Evendale, Ohio-based GE Aerospace (GE) designs and produces commercial and defense aircraft engines, integrated engine components, and mechanical aircraft systems. With a market cap of $325.5 billion, GE Aerospace operates through Commercial Engines and Services and Defense and Propulsion Technologies segments.

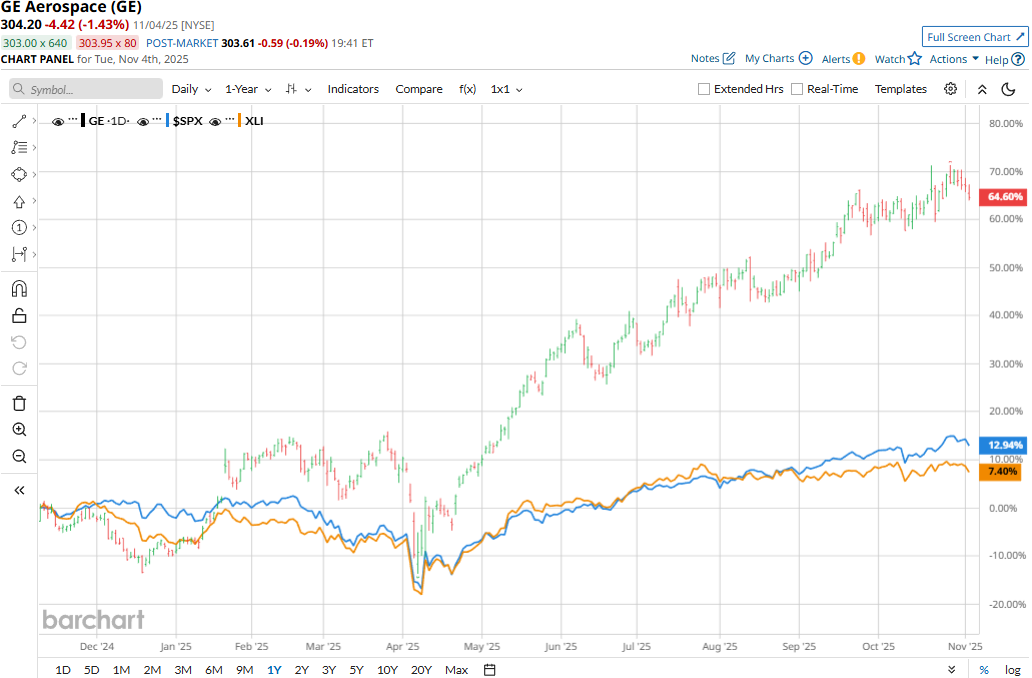

The aerospace and defense giant has notably outperformed the broader market over the past year. GE stock prices have soared 82.4% on a YTD basis and 77.1% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 15.1% gains in 2025 and 18.5% surge over the past year.

Narrowing the focus, GE Aerospace stock has also outperformed the Industrial Select Sector SPDR Fund’s (XLI) 15.8% surge in 2025 and 14% uptick over the past 52 weeks.

GE Aerospace’s stock prices gained 1.3% in the trading session following the release of its exceptional Q3 results on Oct. 21. Driven by increased material input from priority suppliers, the company’s commercial engines & services revenues grew 28%, while deliveries rose 33%. Overall, the company’s non-GAAP topline came in at $11.3 billion, up 26.4% year-over-year and 9.4% ahead of the Street’s expectations. Further, its adjusted EPS soared 44% year-over-year to $1.66, surpassing the consensus estimates by 13.7%.

Observing the solid year-to-date performance and order book, GE raised its full-year revenue and earnings guidance, boosting investor confidence.

For the full fiscal 2025, ending in December, analysts expect GE to deliver an adjusted EPS of $6.17, up 34.1% year-over-year. Moreover, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

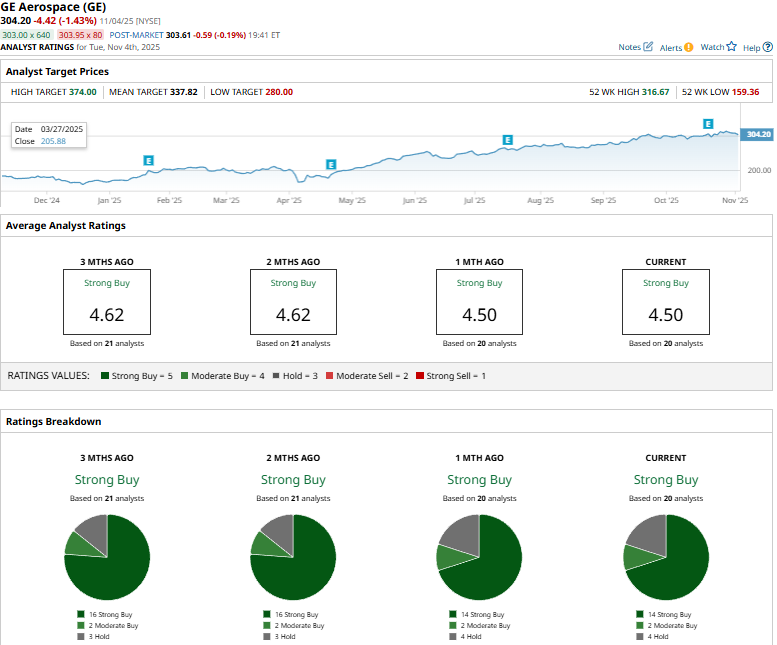

Among the 20 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buys,” two “Moderate Buys,” and four “Holds.”

This configuration is slightly less optimistic than two months ago, when 16 analysts gave “Strong Buy” recommendations.

On Oct. 27, JP Morgan (JPM) analyst Seth Seifman reiterated an “Overweight” rating on GE, and raised the price target from $275 to $325.

GE’s mean price target of $337.82 represents a 11.1% premium. Meanwhile, the Street-high target of $374 suggests a notable 22.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart