Tech infrastructure stocks tied to AI have dominated investor conversations this year, but not every player earns sustained applause; some merely ride the hype, while others show signs of durable product-market fit and improving customer economics. For everyday investors, the difference matters: you want the names that build real platform advantages, not just headlines.

One of those names is Twilio (TWLO). After a quarter that surprised Wall Street, the company’s outlook and execution have prompted a fresh wave of analyst enthusiasm. Not for a single metric, but for the bigger picture: expanding AI-driven use cases, stronger customer engagement, and clearer paths to recurring revenue and cash generation. Analysts are broadly upbeat, and that collective confidence is why investors are asking whether now is the time to buy. Let's find out.

About TWLO Stock

Based in San Francisco, Twilio is a cloud communications platform that provides software APIs that let businesses embed real-time voice, messaging, video, and authentication into their applications. Millions of developers and enterprises worldwide use Twilio’s services to power customer engagement and communications.

Currently, Twilio is heavily investing in AI and improvements to the platform. It introduced new enterprise-level data observability and alerting components to its Customer Engagement Platform in mid-October in an effort to enable its customers to enable trusted workflows with real-time insights of their data. In addition, the company also said it would buy Stytch, an AI application identity authentication startup, in its push of AI into communications and security.

Valued at around $20 billion by market cap, Twilio shares are up about 23% in 2025, fueled by improving growth, rising profitability, and strong cash generation. The latest earnings beat, including accelerating revenue and robust customer adoption, sent the stock up roughly 20%. Investors are increasingly optimistic as AI-driven communications lift demand and guidance continues to trend higher.

Following the rally, investors are debating whether TWLO stock’s valuation fairly reflects its improving fundamentals. TWLO's trailing P/E near 78x and forward P/E around 64x sit well above the software industry average, while its price-to-sales ratio of roughly 3.7x is only slightly elevated. However, the price-to-book ratio of 2.17 is attractively lower than the sector median of 4.62, suggesting some undervaluation.

TWLO Smashes Q3 Earnings Estimate

On Oct. 30, Twilio posted another impressive quarter, showing that its turnaround is gaining momentum. Revenue came in at around $1.30 billion, up 15% year-over-year (YoY) and about 13% on an organic basis. Even better, the company is now solidly profitable: net income hit $37 million, a big improvement from a loss a year ago. Adjusted EPS jumped 23% to $1.25. Gross margins held strong at just over 50%.

Cash generation remains a major bright spot. Twilio produced roughly $248 million in free cash flow this quarter and ended Q3 with $2.46 billion in total liquidity (cash plus marketable securities) versus about $992 million in debt, leaving the company in a comfortable net cash position.

CEO Khozema Shipchandler called it a “record quarter of revenue and non-GAAP income,” saying the company is seeing strength across the board from small startups to the world’s largest enterprises.

Guidance was also upbeat. For Q4, management expects $1.31 to 1.32 billion in revenue, up 9.5 to 10.5% YoY, and $1.17 to 1.22 billion in adjusted EPS, both comfortably ahead of Wall Street’s expectations. For the full year 2025, Twilio raised its revenue growth outlook to 12.4% to 12.6% and bumped free cash flow guidance to $920 to 930 million.

What Do Analysts Say About TWLO Stock

Wall Street largely loves what it’s seeing from Twilio following its big Q3 beat. Morgan Stanley reaffirmed its “Overweight” rating and raised its price target to $154 based on solid mid-teen growth in voice and messaging and strong across-the-board performance among customer segments.

Goldman Sachs shared the same optimism, maintaining a “Buy” rating and increasing its price target to $150 as it noted a threefold increase in AI-driven ConversationRelay volume of voice and a positive, sustainable energy of messaging.

Mizuho had also raised its target to $150 instead of $140 and referred to Twilio as a conviction list pick due to its faster organic growth and initial successes on AI products.

Needham and Rosenblatt were also very optimistic; the analyst of Rosenblatt trailed the results as being exceptionally strong. Even Bank of America, which tends to be reserved in its name, had to accept the momentum: it lifted its target to $110.

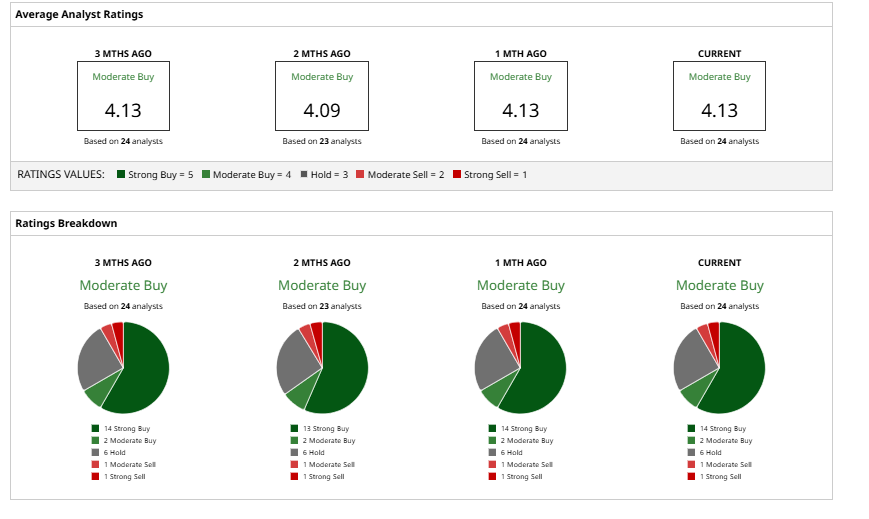

Overall, Twilio is now rated by 24 analysts with a consensus rating of “Moderate Buy” with an average price target near $134.8, suggesting no meaningful upside potential as the stock is now trading at $132.3.

However, given the current performance, the bull case at Twilio is getting stronger than ever, which is backed by growing demand and easier-to-increase profitability, as well as huge opportunities offered by big AI. Some analysts believe that there is still more to gain, probably 20 to 30%, as long as the management continues with the execution; however, the investors should expect bumps along the way.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart