I last wrote about the lumber market and its price action on Barchart on August 21, 2025, where I concluded with the following:

The offseason for lumber demand is on the horizon. The potential for increased price variance due to the uncertainty created by U.S.-Canada trade relations remains high, and the path of least resistance of U.S. short-term interest rates is likely to be lower. Time will tell if longer-term rates follow any Fed Rate cuts over the coming months. Lumber remains a critical construction material, and the current price levels offer a positive risk-reward profile. Accumulating lumber-related assets on a scale-down basis during periods of price weakness over the coming weeks and months could be optimal for 2026, provided the housing market improves and lumber demand rises.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

The active-month lumber futures were trading at $595 per 1,000 board feet on August 19 and were lower, with January futures around the $530 level in late November. Meanwhile, the WOOD and CUT ETFs, as well as WY shares, have declined since August 19, which could present an opportunity for 2026.

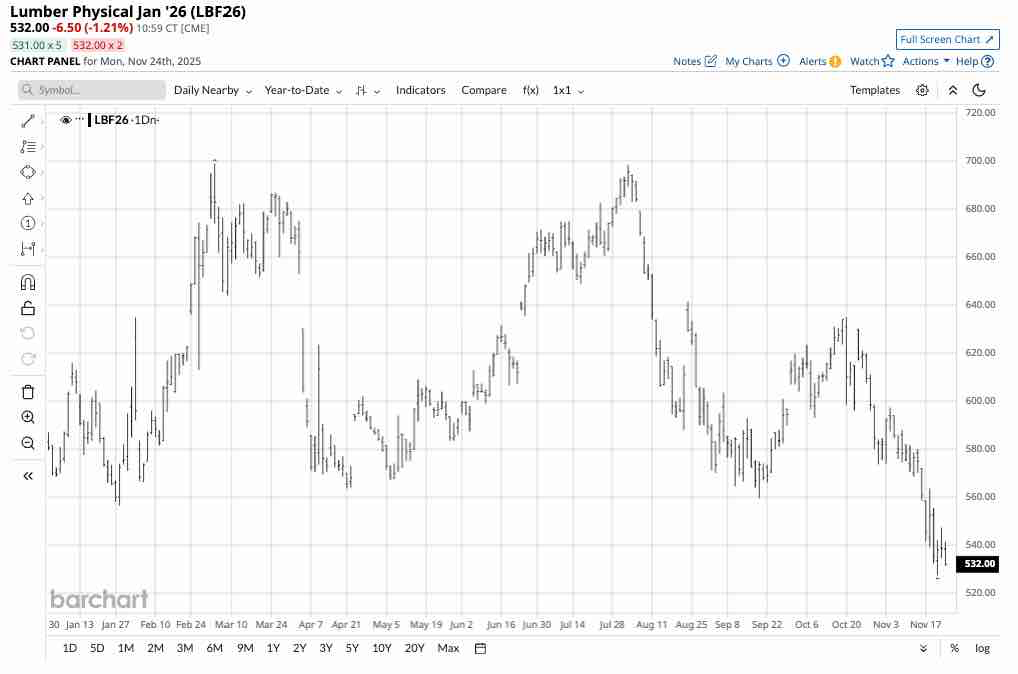

Lumber futures prices are trending lower

The daily continuous CME physical lumber futures chart for January 2026 delivery highlights a choppy year.

January 2026 lumber futures have traded in a $527.50 to $699.00 per 1,000 board feet range in 2025. Lumber futures have been trending lower since reaching a high of $698.50 on August 1, and were at $532, near the lows of 2025 in late November. On August 19, the January lumber futures settled at $595.50 and were 10.7% lower in late November.

While lumber futures were under pressure, the 2025 range has been fairly narrow, given that the random-length lumber futures contract traded to a 2021 high of $1,711.20 and a 2022 peak of $1,477.40 per 1,000 board feet. In both years, the low price was lower than the 2025 low, highlighting the narrow trading range for wood prices in 2025.

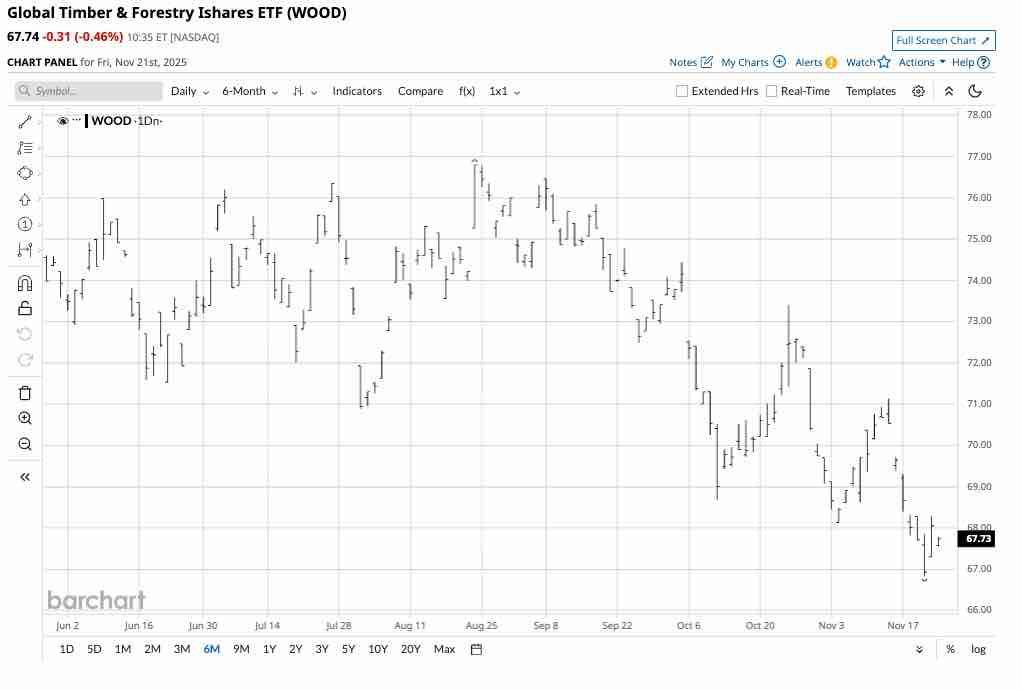

The WOOD and CUT ETFs have declined

On August 19, the iShares Global Timber & Forestry ETF (WOOD) settled at $74.52 per share.

In late November, the WOOD ETF was 9.1% lower at $67.74.

On August 19, the Invesco MSCI Global Timber ETF (CUT) settled at $30.68 per share.

In late November, the CUT ETF was 9.2% lower at $27.86 per share.

The WOOD and CUT ETFs kept pace with the continuous physical lumber futures over the period.

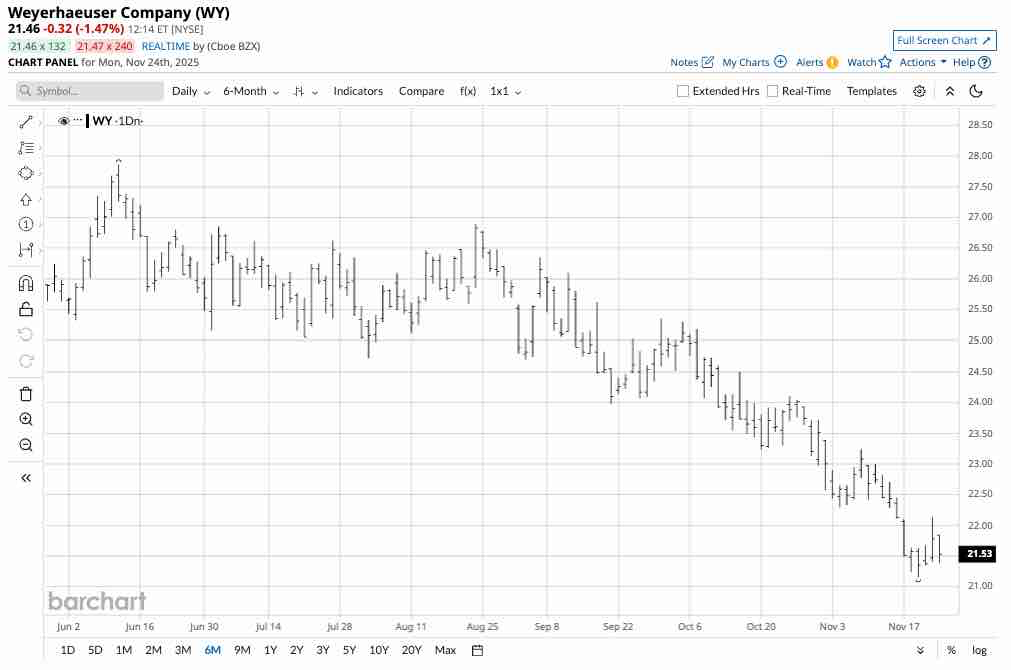

WY shares are falling

On August 19, the shares of the Weyerhaeuser Company (WY) settled at $26.33 per share.

In late November, WY shares were 18.5% lower at $21.46 per share. WY has underperformed lumber and the WOOD and CUT ETFs since August 19, 2025.

The case for accumulating lumber-related ETFs and WY

The case for purchasing lumber exposure through the WOOD and CUT ETFs, and WY shares includes:

- The lumber market tends to reach its highs in spring and early summer and its lows in late fall and winter, driven by demand during the construction season.

- Considering lumber futures’ price range (random-length and physical) since May 2021 has been $1,711.20 to $352.50 per 1,000 board feet, lumber futures are a lot closer to the low than the high, suggesting that there is limited downside.

- U.S. tariffs on Canada, a significant lumber supplier, could continue to distort prices, increasing price variance.

- The prospects for falling U.S. interest rates in 2026 could support new home building and lumber demand. Lower mortgage rates could trigger a surge in new home demand.

As lumber is now in the offseason for demand, this could be an excellent time to begin accumulating lumber-related assets for the coming year. WY shares have declined the most, making the company attractive near the $21.50 per share level. WY’s dividend at $0.83 translates to a 3.9% yield. WY beat EPS and revenue forecasts in its most recent October 30, 2025, earnings report. The WOOD ETF holds 5.14% of its assets in WY shares, while CUT’s exposure is 4.88%.

Leave room to add on further declines and avoid the futures, as liquidity remains exceptionally low

If lumber prices recover, WOOD, CUT, and WY shares could move higher from current levels next year. I favor accumulating these lumber-related assets on a scale-down basis, leaving plenty of room to add on further declines over the coming weeks and months, as lumber will remain in the off-demand season until next spring. The highs in 2021 and 2022 were in May and March, respectively.

Meanwhile, lumber futures remain highly illiquid, with only 9,055 contracts of open interest, the total number of open long and short positions in the physical lumber futures market. While illiquidity makes lumber futures highly dangerous, it can also cause substantial price rallies, as offers to sell can evaporate as prices rise.

As the lumber market heads into winter, lower lows are likely. However, the lower prices fall, the greater the odds of a recovery in 2026, as lumber prices could be waiting for spring to soar.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart