With a market cap of $72.6 billion, U.S. Bancorp (USB) is one of the largest U.S. financial-services holding companies and the parent of U.S. Bank. Headquartered in Minneapolis, it offers retail and commercial banking, payments, lending, and wealth management services nationwide.

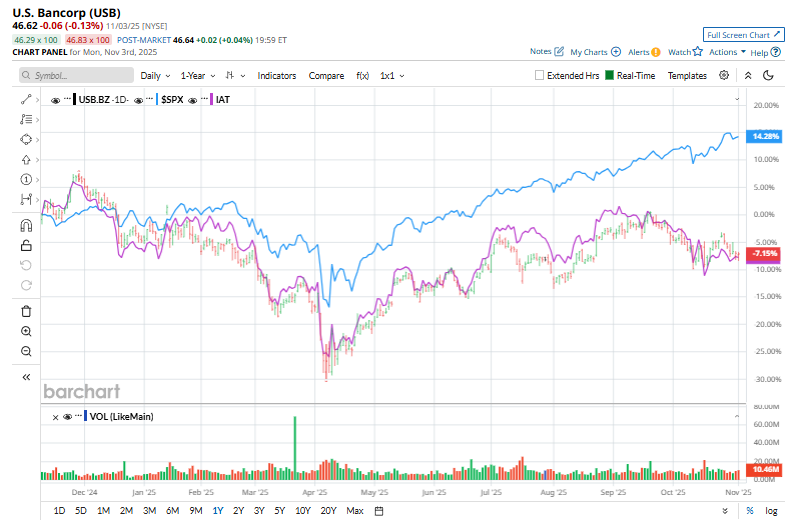

Despite its scale, U.S. Bancorp has lagged the broader market over the past year. USB has declined 2.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 19.6%. The trend has continued into 2025, with the stock slipping 2.5% year-to-date, compared to a 16.5% gain for the index.

Even within its own industry group, USB’s relative weakness is evident. The stock has lagged behind the iShares U.S. Regional Banks ETF (IAT), which has gained marginally over the past year and has dropped 1.8% in 2025.

On Oct. 16, USB shares dipped 1.7% after the company released its fiscal 2025 third-quarter earnings. It posted $7.3 billion in revenue, up 6.8% year over year, and EPS of $1.22, an increase of 18% from last year. The bank benefited from solid fee income growth and an improved net interest margin of 2.8%, supported by disciplined cost management and positive operating leverage.

For the current fiscal year, ending in December, analysts expect USB’s EPS to grow 13.1% to $4.50 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

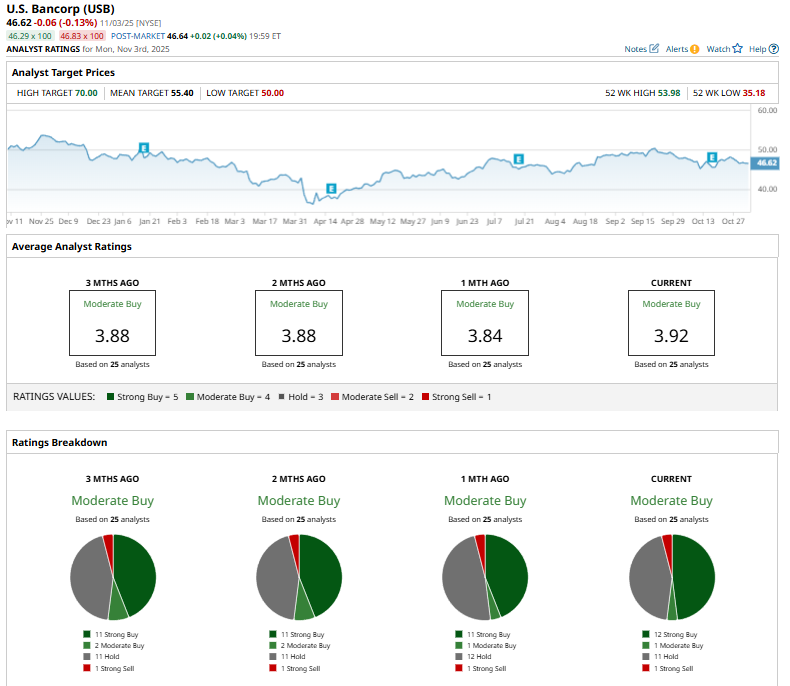

Among the 25 analysts covering USB stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and one recommends a “Strong Sell.”

This configuration is more bullish than a month ago, with 11 analysts suggesting a “Strong Buy.”

On October 10, J.P. Morgan analyst Vivek Juneja reiterated a “Sell” rating on U.S. Bancorp and set a $50 price target.

The mean price target of $55.40 represents an 18.8% premium to USB’s current price levels. The Street-high price target of $70 suggests an ambitious upside potential of 50.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart