In this high-growth market, and one that's been defined by continued earnings beats from many of the top so-called “Magnificent 7” high-growth mega-cap tech names, it can be hard for many growth investors to rationalize stock downgrades of key players like Amazon (AMZN) and Microsoft (MSFT).

Yet, it does appear some Wall Street analysts are dialing back their growth expectations for certain top tech players, as prime factors are driving some bearish sentiment among some renowned analysts. Specifically, analyst Alexander Haissl from Rothschild & Co. Redburn put forward a bearish note on the two companies, alongside a downgrade from “Buy” to “Neutral” for these stocks.

Let's dive into what's driving this key downgrade, and where these two stocks could be headed from here.

Let's Focus on the Microsoft Downgrade

Of the two downgrades this particular analyst put forward today, I think the Microsoft note is perhaps the more important one for investors to consider.

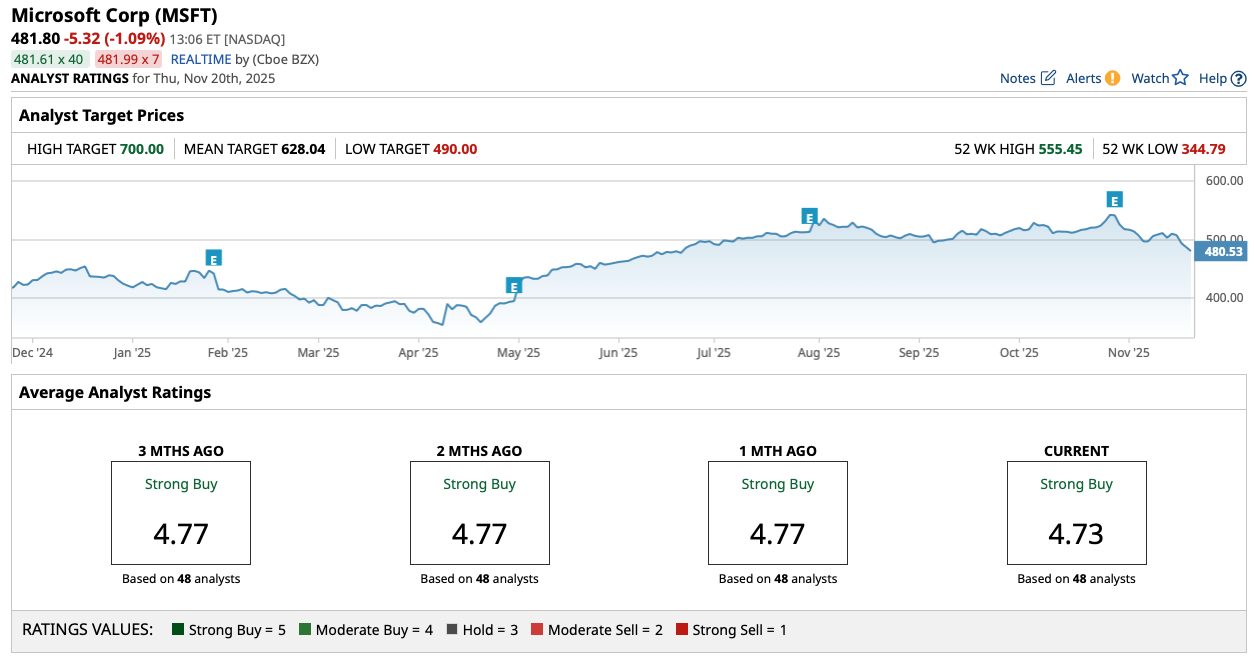

Haissl put forward a revised price target of $500 per share on MSFT stock, down from a previous target of $560. That's a significant drop, and implies very minimal upside from here, given that MSFT stock is trading around 3% off that target at the time of writing.

Microsoft's forward price-earnings ratio of 31 times, this stock certainly isn't cheap. And if analysts like Haissl believe that the economics for Microsoft's hyperscaler business model could be “far weaker than assumed,” and the ongoing buildout of data centers and other infrastructure tied to the AI revolution will be much more expensive from a capital expenditure standpoint, then the argument that MSFT stock is overvalued could certainly make sense.

In the view of this analyst, risks are skewed to the downside for Microsoft stock. And regardless of any investor's view of MSFT's long-term strength, the potential for short-term weakness has many investors growing concerned presently.

What's the Verdict?

In addition to Haissl, 48 analysts are currently covering this stock, with a consensus “Strong Buy” rating for the software and cloud computing giant.

With a current consensus price target of a little more than $628 per share, Wall Street believes Microsoft likely has about 30% upside from here. So, Haissl appears to be an outlier on the bearish front.

However, it's worth pointing out that most analyst price targets have been set in weeks past. It's possible that other analysts jump aboard the negativity train when it comes to Microsoft and other tech darlings, particularly if the current macro backdrop continues to weaken.

Even some historic earnings from these top players, guidance raises, and top and bottom line beats each quarter don't seem to be enough to quell investor concerns around overspending. That's the key focal point for investors once again, with plenty of questions building around when this whole AI and data center buildout will ultimately turn positive.

In my view, a bearish near-term perspective right now is a thesis that can be understood and accepted. However, over the long-term, Microsoft is likely to be a winner.

So perhaps the downgrade should be taken lightly by investors who plan on holding this stock for a decade or longer. But for those who may need some capital now, taking some profit and then taking a wait-and-see-what happens approach can be valid as well.

Again, I think Microsoft is a stock that should be owned, and not traded. But for those doing the trading, this near-term bearish momentum does appear to be real.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2025 Hasn’t Been Pleasant for Tesla Stock. Will 2026 Be Any Better?

- 3 Simple Options Strategies to Act on Thursday’s Unusual Activity Now

- The Bull Case for AI Stocks Is ‘Far Weaker’ Than You Think…At Least According to This Analyst. 1 Stock He’s Downgrading Now.

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’