Happy Black Friday to Barchart readers everywhere. I hope Thanksgiving was a great day spent with friends and family, enjoying each other’s company, and watching a lot of football.

Typically, on Friday, I write something that caught my attention about Thursday’s unusual options activity. However, with the markets closed yesterday, I thought I’d do something a little different.

I’ve been writing about investments full-time or part-time since 2004. I’ve learned a lot over the last two decades. One of the things I’ve always tried to foster in my writing is accountability. When you make so many suggestions or recommendations to readers about stocks to buy or sell, inevitably, you are going to be wrong a great deal.

Veteran credit investor Howard Marks likes to say that he has made five market calls in 50 years in the investment business. Buffett says that 12 decisions made over six decades explain all of his good fortune. Good investors usually have a great deal of humility. The same is true for the investment media.

So, to make sure I remain humble, I thought I’d look back at some of my suggestions and recommendations from my unusual options activity commentary in October and November—both good and bad.

All investors should reflect on their good and bad calls. It helps us learn and be better.

Enjoy the rest of your Thanksgiving weekend!

I Made Lemonade Out of Lemons

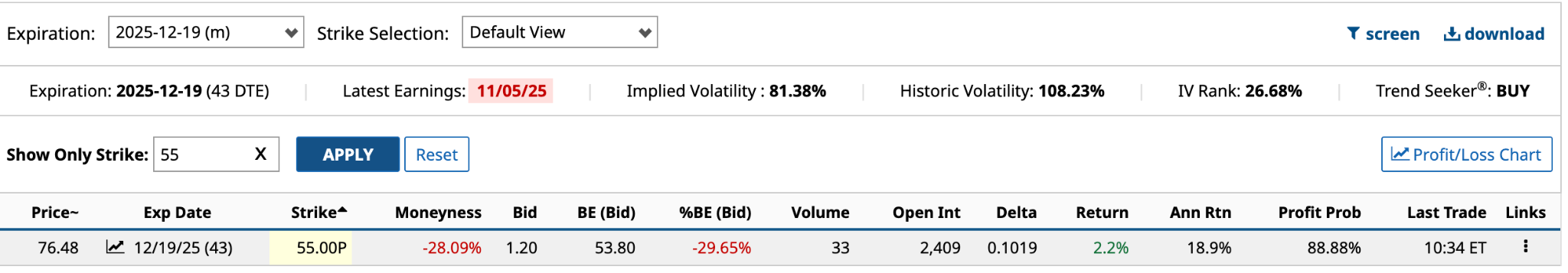

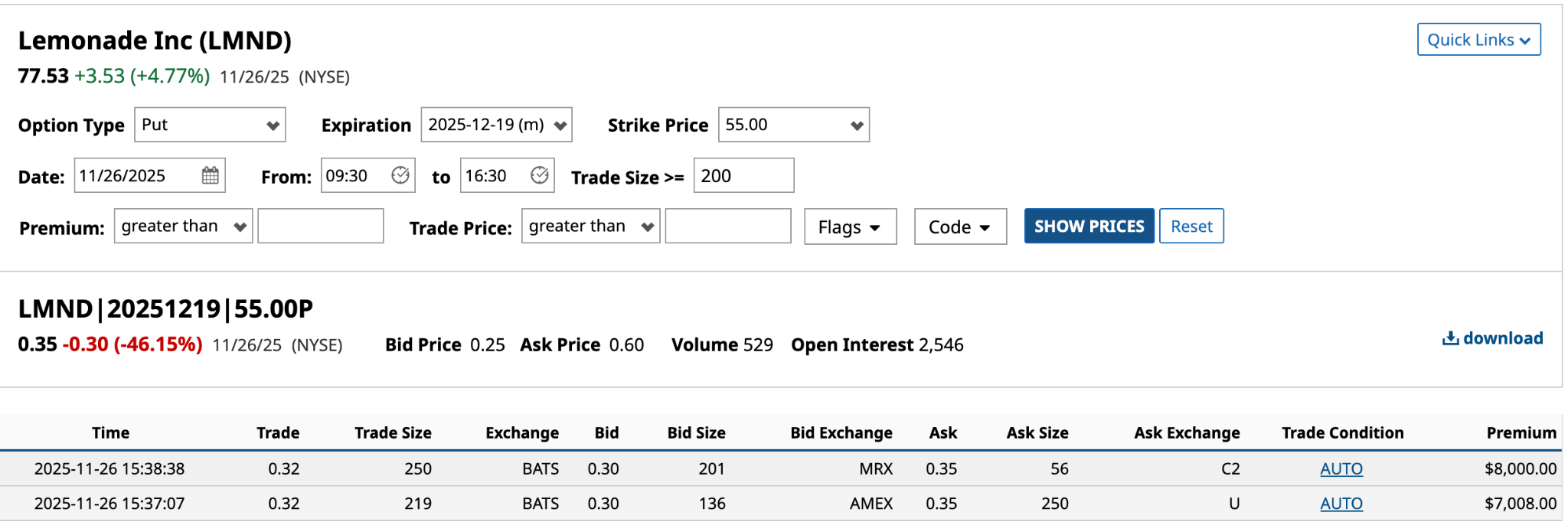

On Nov. 6, I wrote about potential holiday income from Lemonade (LMND), the New York-based insurtech. Specifically, I looked at five bullish income-generating strategies: Covered Call, Cash-Secured Puts, Bull Call Spread, Bull Put Spread, and Iron Condor.

From the Nov. 5 closing price of $78.73, LMND stock is down 1.5%. In today’s pre-market, it looks to get those losses back.

The good news about all five strategies is that their expiration dates are Dec. 19, so there are still three weeks of time decay left.

For example, I suggested selling Dec. 19 $55 cash-secured puts for $120 in premium income. According to Wednesday’s trading, the bid price on the two largest trades was $0.30, or about one-quarter of what they were three weeks earlier. That’s a win.

The QQQ Covered Strangle Thought Experiment Fails

The QQQ Covered Strangle Thought Experiment Fails

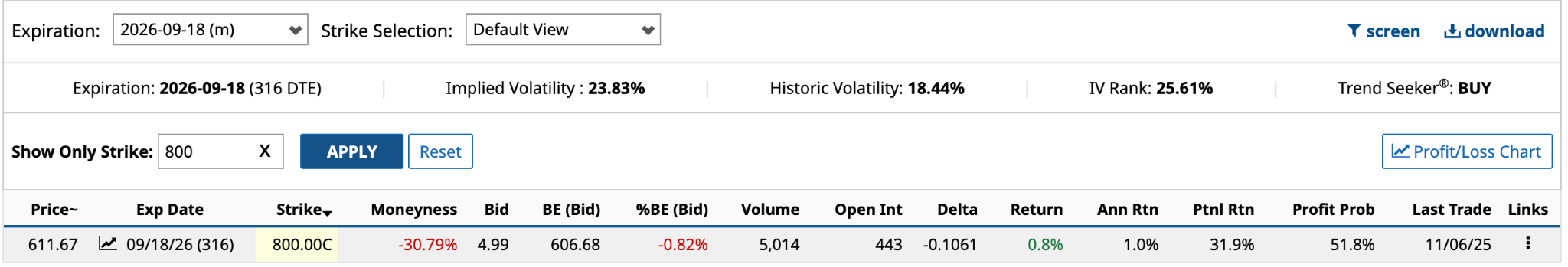

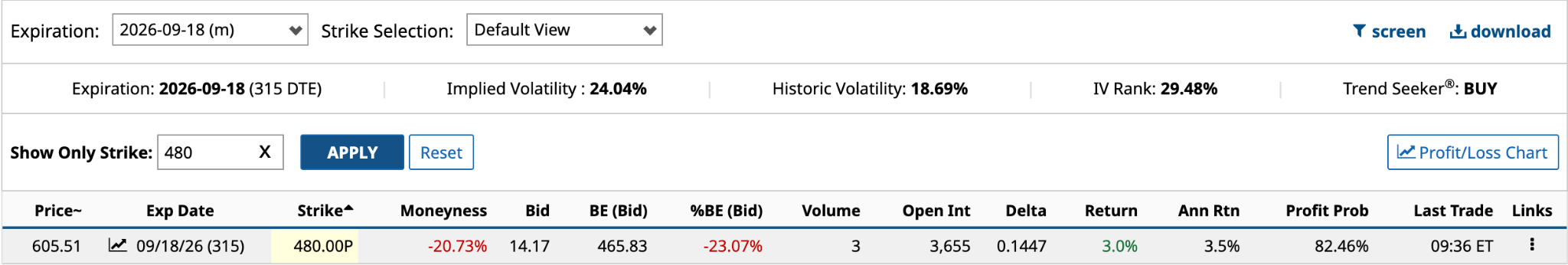

As a bit of a thought experiment, I thought I’d recommend a longer-duration expiry for my Invesco Nasdaq QQQ ETF (QQQ) covered strangle. As I said in my article, 20 to 60-day DTEs (days to expiration) make the most sense for this options strategy, so I was going way out on a limb.

Based on the Nov. 6 closing price of $611.67, QQQ is up 0.4%; it’s barely moved, albeit with a fair bit of volatility in both directions.

The covered strangle combines a covered call OTM (out of the money) with a cash-secured put OTM. I pointed out that if you bought 100 shares at $611.67 and sold a covered call with an $800 strike, your potential return if the shares moved up to $800 or more at expiration on Sept. 18, 2026, would be 31.9%.

However, if you bought the shares at the April 52-week low of $402.39, your return would increase more than threefold. Of course, if the share price doesn’t move, you get to keep the $499 premium, for a 1% annualized return. Hardly worth your time.

As for the cash-secured put, I suggested selling the $480 strike, which is 20.73% OTM, for a 3.5% annualized return. Also, not going to make you rich. The put trade in this instance provides a possible lower entry point for QQQ of $480. However, if the market falls apart, you could face a significant loss.

The thought experiment failed because the reward wasn’t nearly lucrative enough to warrant the risk. Sometimes, best practices exist for a reason.

The thought experiment failed because the reward wasn’t nearly lucrative enough to warrant the risk. Sometimes, best practices exist for a reason.

I Won the Battle But Lost the War With Bath & Body Works

On Nov. 13, I wrote about two unusually active options for Pfizer (PFE) and Bath & Body Works (BBWI). I wanted to know whether each was suitable for a long or short straddle.

I concluded that the former was a short straddle and the latter was a long straddle. For this article, I’ll focus on BBWI. A long straddle involves buying a call and a put with the same strike price and expiration date.

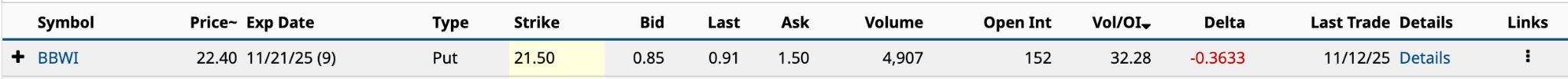

The unusually active option for BBWI was the Nov. 21 $21.50 put. So, the straddle involved buying a $21.50 put and a $21.50 call, both expiring on Nov. 21.

The net debit for the hypothetical trade would be $3.05 [$1.50 ask price for put and $1.55 ask price for call] or 13.6% of the $22.40 Nov. 12 closing price. For the long straddle to be successful, its share price needed to be higher than the upper breakeven or below the lower breakeven at expiration in a little over a week.

The upper and lower breakeven prices were $24.55 and $18.45, respectively. Bath & Body Works reported disappointing Q3 2025 results before the markets opened on Nov. 20. The shares lost 25% of their value, hitting a new 52-week low of $14.28. The shares closed the next day, on Nov. 21, at $14.85, below the breakeven.

So, the call would have expired worthless, while the put would have generated a $3.60 ($360) profit [$21.50 strike price - $14.85 share price - $3.05 net debit], an annualized return of 4,785.6% [$3.60 profit / $3.05 net debit * 365 / 9].

Honestly, the trade worked out, but I got lucky. I had no idea the company’s newish CEO would pull a mea culpa and admit it messed up with moves into adjacent businesses, etc.

I Went to the Palantir Well Once Too Often

My final look back is my Oct. 31 article about Palantir (PLTR), Chipotle Mexican Grill (PLTR), and Constellation Brands (STZ). All three had unusually active options the day before. I’ve been bullish about Palantir for a long time, so I’ll focus on its stock and options.

“I’ve been bullish about Palantir CEO and co-founder Alex Karp for some time. He’s a very bright individual who isn’t afraid to speak his mind. A recent CNBC article discussing the company’s shift in political support from Democrats to Republicans is something to worry about —but not for the reasons you might think,” I wrote on Halloween.

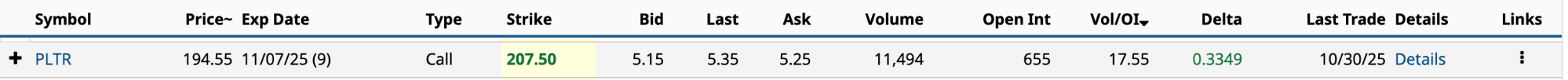

On Oct. 31, Palantir had one unusually active option with open interest over 500, so I went with the Nov. 7 $207.50 call expiring in nine days.

I suggested doing a covered call, which involved buying 100 Palantir shares for $19,455, and simultaneously selling one Nov. 7 $207.50 call for $515 in premium income.

On Nov. 4, PLTR stock dropped by more than 8% on news that hedge fund manager Michael Bury, the guy behind the book The Big Short, had taken a short position in its stock, despite the company reporting excellent quarterly results. They’ve since dropped an additional 14%.

The net debit of the covered call would have been $189.40 [$194.55 share price - $5.15 bid price]. The paper loss at expiration would be $22.51 or $2,251 [$166.89 share price at expiration - $189.40 net debit]. That’s a return of -11.9%.

Live by the sword, die by it.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart