Live Nation Entertainment, Inc. (LYV) is recognized as a leading force in the global live entertainment industry, specializing in concert organization, ticketing solutions, and comprehensive event management services. Its primary base of operations is in Beverly Hills, California, from where it directs an extensive network of venues and artist partnerships worldwide.

Since its inception in 2005, Live Nation has utilized innovation and large-scale partnerships to connect millions of fans to live experiences each year. The company has a market capitalization of $35.06 billion.

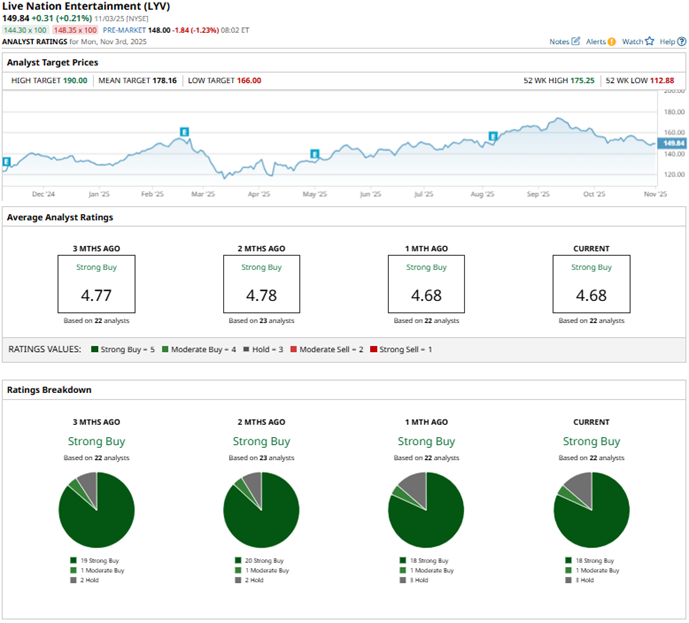

Based on key factors such as demand for live entertainment, expansion into new markets, and international concerts, Live Nation’s stock has remained buoyant. Over the past 52 weeks, the stock has gained 27.9%, while it is up 12% over the past six months. Live Nation’s shares reached a 52-week high of $175.25 in September but are down 14.5% from that level.

While the stock has outperformed the S&P 500 Index ($SPX), which has gained 19.6% over the past 52 weeks. However, it has underperformed the index’s 20.5% gain over the past six months. The same dichotomy can be observed when comparing it with its sector-specific Vanguard Communication Services Index Fund ETF Shares (VOX), which has increased 24.7% and 22.5% over the same periods, respectively.

In the second quarter, Live Nation’s revenue increased by 16% year-over-year (YOY) to $7.01 billion, which was higher than the $6.80 billion expected. This was predicated on an annual increase in concert revenue of 19% to $5.95 billion. Its adjusted operating income increased by 11% YOY to $798.40 million.

Live Nation’s deferred revenues also indicate heightened momentum. Concerts event-related deferred revenue was $5.10 billion, up 25% compared to the same period last year, while Ticketmaster deferred revenue was up 22% to an all-time high of $317 million. These point towards a record year.

Wall Street analysts show concern about Live Nation’s bottom-line trajectory, giving a mixed outlook. For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Live Nation’s EPS to drop 85% YOY to $0.41 on a diluted basis. However, EPS is expected to increase 495.1% to $2.44 in fiscal 2026.

For Q3 (which is set to be reported on Nov. 4 after the market closes), EPS is projected to decrease 27.1% annually to $1.21. On the other hand, the company has a solid history of surpassing consensus EPS estimates, topping them in three of the four trailing quarters.

Among the 22 Wall Street analysts covering Live Nation’s stock, the consensus is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and three “Holds.” The ratings configuration is less bullish than it was two months ago, with 18 “Strong Buy” ratings, down from 20 in the previous configuration.

Last month, Citigroup analyst Jason Bazinet downgraded Live Nation’s price target from $195 to $181. However, its “Buy” rating was reiterated. Similarly, Deutsche Bank analysts, led by Benjamin Soff, maintained a “Buy” rating on the stock but adjusted the price target from $175 to $173.

Live Nation’s mean price target of $178.16 indicates an 18.9% upside over current market prices. The Street-high price target of $190 implies a potential upside of 26.8%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart