With a market cap of $83 billion, Howmet Aerospace Inc. (HWM) is a leading global provider of advanced engineered solutions for the aerospace and transportation industries. Operating through four key segments: Engine Products; Fastening Systems; Engineered Structures; and Forged Wheels, the company serves customers worldwide with high-performance components and systems.

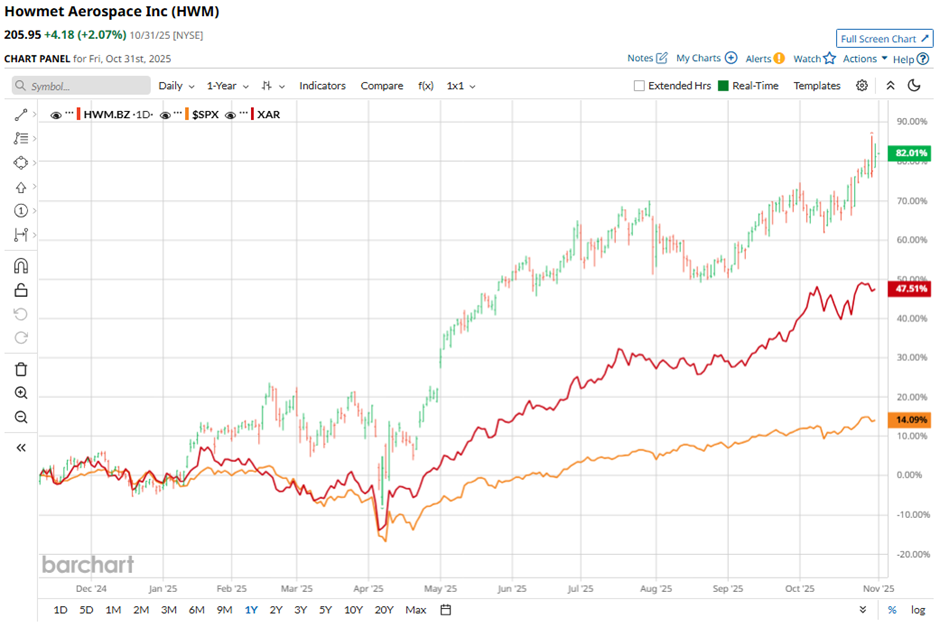

Shares of the Pittsburgh, Pennsylvania-based company have significantly outperformed the broader market over the past 52 weeks. HWM stock has surged 103.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.7%. In addition, shares of the company are up 88.3% on a YTD basis, compared to SPX’s 16.3% gain.

Focusing more closely, shares of the aerospace and defense supplier have also outpaced the SPDR S&P Aerospace & Defense ETF’s (XAR) 56.9% return over the past 52 weeks and 49.9% YTD increase.

Despite reporting better-than-expected Q3 2025 EPS of $0.95 and revenue of $2.09 billion, Howmet Aerospace shares fell marginally on Oct. 30 due to guidance for slower revenue growth in 2026 of roughly $9 billion (up 10% year-over-year), down from the current 14% growth rate. Additionally, persistent weakness in the commercial transportation segment, which declined 3% year-over-year, raised concerns.

For the current fiscal year, ending in December 2025, analysts expect HWM’s EPS to grow 37.2% year-over-year to $3.69. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

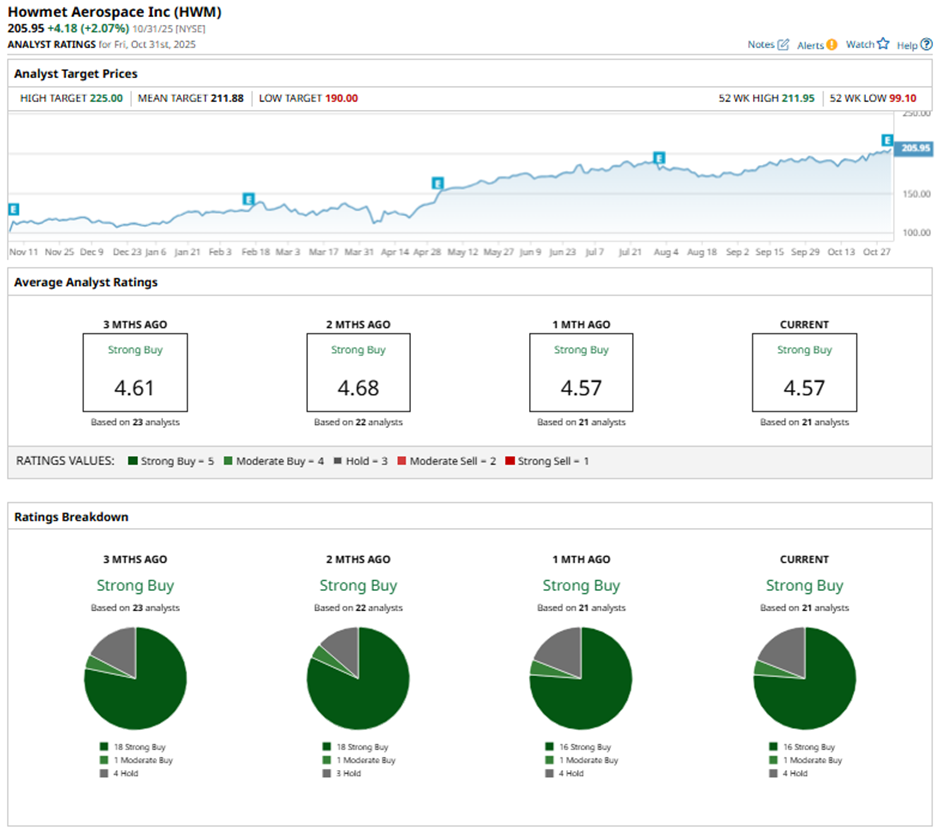

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

This configuration is less bullish than three months ago, with 18 “Strong Buy” ratings on the stock.

On Oct. 31, RBC Capital analyst Ken Herbert raised the price target on Howmet Aerospace to $235 and maintained an “Outperform” rating.

The mean price target of $211.88 represents a 2.9% premium to HWM’s current price levels. The Street-high price target of $225 suggests a 9.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart