Oracle Corporation (ORCL), headquartered in Austin, Texas, offers products and services that address enterprise information technology environments. The company is valued at $735.1 billion by market cap, and its software runs on network computers, personal digital assistants, set-top devices, PCs, workstations, minicomputers, mainframes, and massively parallel computers.

Shares of this tech giant have notably outperformed the broader market over the past year. ORCL has gained 46.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.5%. In 2025, ORCL stock is up 48.9%, surpassing the SPX’s 15.1% rise on a YTD basis.

Zooming in further, ORCL’s outperformance is also apparent compared to the SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has gained about 14.2% over the past year. Moreover, ORCL’s double-digit returns on a YTD basis outshine the ETF’s 1% gain over the same time frame.

Oracle's strong performance is driven by strategic partnerships and AI advancements. Key developments include a partnership with OpenAI, a deal with Zoom Communications Inc. (ZM) to enhance cloud offerings, and a collaboration with NVIDIA Corporation (NVDA) to boost data center networks. Oracle also introduced new cloud services, fueling investor confidence in its AI and cloud growth.

On Sep. 9, ORCL reported its Q1 results, and its shares surged 36% in the following trading session. Its adjusted EPS of $1.47 met Wall Street expectations of $1.47. The company’s revenue was $14.9 billion, falling short of Wall Street forecasts of $15 billion.

For the current fiscal year, ending in May 2026, analysts expect ORCL’s EPS to grow 23% to $5.41 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

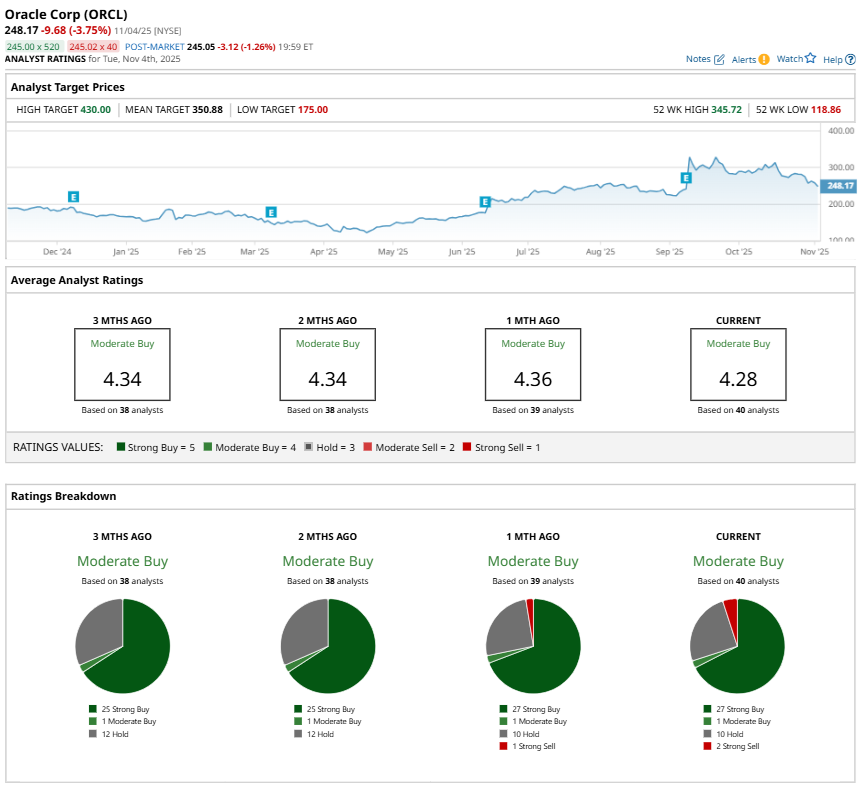

Among the 40 analysts covering ORCL stock, the consensus is a “Moderate Buy.” That’s based on 27 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and two “Strong Sells.”

This configuration is more bearish than a month ago, with one analyst suggesting a “Strong Sell.”

On Oct. 26, Brent Thill from Jefferies Financial Group Inc. (JEF) maintained a “Buy” rating on ORCL with a price target of $400, implying a potential upside of 61.2% from current levels.

The mean price target of $350.88 represents a 41.4% premium to ORCL’s current price levels. The Street-high price target of $430 suggests an ambitious upside potential of 73.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart