Chevron Corporation (CVX) is a leading multinational energy company that explores, produces, refines, and markets crude oil, natural gas, petrochemicals, and related energy products globally. Headquartered in Houston, Texas, the company operates across both upstream and downstream segments. Chevron has a market cap of $301.2 billion, making it one of the largest energy companies globally.

Companies valued at $200 billion or more are generally considered "mega-cap" stocks, and Chevron falls into this category, reflecting its significant scale, stability, and influence in the energy sector. As one of the world’s leading integrated energy companies, Chevron exemplifies the strength and resilience of a mega-cap company, supported by its extensive global operations, consistent financial performance, and dedication to advancing growth and innovation in the energy industry.

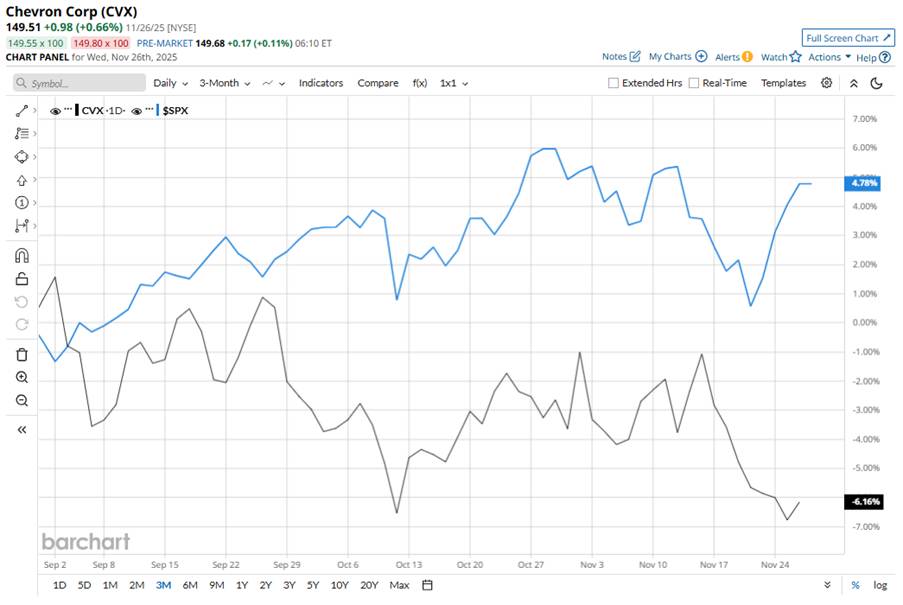

CVX stock is trading 11.5% below its 52-week high of $168.96, set on March 26. CVX has declined 5% over the past three months, underperforming the broader S&P 500 Index ($SPX), which has gained 5.1% over the same time frame.

Longer term, CVX is up 3.2% on a YTD basis, while the shares have declined 8% over the past 52 weeks. In comparison, the SPX has gained 15.8% in 2025 and rallied 13.6% over the past year.

CVX has been trading below its 50-day moving average since late September with some fluctuations. However, it has been trading over the 200-day moving average line since early July, but with some occasional dips.

CVX stock has underperformed due to a combination of falling global oil prices and company-specific operational and legal challenges. The stock is highly sensitive to commodity price fluctuations, and as oil prices weakened throughout the year, Chevron's shares suffered. Additionally, the company faced a loss of high-margin production after its U.S. license for Venezuelan operations expired in May 2025, further pressuring cash flow. However, the Trump administration later issued a restricted license allowing Chevron to resume production and export operations in Venezuela.

In comparison, Chevron’s competitor, Exxon Mobil Corporation (XOM), has gained 6.7% YTD but declined 2.7% over the past 52 weeks.

CVX has a consensus rating of “Moderate Buy” from 26 analysts in coverage. The mean price target of $169.43 reflects a 13.3% premium to current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart