Last month, I recommended shorting the Amazon, Inc. (AMZN) $235.00 strike price put option expiring today for a 1.36% yield over the month. It makes sense now to roll this put AMZN option over to the next month, as it might expire in the money.

AMZN is trading at $232.03 in late trading today, as the market closes early. This is up from a recent low of $217.14 on Nov. 20.

I had discussed shorting the $235.00 put option expiring today in the Oct. 31 Barchart article, “Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued.”

At the time, AMZN stock was at $245.90, and the put had a midpoint premium of $3.20. So, that provided an immediate yield to the short-seller of 1.36% (i.e., $3.20/$235.00).

The $235.00 strike price put option will be exercised if AMZN stays at this level. However, it still trades for 4 cents, and the short-put investor can repurchase it.

So, now it makes sense to roll this over to the next month.

Rolling the Put Option Over

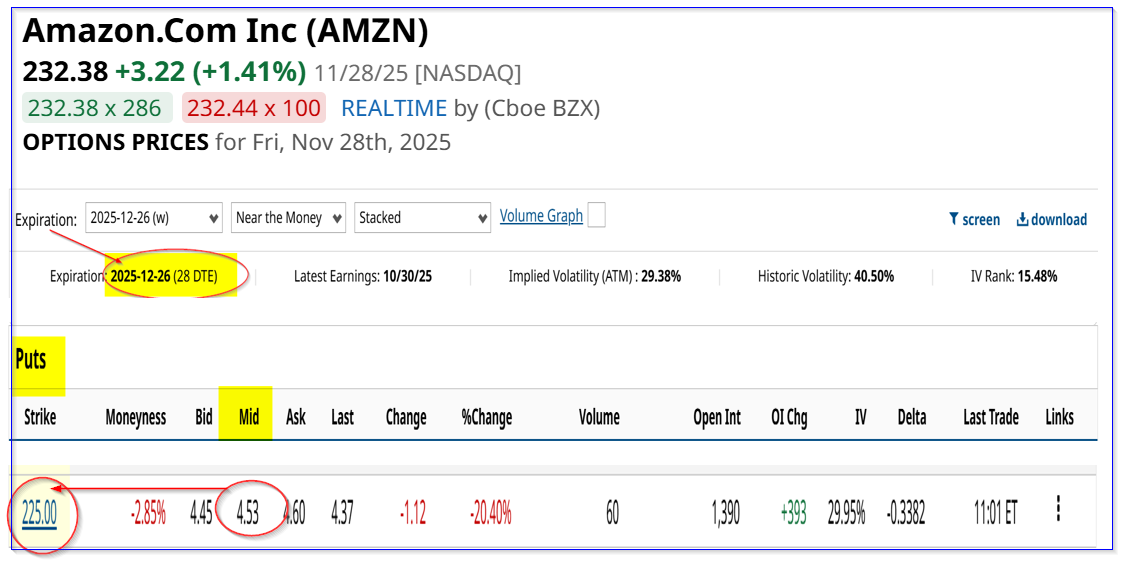

For example, the Dec. 26, 2025, put option period shows that the $225.00 strike price put option has a midpoint premium of $4.53. That provides an immediate cash-secured put option yield of 2.0% (i.e., $4.53/225.00).

That is a great way to play AMZN as it sets a new, potentially lower buy-in point. For example, the breakeven point, should AMZN fall to $225.00 on or before Dec. 26, is:

$225.00 - $4.53 = $220.47

That is over 5.1% lower than today's price.

So, the investor makes 2.0% plus gets to potentially buy in at a lower point.

I set the price target in my last article at $311.50 per share, so that provides a good upside:

$311.50/$220.47 = +41.2% upside.

The bottom line is that AMZN stock looks cheap here. One way to play it relatively safely is to short out-of-the-money (OTM) put options in one-month out expiry periods.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Shorting Secured Out-of-the-Money Amazon Puts Works Here

- This Rare Earths Stock Just Locked Down a New Supply Deal. Should You Buy Shares Here?

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.