Philip Morris International Inc. (PM) is a leading global tobacco company specializing in the manufacture and sale of cigarettes, smoke-free nicotine products and related brands. The company is headquartered in Stamford, Connecticut, with its market capitalization currently standing at around $229.9 billion.

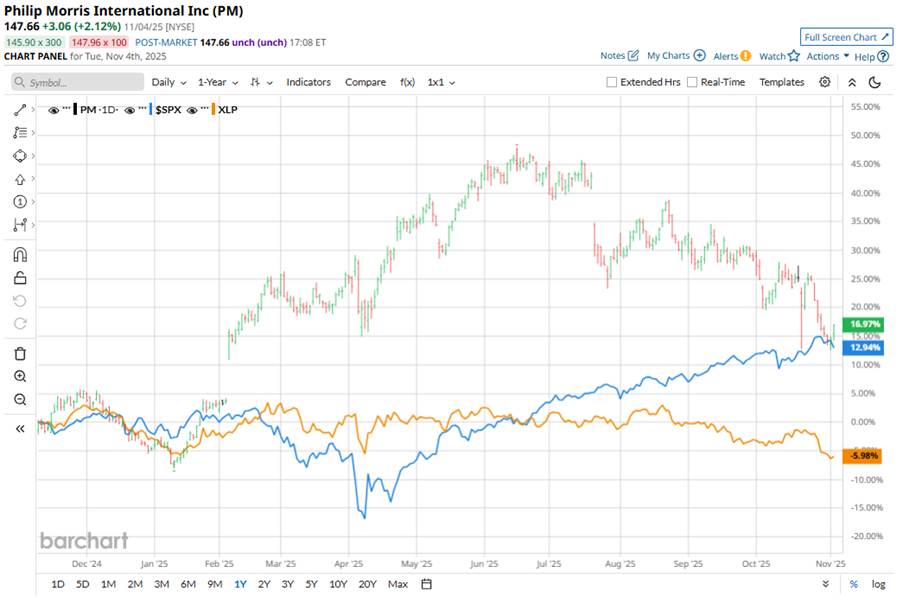

Shares of the tobacco giant have underperformed the broader market over the past 52 weeks. PM stock has surged 13.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.5%. However, shares of Philip Morris are up 22.7% on a year-to-date (YTD) basis, compared to SPX’s 15.1% increase.

Narrowing the focus, PM stock has outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.5% dip over the past 52 weeks and 3.3% YTD.

Shares of Philip Morris have been rising in 2025 primarily because the company’s pivot toward “smoke-free” products, such as the IQOS heated-tobacco system and the ZYN nicotine pouches, is gaining traction globally. At the same time, favorable pricing in its combustible tobacco business in many markets has helped boost margins. These factors are giving investors confidence in PM’s ability to grow and transform its business, hence the upward stock momentum.

For the fiscal year ending in December 2025, analysts expect PM’s EPS to grow 14.2% year-over-year to $7.50. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

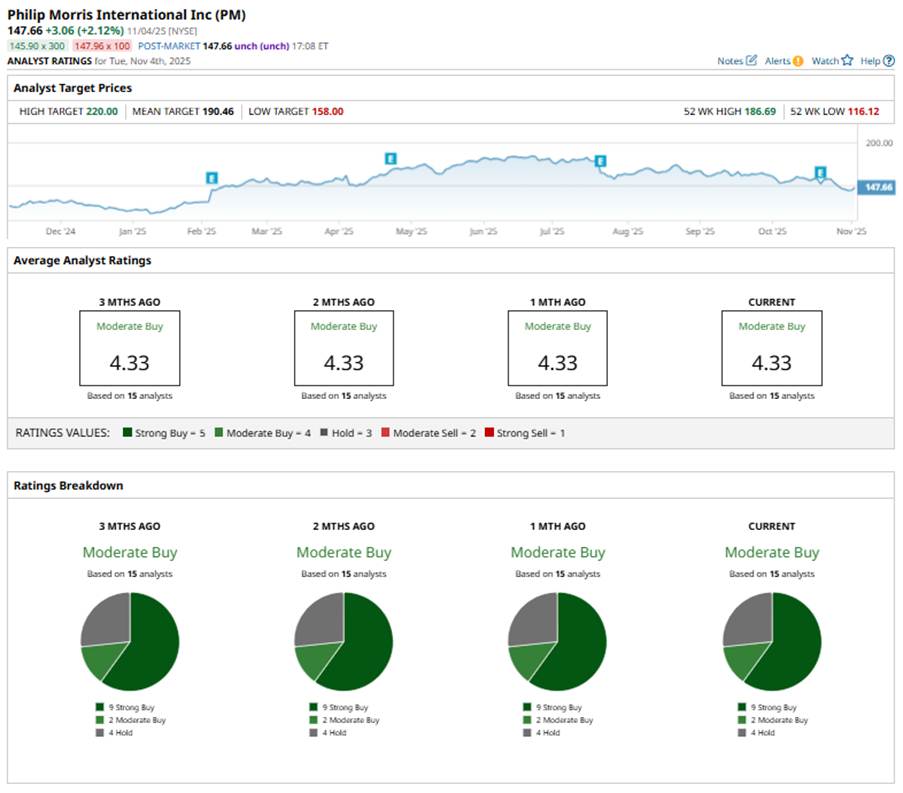

Among the 15 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

This configuration has remained largely consistent over the past few months.

Last month, Stifel reiterated its “Buy” rating and $180 price target on PM after strong Q3 results. Despite near-term inventory headwinds, Stifel remains optimistic, viewing the challenges as temporary and maintaining confidence in Philip Morris’s solid growth and earnings profile.

Its mean price target of $190.46 suggests an upside of 29%. The Street-high price target of $220 implies a potential upside of 49% from the current price.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Slip on Weak Tech Earnings and Valuation Concerns, U.S. ADP Jobs Report in Focus

- This Dividend Stock Got Butchered After Q3 Earnings: Time to Buy the Dip?

- Beyond Meat Just Delayed Its Earnings Release. Should You Jump Ship in BYND Stock Now?

- Dear IonQ Stock Fans, Mark Your Calendars for November 5