NextEra Energy, Inc. (NEE) is a major utility and clean-energy company that generates, transmits, distributes, and sells electric power to retail and wholesale customers across North America through a diverse mix of energy sources, including wind, solar, nuclear, natural gas and other clean-energy assets. Headquartered in Juno Beach, Florida, NextEra Energy’s market cap is around $178.1 billion.

Companies worth $10 billion or more are generally described as “large-cap” stocks, and NextEra Energy’s market cap places it firmly in that category, highlighting its substantial size, operational stability, and influence within the utilities sector.

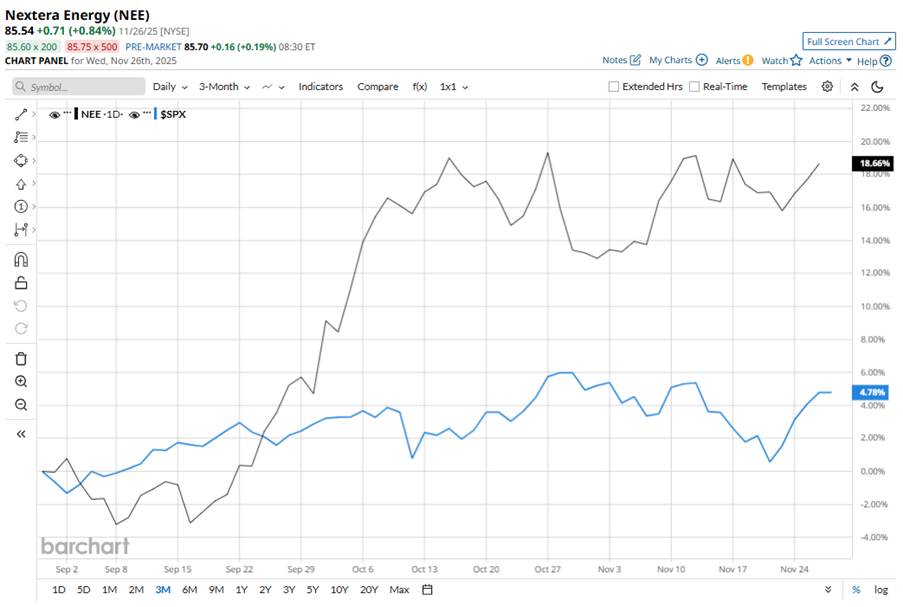

Shares of this utility giant are trading 2.3% below their 52-week high of $87.53 on Oct. 28. NEE stock is up 19.8% over the past three months, outperforming the S&P 500 Index’s ($SPX) 5.1% gains during the same time frame.

Longer term, NEE rose 10.4% over the past year, and 20.5% on a year-to-date (YTD) basis. In comparison, SPX is up 13.6% over the past year and 15.8% YTD.

To confirm the recent momentum, NEE has been trading above its 50-day and 200-day moving averages since late September.

NextEra Energy’s shares are rising in 2025 due to strong operational execution, a rapidly growing renewable energy pipeline, and higher electricity demand fueled by data centers and AI expansion. Also, NextEra and Alphabet Inc. (GOOGL) (GOOG) signed a 25-year agreement in October 2025 to restart Iowa’s nuclear facility, supplying carbon-free power for Google’s expanding AI and cloud operations. This deal underscores NextEra’s strategic positioning as a leading provider of reliable clean energy for major tech clients.

Rival Duke Energy Corporation (DUK) has underperformed NEE with 5.5% gains over the past 52 weeks and 14.6% YTD.

The stock has a consensus rating of “Moderate Buy” from the 23 analysts in coverage, and the mean price target of $89.19 is a 4.3% premium to current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart