With a market cap of $17.4 billion, Evergy, Inc. (EVRG) is an energy company that, through its subsidiaries Kansas City Power & Light Company and Westar Energy Inc., generates, transmits, distributes, and sells electricity. Its diverse energy mix includes coal, natural gas, oil, uranium, and renewable sources such as wind, solar, and landfill gas, serving residential, commercial, industrial, and municipal customers.

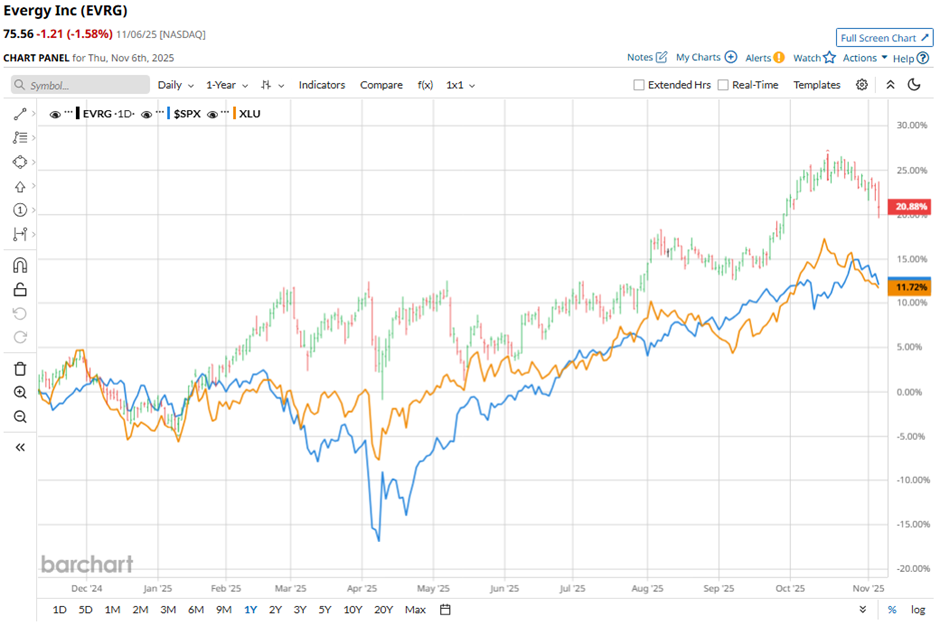

Shares of the Kansas City, Missouri-based company have outperformed the broader market over the past 52 weeks. EVRG stock has returned 23.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.4%. Moreover, shares of Evergy are up 22.8% on a YTD basis, compared to SPX's 14.3% gain.

Looking closer, the electric utility stock has also outpaced the Utilities Select Sector SPDR Fund's (XLU) 13.5% rise over the past 52 weeks.

Shares of Evergy fell 1.6% on Nov. 6 despite reporting solid Q3 2025 GAAP and adjusted EPS of $2.03, slightly above $2.02 in 2024, as investors reacted to the company narrowing its 2025 adjusted EPS guidance range to $3.92 - $4.02 from the prior $3.92 - $4.12. Management cited the impact of cooler-than-normal summer weather, which weighed on demand and offset cost mitigation efforts.

For the fiscal year ending in December 2025, analysts expect EVRG's adjusted EPS to grow nearly 5% year-over-year to $4. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

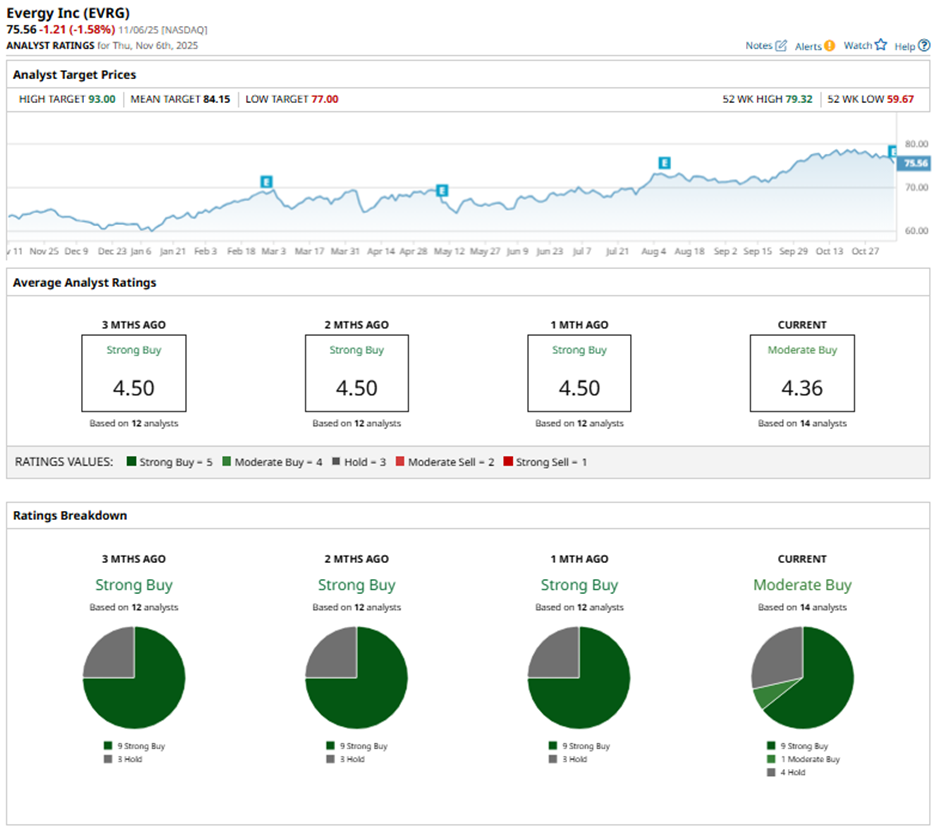

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

On Oct. 24, BMO Capital analyst James Thalacker maintained a “Buy” rating on Evergy with a price target of $84.

The mean price target of $84.15 represents a premium of 11.4% to EVRG's current price. The Street-high price target of $93 suggests a 23.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart