Nucor Corporation (NUE) is a leading steel producer, headquartered in Charlotte, North Carolina, with a market cap of around $34 billion. The company specializes in manufacturing a diverse array of steel and steel-product offerings through its integrated operations, including sheet, plate, bar, and structural steel.

Shares of this steel titan have trailed the broader market over the past 52 weeks. Over the past year, NUE has gained 1.1%, while the broader S&P 500 Index ($SPX) has rallied nearly 13.7%. However, on a year-to-date (YTD) basis, NUE stock rose 27.4%, surpassing the SPX’s 13.4% YTD rise.

Narrowing the focus, NUE’s underperformance is also apparent compared to the VanEck Steel ETF (SLX). The exchange-traded fund has gained about 13.6% over the past year and 32.4% YTD.

Nucor’s shares are rising in 2025 mainly because investors are excited about its growth trajectory, with the company ramping up production via major projects, while it is benefiting from U.S. steel import tariffs, which bolster domestic demand and give its integrated, scrap-based model a competitive edge. Additionally, Nucor is showing strong operational momentum, which fuels confidence in its long-term capacity buildout.

For the current fiscal year, ending in December 2025, analysts expect Nucor’s EPS to fall 11.5% YoY to $7.88 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on one other occasion.

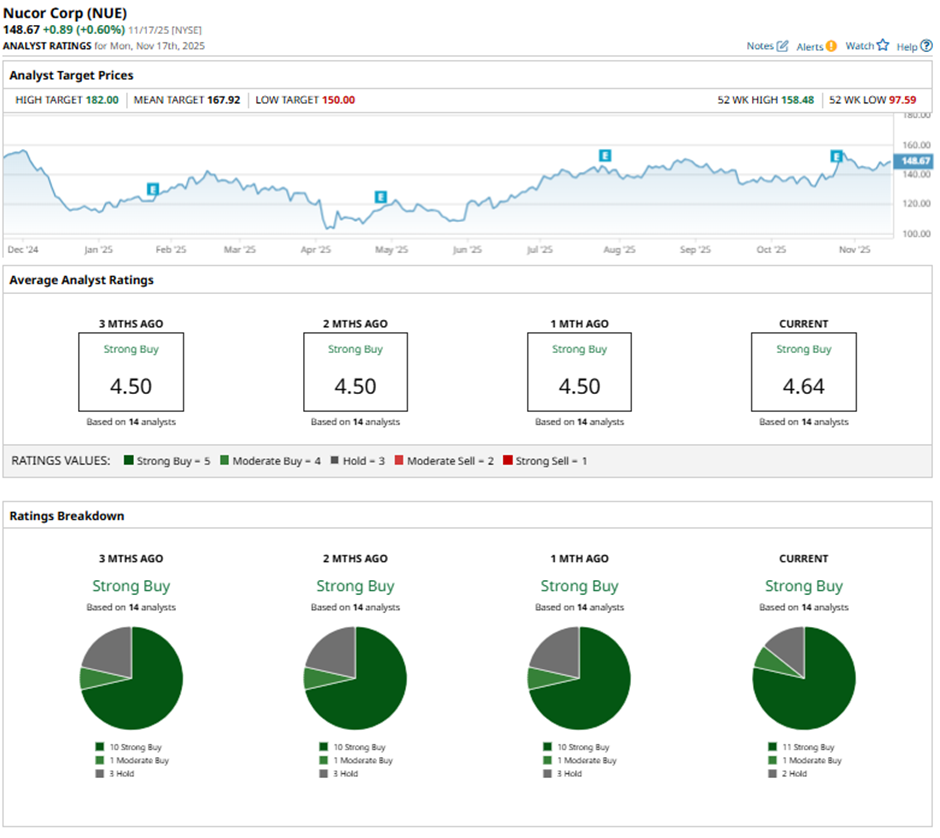

Despite trailing behind the broader market, analysts are bullish about the stock’s potential. Among the 14 analysts covering NUE stock, the consensus is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.”

This configuration is slightly more bullish than one month ago, when there were 10 “Strong Buy” ratings.

Recently, Wells Fargo & Company upgraded Nucor from an “Equal weight” rating to an "Overweight" rating.

The mean price target of $167.92 represents 12.9% premium to NUE’s current price levels. The Street-high price target of $182 suggests upside potential of 22.4%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 30% in a Month, Should You Buy MicroStrategy Stock Here?

- Here Is What Options Traders Expect for NVDA Stock After Nvidia Reports Q3 Results This Week

- ‘Good News’ Is Coming for Nvidia Stock, So Buy NVDA Shares Here

- This ‘Buy’-Rated Stock Is Calling for 34% Revenue Growth and Analysts Think Shares Can Gain 48% from Here