Vertex Pharmaceuticals Incorporated (VRTX) is a leading U.S. biopharmaceutical company, headquartered in Boston, Massachusetts, deeply committed to discovering and developing transformative therapies for serious diseases. Vertex is best known for its pioneering work in cystic fibrosis (CF) with blockbuster drugs like Trikafta, Kalydeco, Orkambi, and others in its commercial portfolio. Beyond CF, its pipeline spans treatments for pain, sickle cell disease, kidney disorders, and type 1 diabetes. Vertex’s market cap is around $111.3 billion.

Shares of the biopharma giant have underperformed the broader market. Over the past 52 weeks, VRTX stock has slipped 6.8%, while the broader S&P 500 Index ($SPX) has gained 13.7%. Although the stock surged 7.8% on a year-to-date (YTD) basis, it still lagged behind SPX’s 13.4% gains.

Zooming in further, the drugmaker has underperformed the Health Care Select Sector SPDR Fund’s (XLV) 7% rise over the past 52 weeks and 10.3% gains YTD.

Over the past year, VRTX has slipped largely because of disappointing clinical and regulatory setbacks in its pain-drug pipeline. Its Phase 2 trial for VX-993 failed to hit the primary efficacy endpoint, prompting the company to halt its development as a standalone therapy. At the same time, the FDA signaled hesitation about broadening the label for its approved pain drug, Journavx, limiting its potential expansion into chronic nerve-pain markets. These developments have shaken investor confidence in Vertex’s effort to diversify beyond its cystic fibrosis franchise.

For the fiscal year ending in December 2025, analysts expect Vertex’s EPS to grow substantially year-over-year to $15.99. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on one other occasion.

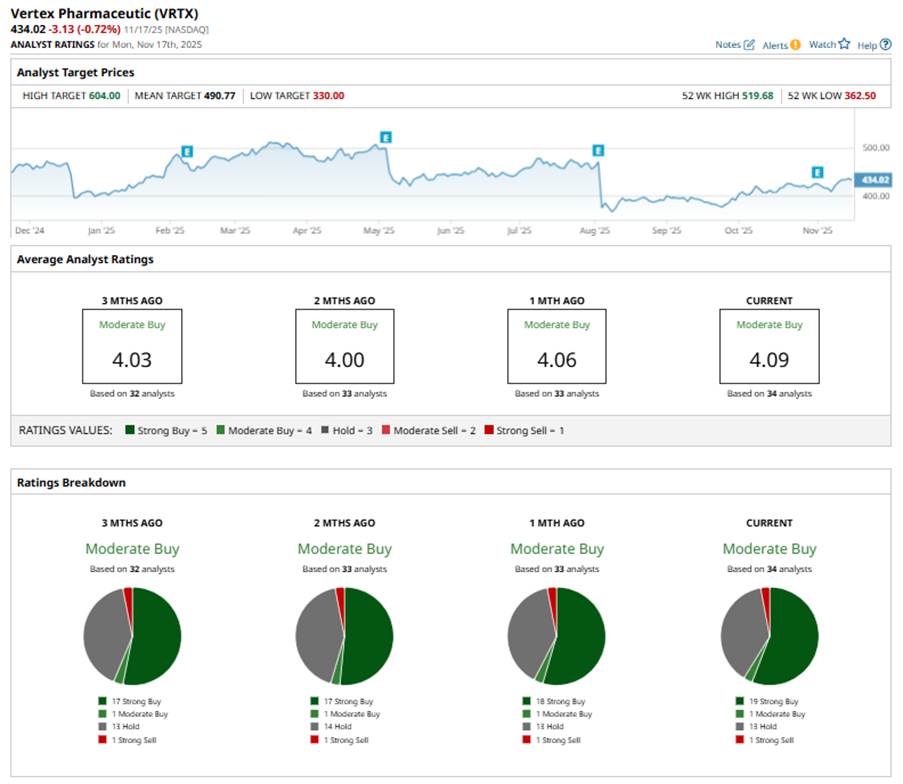

Among the 34 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 19 “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish compared to two months ago, when there were 17 “Strong Buy” ratings.

Earlier this month, Stifel reiterated its “Hold” rating and $445 price target on VRTX stock after the company reported encouraging Phase 1/2 data for povetacicept in IgAN and pMN.

VRTX’s mean price target of $490.77 suggests an upside of 13.1%. The Street-high price target of $604 implies a potential upside of 39.2% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment