With a market cap of $173.9 billion, Uber Technologies, Inc. (UBER) is a California-based technology company best known for its ride-hailing platform, which connects passengers with drivers through its mobile app. Beyond transportation, Uber operates Uber Eats for food delivery, a freight logistics division, and other mobility services such as shared bikes and scooters.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Uber Technologies fits this criterion perfectly, exceeding the mark. Operating in dozens of countries, the company has become a major player in on-demand services and urban mobility, aiming to build a scalable platform for transportation and delivery worldwide.

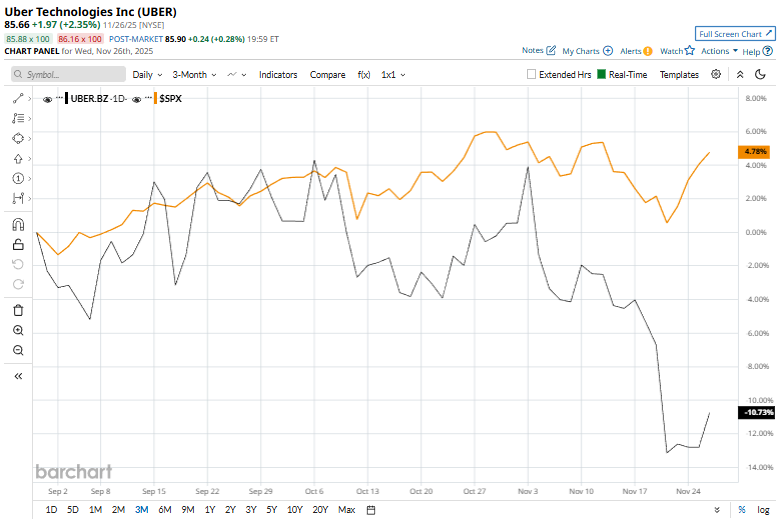

However, shares of the company have dipped 16% from its 52-week high of $101.99 touched on Sept. 22. Over the past three months, shares of Uber Technologies have decreased 11.3%, trailing the S&P 500 Index ($SPX) 5.4% surge during the same period.

In the longer term, UBER stock has soared 42% on a YTD basis, outperforming SPX’s 15.8% return. Moreover, shares of the company have returned 19.7% over the past 52 weeks, compared to SPX’s 13.1% over the same time frame.

Despite a few fluctuations, UBER stock has been trading below its 50-day and 200-day moving averages this month, indicating a downtrend.

Shares of ride-sharing and on-demand delivery platform Uber slid 6.8% on Nov. 4, after the company posted mixed third-quarter results that featured a narrow miss on a key profitability metric. The company generated $13.47 billion in revenue, topping analyst expectations of $13.27 billion, while EPS came in at $3.11, far exceeding the Street’s forecast of $0.69.

It continued to demonstrate strong operating momentum, with trips rising 22% year over year to 3.5 billion and gross bookings up 21% to $49.7 billion. Adjusted EBITDA reached $2.26 billion, up 33% from the prior year but slightly below consensus estimates of $2.27 billion, an outcome that appeared to dampen investor sentiment despite record profitability and robust performance across both mobility and delivery segments. The company added 28 million new monthly active platform users during the quarter, bringing the total to 189 million, while generating $1.1 billion in operating income and $2.2 billion in free cash flow.

In comparison, rival ServiceNow, Inc. (NOW) has performed weaker than UBER stock. NOW stock has decreased 25% over the past 52 weeks and declined 24.3% on a YTD basis.

Due to UBER’s strong performance, analysts are bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 50 analysts covering the stock, and the mean price target of $111.60 represents a premium of 30.3% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With a 6.7% Yield and 27 Years of Dividend Hikes, Is This Stock a Buy Today?

- Marvell Stock Is Down 25% in 2025, and This Analyst Says Investors Should Stay Away from the MRVL Dip

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?