Nike, Inc. (NKE), based in Beaverton, Oregon, is the leading global provider of athletic shoes, apparel, and sports equipment. Known for its iconic Swoosh and groundbreaking innovations, Nike has recently launched new initiatives focused on sustainability and advanced sports technology.

These efforts underscore the company’s commitment to enhancing athletic performance while promoting environmental responsibility, thereby solidifying its position as a leader and innovator in the sportswear industry. The sportswear giant has a market capitalization of $95.48 billion.

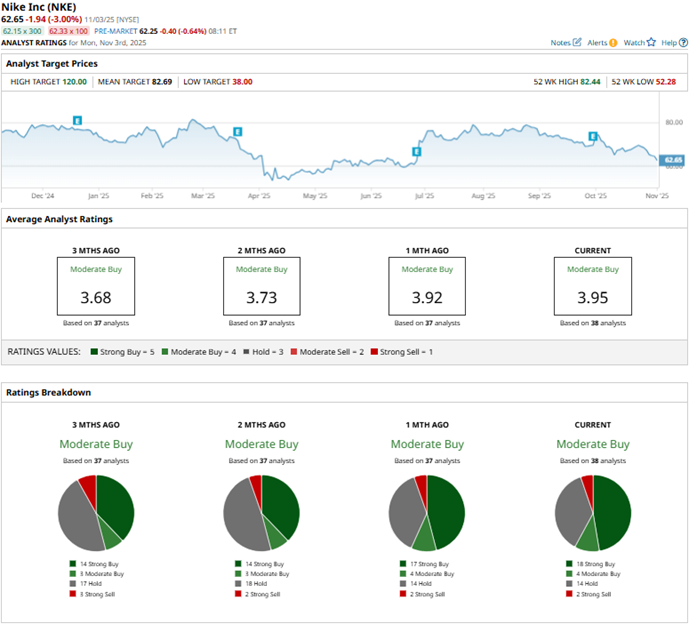

Based on subdued expectations and consumer sentiment, Nike’s stock has been under pressure. Over the past 52 weeks, the stock has declined 19.7%. It is also down by 16% over the past three months. The stock reached a 52-week low of $52.28 in April but is now up 19.8% from that level.

In contrast, the S&P 500 Index ($SPX) has gained 19.6% and 9.8% over the same periods, respectively, which reflects that the stock is underperforming the broader market. Nike’s business nature categorizes it as a consumer cyclical company. Comparing the stock to the Consumer Discretionary Select Sector SPDR Fund (XLY), we see that the stock has also underperformed its sector, as the ETF has gained 21% over the past 52 weeks and 12.1% over the past three months.

For the first quarter of fiscal 2026 (the quarter that ended on Aug. 31), Nike’s revenues increased by a modest 1% year-over-year (YOY) to $11.72 billion, as the company faces market headwinds and is trying to recover from losses. Its gross profit declined by 6% annually to $4.94 billion. However, Nike’s inventories also dropped by 2% to $8.10 billion as of Aug. 31, and the company returned approximately $714 million to shareholders in the first quarter.

Wall Street analysts express concern about Nike’s bottom-line trajectory, offering a mixed outlook. For the fiscal year 2026, which ends in May 2026, Wall Street analysts expect Nike’s EPS to drop 23.6% YOY to $1.65 on a diluted basis. However, EPS is expected to increase 50.3% to $2.48 in fiscal 2027. On the other hand, the company has a solid history of surpassing consensus EPS estimates, topping them in all four trailing quarters.

Among the 38 Wall Street analysts covering Nike’s stock, the consensus is a “Moderate Buy.” That’s based on 18 “Strong Buy” ratings, four “Moderate Buys,” 14 “Holds,” and two “Strong Sells.” The ratings configuration is more bullish than it was a month ago, with 18 “Strong Buy” ratings, up from 17 in the previous configuration.

Last month, Bernstein analyst Aneesha Sherman maintained a “Buy” rating on NIKE’s stock, with a price target of $90. Just a few days earlier, Piral Dadhania from RBC Capital maintained a “Buy” rating on the stock, with a price target of $85.

Nike’s mean price target of $82.69 indicates a 32% upside over current market prices. The Street-high price target of $120 implies a potential upside of 91.5%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Will SoFi Stock Keep Climbing or Is It Due for a Pullback After a 181% Gain?

- 35% of the Top 100 U.S. Stocks Are Down This Year. These 3 Stocks in Particular Will Tell Us When It’s Time to Run.

- 2 Stocks to Buy Now to Profit from the Rise of Robotics

- Bull Put Spread Provides Opportunities for Long-Term Microsoft Bulls