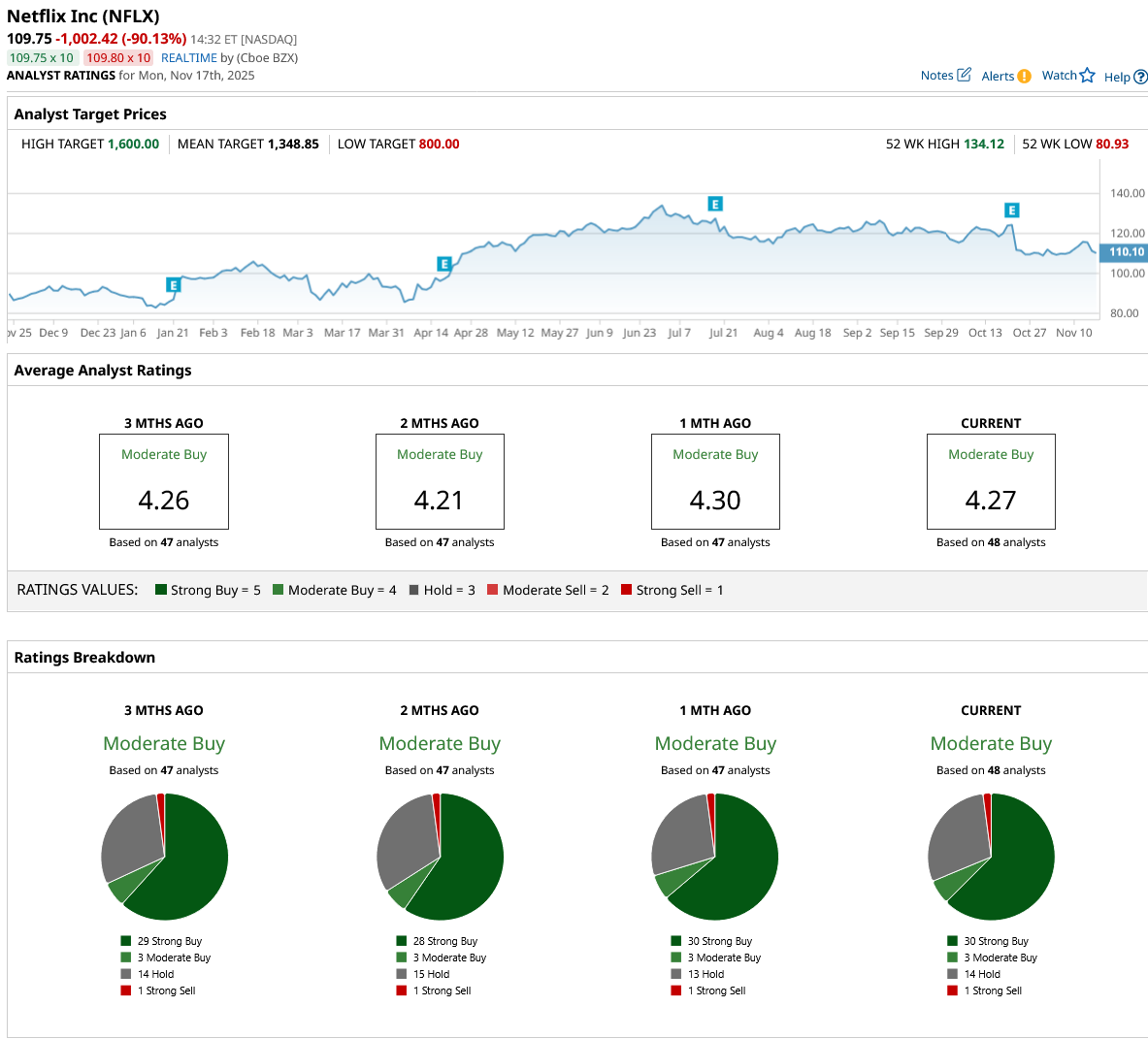

Out of the 48 analysts covering Netflix stock, 30 recommend “Strong Buy,” three recommend “Moderate Buy,” 14 recommend “Hold,” and one recommends “Strong Sell.”

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?

- MicroStrategy Is Buying the Bitcoin Dip. Should You Buy the Dip in MSTR Stock?

- Should You Buy Netflix Stock Today After Its 10-for-1 Split?