Over the last couple of months, several stocks have received what I would term an artificial intelligence (AI) bump. In a nutshell, it’s a phenomenon where a stock rallies after announcing a partnership with an AI major. One could be spoilt for examples here, but for instance, names like Intel (INTC) and Nokia (NOK) rallied after partnering with Nvidia (NVDA). At the same time, Advanced Micro Devices (AMD) and PayPal (PYPL) soared after announcing deals with ChatGPT-parent OpenAI. As part of PayPal’s deal with OpenAI, users will now be able to use PayPal wallets while shopping on ChatGPT in early 2026. While most other companies managed to hold on to bulk – if not all – of their “AI bumps,” PayPal’s gains have fast faded away.

PayPal Stock Has Underperformed Terribly

PayPal shares are down over 22% for the year to date and appear set to underperform the markets in 2025. Underperformance is something that PayPal investors have grown accustomed to over the last few years. The stock, which peaked above $300 in mid-2021, underperformed the markets for three consecutive years before delivering 39% returns last year, which were ahead of what the average S&P 500 Index ($SPX) constituent gained.

I listed PayPal as a “screaming buy” in my previous article in June, and while the stock did rally over the next month, it currently trades below those levels. The underperformance has been disappointing to say the least for investors like me who have bet on the company’s turnaround under CEO Alex Chriss.

PayPal’s Business Has Shown Signs Of Growth Amid the Transformation

That said, the turnaround strategy has shown visible results, as is evident in PayPal’s financial performance. For instance, branded experiences’ total payment volumes have grown in high single digits for four consecutive quarters, versus the negative growth it was witnessing two years back. Other parts of PayPal’s business, including Venmo, buy-now-pay-later (BNPL), and the enterprise payments business, have also seen an acceleration in growth.

True to the stated objective of profitable growth, PayPal’s top-line growth is flowing to the bottom line, and the company expects adjusted earnings per share (EPS) to rise by at least 15% year-over-year in 2025.

Management is optimistic of delivering “high single-digit transaction margin dollar growth and non-GAAP EPS growth in the teens or better over the longer term.” While these numbers are much lower than what PayPal treated investors to in the past, they should be seen in the context of its current valuations.

PayPal Stock Looks Reasonably Valued

PayPal trades at a forward price-earnings (P/E) multiple of 12.7x with a P/E-to-growth (PEG) multiple of 1x. The multiples look reasonable for a company that expects to grow adjusted EPS in the teens at a minimum over the long term.

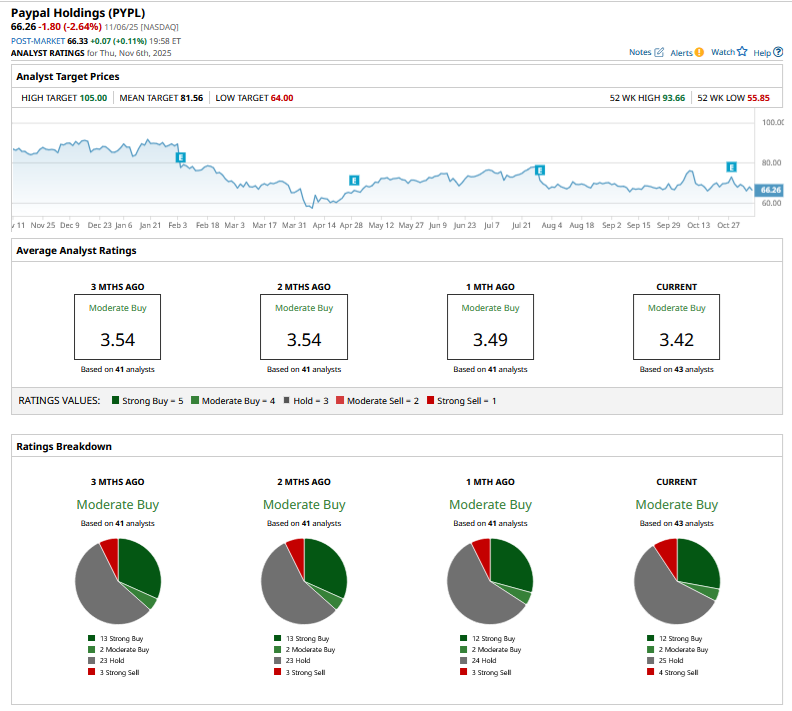

While sell-side analysts are not too bullish on PayPal and just about a third of the 43 analysts covering the stock rate it as a “Strong Buy” or “Moderate Buy,” the stock’s mean target price of $81.56 is over 23% higher than the current levels. PayPal trades only slightly higher than the most pessimistic target price of $64, while the Street-high estimate of $105 is 58% higher.

PayPal Stock Looks Like a Buy

One of the concerns for PayPal investors has been rising competition, but the company has tried to offset some of that by expanding its total addressable market (TAM). Once synonymous with online retail, PayPal has a growing offline presence and is well-prepared for an “agentic” future where AI agents shop on behalf of customers. To capitalize on that market, PayPal has announced its agentic commerce services to help merchants sell on AI platforms like OpenAI and Perplexity.

BNPL could be another growth driver for PayPal, and the company said that it is on track to achieve $40 billion in total payment volumes in 2025. It is expanding the service to new markets, which will help it increase the TAM even further. PayPal World – which would make international payments seamless for users by connecting different wallets across the world – is now in the pilot stage.

To sum it up, PayPal has several growth drivers that should help buoy its revenues over the medium term. I find PayPal stock a good buy and am looking to add more to my existing holdings as the company’s turnaround seems to be progressing in the right direction, and the valuations are reasonable enough to trigger a fresh purchase.

On the date of publication, Mohit Oberoi had a position in: INTC , PYPL , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart