Dublin, Ohio-based Cardinal Health, Inc. (CAH) manufactures and distributes pharmaceuticals, medical & laboratory products, and performance & data solutions for healthcare facilities. With a market cap of $46.4 billion, Cardinal operates in over 30 countries and employs over 53,000 people across the globe.

The healthcare giant has notably outperformed the broader market in 2025 and over the past year. CAH stock prices have soared 66.4% in 2025 and 73.9% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 15.6% gains on a YTD basis and 17.5% returns over the past year.

Narrowing the focus, Cardinal has also outperformed the industry-focused SPDR S&P Health Care Services ETF’s (XHS) 16.3% gains in 2025 and 10.9% uptick over the past 52 weeks.

Cardinal Health’s stock prices shot up more than 15% in a single trading session following the release of its robust Q1 results on Oct. 30. Continuing its solid business momentum, the company has observed solid organic growth across its businesses and registered notable contributions from acquisitions. Its topline for the quarter soared 22.4% year-over-year to $64 billion, beating the Street’s expectations by a staggering 8.4%. Further, its adjusted EPS surged 35.6% year-over-year to $2.55, exceeding the consensus estimates by 15.4%.

For the full fiscal 2026, ending in June, analysts expect CAH to deliver an adjusted EPS of $9.92, up 20.4% year-over-year. On an even more positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line expectations in each of the past four quarters.

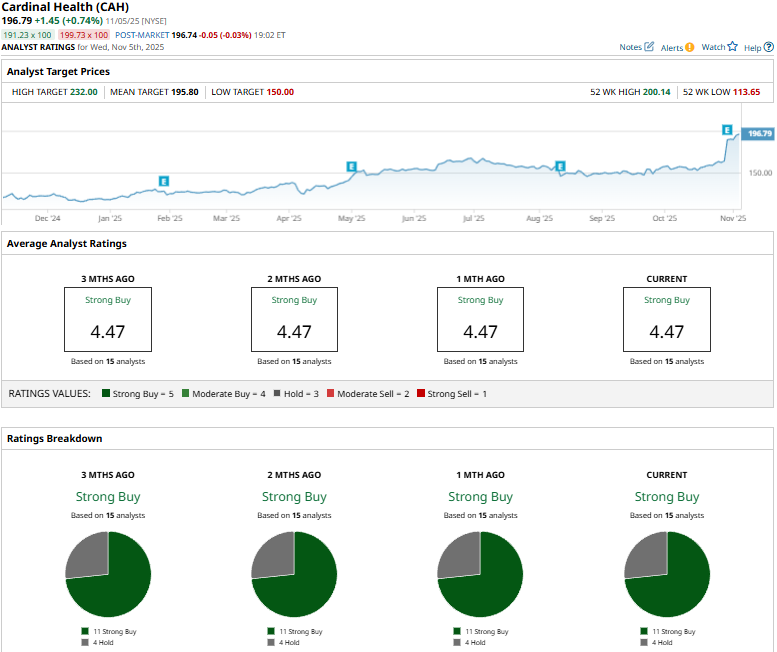

Among 15 analysts covering the CAH stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buys” and four “Holds.”

This configuration has remained stable in recent months.

On Nov. 5, Wells Fargo (WFC) analyst Stephen Baxter maintained an “Overweight” rating on CAH and raised the price target from $185 to $221.

As of writing, CAH is trading slightly above its mean price target of $195.80. Meanwhile, the street-high target of $232 suggests a 17.9% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AbbVie Just Raised Its Dividend by 5.5%. Should You Buy ABBV Stock Here?

- 1 High-Risk, High-Reward Way to Trade Earnings with 0DTE Options

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?