Cryptocurrencies are going through a rough patch, with many names down in recent weeks. Bitcoin (BTCUSD) prices are down more than 21% in the last month, while Ethereum (ETHUSD) dropped 25% and Cardano (ADAUSD) collapsed by more than 36%.

Amid this backdrop are companies that are in the crypto business, such as Bullish (BLSH). But the crypto exchange, which targets institutional investors, is having problems of its own. Bullish stock is 66% off its all-time high set shortly after its August initial public offering.

However, Cathie Wood has never been fearful of a falling stock, and her Ark Invest is adding shares. The Ark Innovation ETF (ARKK) dipped into Bullish 10 times since Aug. 19, and currently holds 2.86 million shares. The Ark Fintech Innovation ETF (ARKF) and Ark Next Generation Internet ETF (ARKW) also made multiple purchases since Sept. 5, bringing Ark Invest’s total position in Bullish to $151.8 million.

Is Wood onto something here? With cryptos showing some weakness, is this a good time to scoop up a downtrodden stock before the inevitable bounce?

About Bullish Stock

From its headquarters in the Cayman Islands, Bullish offers high-efficiency trading of Bitcoin, Ethereum, and other cryptocurrencies. Its services include an exchange, indexes, market data, and analytics. It also operates coindesk.com, which is a media platform that writes about digital assets, policy, and the blockchain. The company has a market capitalization of just over $6 billion.

Shares are down nearly 40% over the past three months, with 27% of that drop happening in the last month. Share prices have fallen in conjunction with the drop in Bitcoin, which is down 21% in the last month, and Coinbase Global (COIN), which has fallen 30%.

The company carries a forward price-earnings ratio of 80x, which is about twice the level of the more established and mature Coinbase.

Bullish Beats on Earnings

Bullish’s second-ever earnings report – for the third quarter of 2025 – came out Nov. 19. Revenues were $41.6 billion, down from $54.2 billion a year ago. Net income was $18.4 million, a vast improvement from the $67.2 million loss Bullish posted a year ago. Earnings per share of $0.10 were $0.02 better than analysts’ expectations.

“Bullish had a highly successful third quarter,” CEO Tom Farley said. “We launched our crypto options trading and U.S. spot trading businesses, signed notable institutional clients, gained indices traction, and expanded our liquidity services partners meaningfully. We believe Bullish is positioned at the intersection of trends driving crypto evolution: regulatory clarity, institutional adoption, and real-world asset tokenization.”

Management noted that the crypto options product, which was launched in September, surpassed $1 billion in trading volume, and that quarter-to-date spot trading volume is already up 77% from the third quarter. The company posted fourth-quarter guidance that includes revenue in a range of $47 million to $53 million, and expenses of $48 million to $50 million.

What Do Analysts Expect for Bullish Stock?

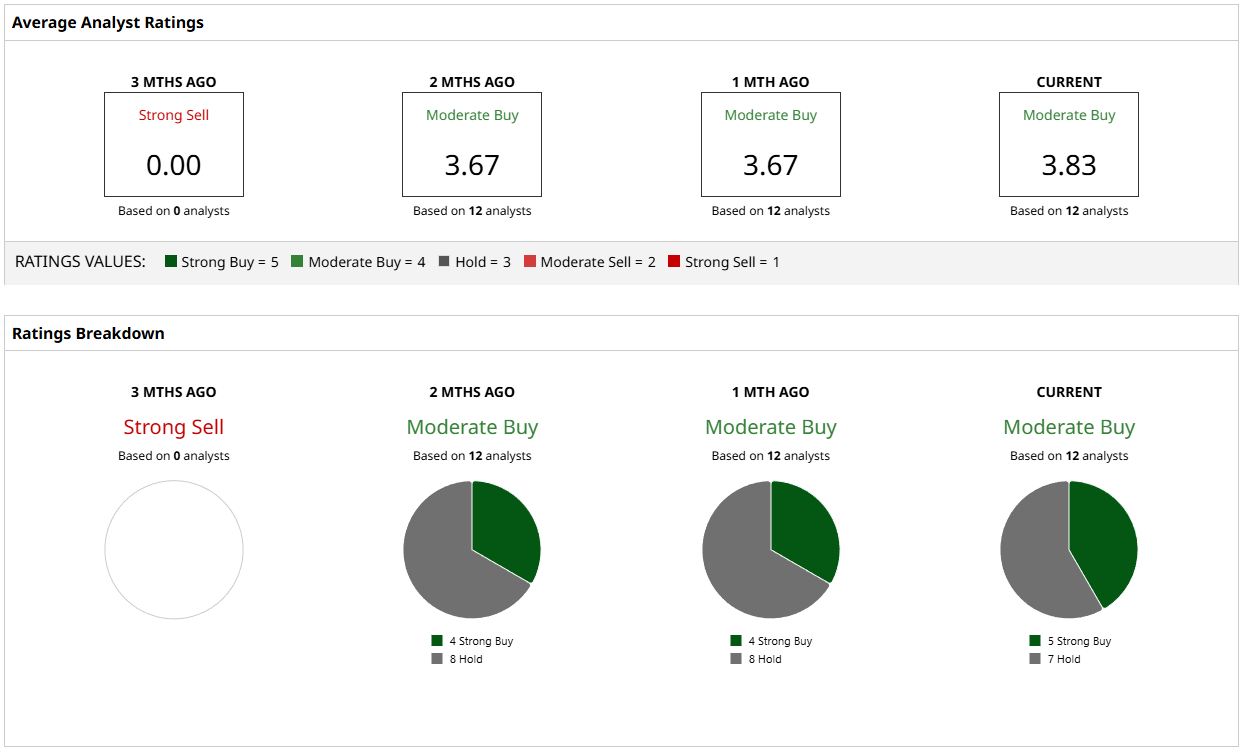

Obviously, Wood is bullish on Bullish. And she’s not alone. Of the 12 analysts currently covering the stock, five of them have “Strong Buy” ratings and the rest recommend holding. There are no bears when it comes to Bullish – at least among this group of analysts.

They have a mean price target on Bullish of $54.80, which is a 35% gain in stock price. The most optimistic rating suggests a whopping 85% increase is possible, while the most pessimistic target of $40 is very close to the current stock price.

The crypto market will always be volatile, so the current negative sentiment is not surprising. But analysts – and Wood – seem to believe that Bullish will recover sooner rather than later.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart