With a market cap of $113.5 billion, Constellation Energy Corporation (CEG) focuses on electricity generation and sales. The company provides natural gas, renewable energy, and other energy-related products across various U.S. regions, leveraging a diverse mix of power generation assets.

Shares of the Baltimore, Maryland-based company have significantly surpassed the broader market over the past 52 weeks. CEG stock has surged 53.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.5%. In addition, shares of CEG are up 61.4% on a YTD basis, compared to SPX's 15.6% gain.

Looking closer, shares of the electric utility company have also outpaced the Utilities Select Sector SPDR Fund's (XLU) 14.5% return over the past 52 weeks.

Despite Constellation Energy’s better-than-expected Q2 2025 adjusted EPS of $1.91 and revenues of $6.1 billion, shares fell marginally on Aug. 7 due to concerns over rising operating expenses, which jumped 17.7% to $5.15 billion year-over-year. Investors also reacted cautiously to a slight decline in nuclear generation output to 45,170 GWh from 45,314 GWh, reflecting higher non-refueling outage days.

For the fiscal year ending in December 2025, analysts expect CEG's adjusted EPS to grow 8.5% year-over-year to $9.41. The company's earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

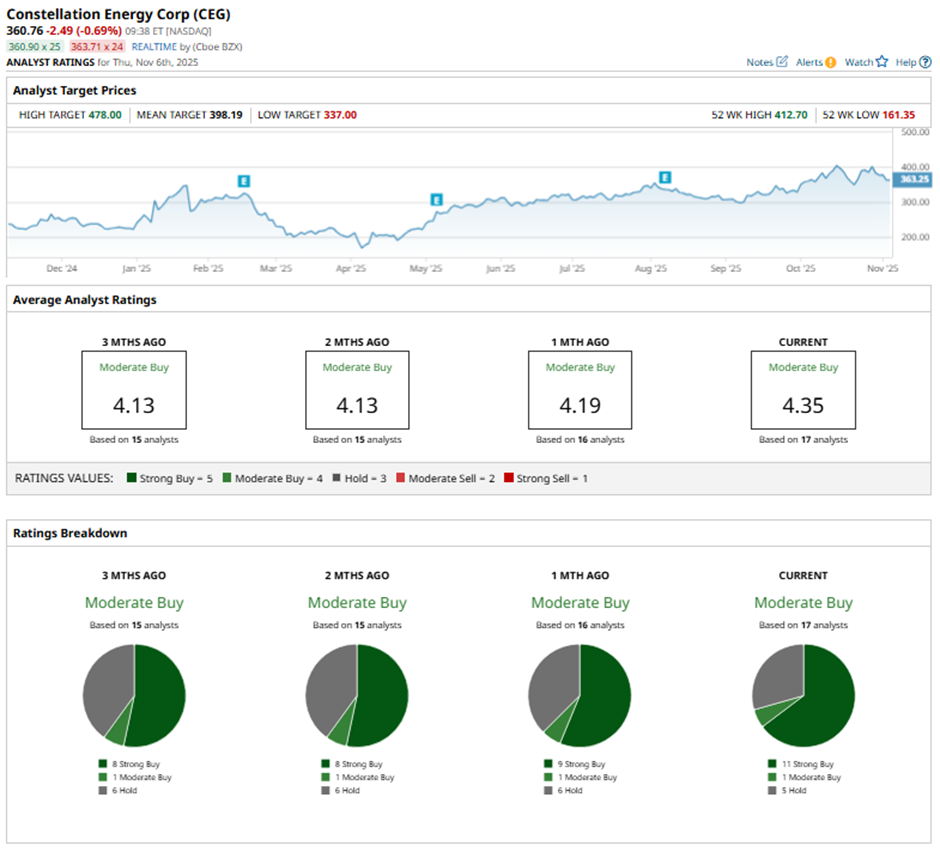

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This configuration is more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Oct. 20, JPMorgan raised its price target on Constellation Energy to $422 and maintained an “Overweight” rating.

The mean price target of $398.19 represents a premium of 10.4% to CEG's current levels. The Street-high price target of $478 implies a potential upside of 32.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?

- 2 Chart Indicators to Confirm Stock Breakouts & Reversals with Heikin Ashi Candlesticks

- Dear Opendoor Stock Fans, Mark Your Calendars for November 6

- Apple Stock ‘Won’t Work’ Until This 1 Thing Happens, According to Analysts