Apple (AAPL) is once again in the limelight, as Jefferies upgraded the stock to "Hold," reversing a previous "Underperform," in reaction to encouraging iPhone 17 sales as well as services performance. This upgrade comes on the back of Apple’s record-breaking performance in the September quarter, in which the company topped analysts’ forecasts in terms of both revenues and profits, in addition to forecasting double-digit gains in the upcoming December quarter.

However, despite this outstanding performance, analysts continue to cite a "premium stock," leading to speculation that the next wave of gains will require innovation in products, including the soon-to-be-launched foldable iPhone 18.

This optimism arises against a rather turbulent technological environment, with the Nasdaq Composite ($NASX) having surged by nearly 30% year-to-date (YTD) as investors continue to rotate into large-cap AI plays. It is against this background that a hardware leader combined with a growing income base has been identified as critical in maintaining investor interest going into 2026.

About Apple Stock

Apple, the largest technology firm in the world in terms of market capitalization, is headquartered in Cupertino, California, with a current valuation of about $4 trillion. This firm is involved in the design, development, and sale of various consumer electronics as well as software products such as iPhone, iPad, Mac, and Apple Watch, as well as a rapidly increasing services-based ecosystem that encompasses the App Store, iCloud, and Apple TV+ content.

AAPL stock is currently pegged at around $271, a gain of approximately 21% in the last 52 weeks, only slightly outpacing the S&P 500 Index ($SPX) performance of 19%. Apple stock touched a high of $277.32 on Oct. 31 due to stable iPhone sales as well as the company’s entry into AI-based products.

From a valuation perspective, Apple is currently priced at a price-earnings ratio of 34.5x and a price-sales ratio of 9.68 times, both of which are higher than the industry averages. Even as a sign of overvaluation, these ratios do point towards a certain pricing power enjoyed by Apple in terms of its sustainable revenues. Apple’s return on equity of 168.5% is a telling indicator of the firm’s capital efficiency, even if analysts fear a certain slowdown in price gains.

Apple announced a dividend of $0.26 per share that is payable on Nov. 13. This is in line with the long history of distributing dividends to shareholders. However, considering the stock price appreciation, this is a small contribution.

Apple Beats on Earnings and Raises Guidance

Apple posted Q4 FY2025 results of $102.5 billion in revenue, a jump of 8% year-over-year (YoY), including diluted EPS of $1.85, a rise of 13% on a YoY basis. This beats analysts’ forecasts, setting a record in the September quarter in the iPhone as well as Services businesses.

It had a great quarter in terms of Services, seeing a revenue increase of 15% in Services, driven by the App Store, ads, cloud subscriptions, and a boost in iPhone sales of 6% in the new iPhone 17 model. Mac sales also experienced a surge of 13%, with a dip of approximately 4% in China due to a short-term limitation in “product availability,” according to CEO Tim Cook.

Going ahead, Apple has predicted a revenue increase of 10%-12% in the December quarter, marking the first double-digit increase since 2022. Its gross margins are predicted to range between 47% and 48% despite incurring approximately $1.4 billion in tariffs. According to Jefferies analyst Edison Lee, "Apple’s guide suggests product growth of about 10% and services of 13%-14%," indicating a positive performance in the next fiscal year of 2026.

Jefferies sees a positive China revenue growth in 1QFY26 driven by aggressive pricing strategies as well as government subsidies in the iPhone 17 sale. Nevertheless, they noted that a boost in earnings upgrade is not yet forthcoming amidst stronger comparables as well as a possible price hike of the iPhone 18 in the next year.

What Do Analysts Expect for AAPL Stock?

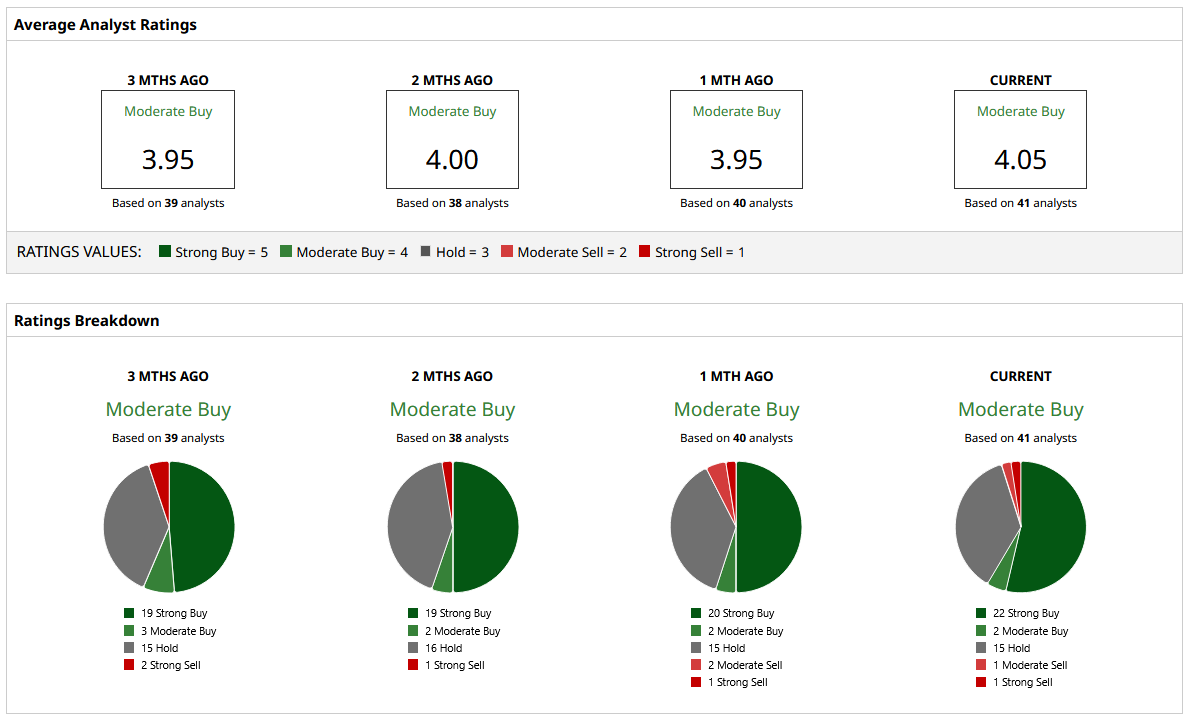

AAPL stock has a "Moderate Buy" rating consensus and a mean price target of $275.23, which implies a modest upside of around 2% at the current price of $270.79. A high price target of $345 suggests substantial gains if Apple’s hardware innovation cycle turns out well, but a low price target of $180 is a concern in terms of product mix and consumer spending.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Royal Caribbean’s (RCL) Options Implosion Offers Up a Massive Informational Arbitrage Trade

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.

- Core Scientific Just Got a New Street-High Price Target. Should You Buy CORZ Stock Here?