San Jose, California-based Super Micro Computer, Inc. (SMCI) develops and manufactures advanced server and storage solutions built on a modular and open architecture. Valued at $30.2 billion by market cap, the company offers servers, storage systems, motherboards, full racks, chassis, and accessories worldwide.

Shares of this AI server giant have significantly outperformed the broader market over the past year. SMCI has gained 94.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 19.6%. In 2025, SMCI stock is up 66.5%, surpassing SPX’s 16.5% rise on a YTD basis.

Zooming in further, SMCI’s outperformance is also apparent compared to the Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained about 34.8% over the past year. Moreover, SMCI’s gains on a YTD basis outshine the ETF’s 29.8% returns over the same time frame.

SMCI's performance boost comes from new partnerships and record-breaking results in high-performance computing and AI server solutions. The company, in collaboration with Intel Corporation (INTC) and Micron Technology, Inc. (MU), set new world records in the STAC-M3 benchmark for financial databases, achieving faster query times and using fewer CPU cores. This could speed up algorithmic trading and strategy testing for financial firms.

On Aug. 5, SMCI reported its Q4 results, and its shares closed down more than 18% in the following trading session. Its net sales stood at $5.8 billion, up 7.5% year over year. The company’s adjusted EPS declined 24.1% year over year to $0.41.

For fiscal 2026, ended in June 2026, analysts expect SMCI’s EPS to grow 23.8% to $2.13 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimates in two of the last three quarters while beating the forecast on another occasion.

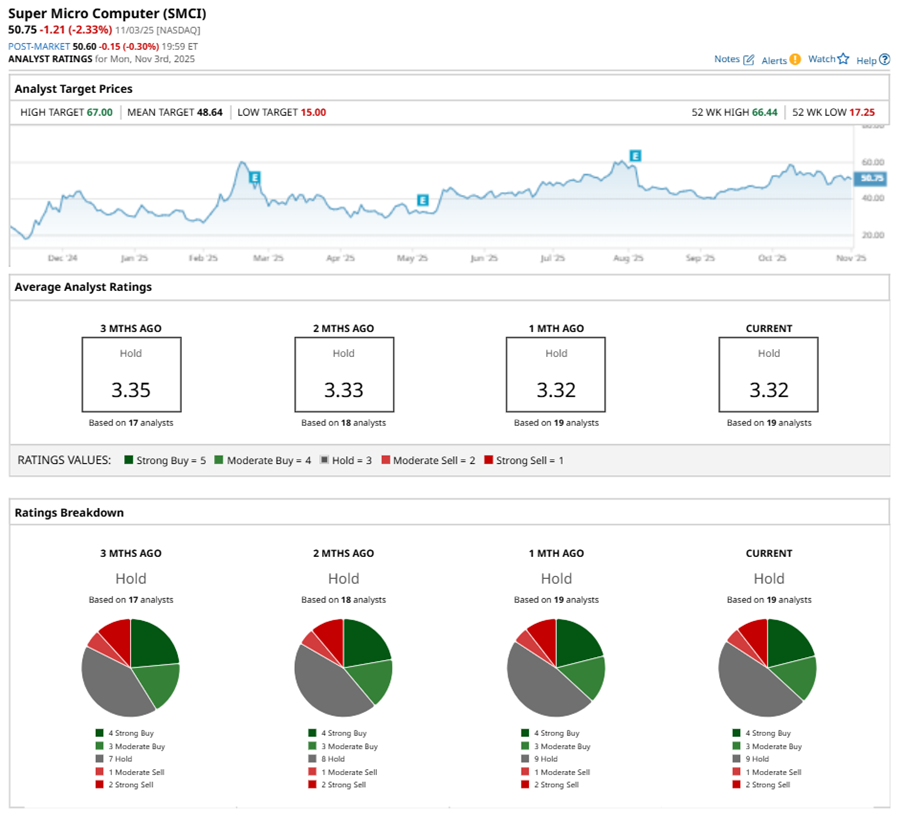

Among the 19 analysts covering SMCI stock, the consensus is a “Hold.” That’s based on four “Strong Buy” ratings, three “Moderate Buys,” nine “Holds,” one “Moderate Sell,” and two “Strong Sells.”

The configuration has been relatively stable over the past three months.

On Oct. 24, JPMorgan Chase & Co. (JPM) kept a “Neutral” rating on SMCI and lowered the price target to $43.

While SMCI currently trades above its mean price target of $48.64, the Street-high price target of $67 suggests a 32% upside potential.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart