Seattle-based Starbucks Corporation (SBUX) operates as a roaster, marketer, and retailer of coffee worldwide. Its stores offer coffee, tea, and various food products. With a market cap of $98.6 billion, Starbucks operates through North America, International, and Channel Development segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Starbucks fits this bill perfectly. Given the company’s extensive operations and stronghold in the QSR and coffee space, its valuation above this mark is unsurprising.

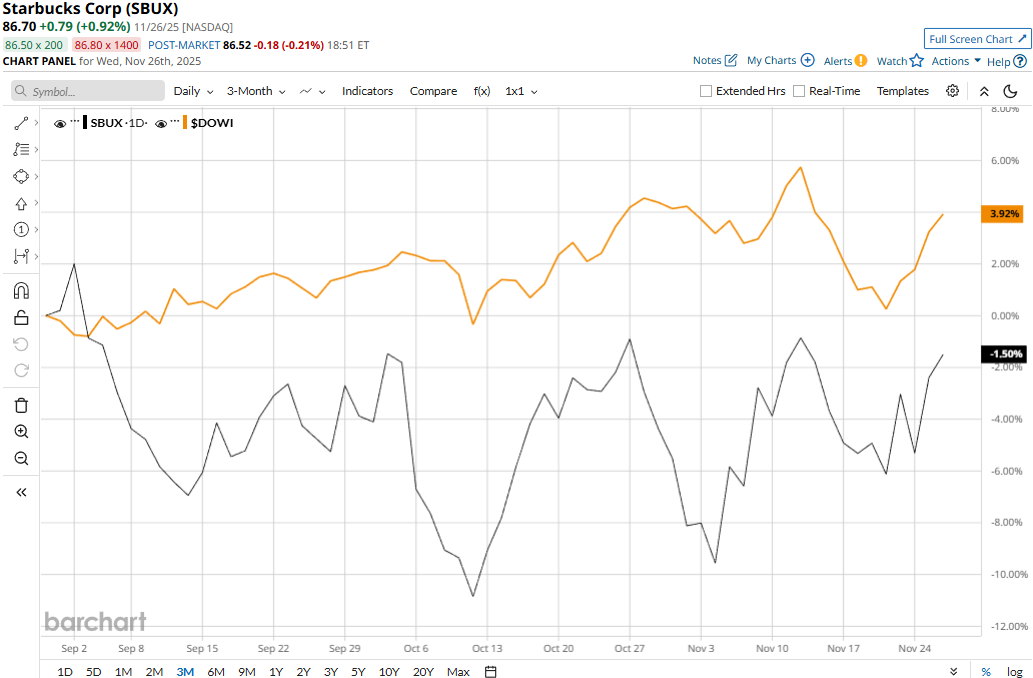

The coffee giant touched its three-year high of $117.46 on Mar. 3 and is currently trading 26.2% below that peak. Meanwhile, SBUX has observed a marginal 8 bps uptick over the past three months, lagging behind the Dow Jones Industrial Average’s ($DOWI) 4.4% gains during the same time frame.

Starbucks’ performance has remained underwhelming over the long term as well. SBUX stock has dropped nearly 5% on a YTD basis and declined 13.9% over the past 52 weeks, compared to the Dow’s 11.5% gains in 2025 and 5.7% uptick over the past year.

Starbucks has traded below its 200-day moving average since early April and below its 50-day moving average since late July, underscoring its bearish trend.

It's been over a year since the start of the new CEO Brian Niccol’s Back to Starbucks strategy, and the results of this strategy haven’t been as fruitful as initially expected. Starbucks' comparable sales have observed a consistent decline for several quarters. Despite the low base, its comparable sales haven’t observed the anticipated growth. In Q4 2025, the company’s North America comps remained flat year-over-year. However, international comps observed a 3% improvement, driven by 6% increase in comparable transactions, partially offset by 3% decline in average ticket.

Its overall topline increased 5.5% year-over-year to $9.6 billion, beating the Street’s expectations. However, due to lower average ticket size in international markets and subdued performance in local markets, Starbucks’ margins got squeezed. Its adjusted EPS for the quarter plummeted 35% year-over-year to $0.52, missing the consensus estimates by 5.5%. SBUX stock prices have dropped 1.2% in the trading session following the release of its lackluster Q4 results on Oct. 29.

When compared to its peer, Starbucks has significantly underperformed its peer, Dutch Bros Inc.’s (BROS) 11.3% surge in 2025 and 10% returns over the past 52 weeks.

Nonetheless, analysts remain cautiously optimistic about the stock’s prospects. SBUX has a consensus “Moderate Buy” rating overall. Its mean price target of $92.55 suggests a 6.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This AI Dividend Stock Is a Buy Even as the S&P 500’s Yield Falls to Dot-Com Lows

- Have You Heard of the ‘Wheel’ Strategy? These 3 Unusually Active Stocks to Buy Can Get You Started

- 3 Buy-Rated Dividend Aristocrats Easily Beating Inflation

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?