Long-term technical analysis of US stock indexes has become simple, with each month seemingly a repeat of new all-time highs and higher closes.

Fundamentally, it's hard to say what is driving the bull run, with the most likely catalyst the changed dynamics of the industry itself over the past number of decades.

More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.If a top were to form for US indexes, it could come in the form of higher interest rates between now and May 2026.

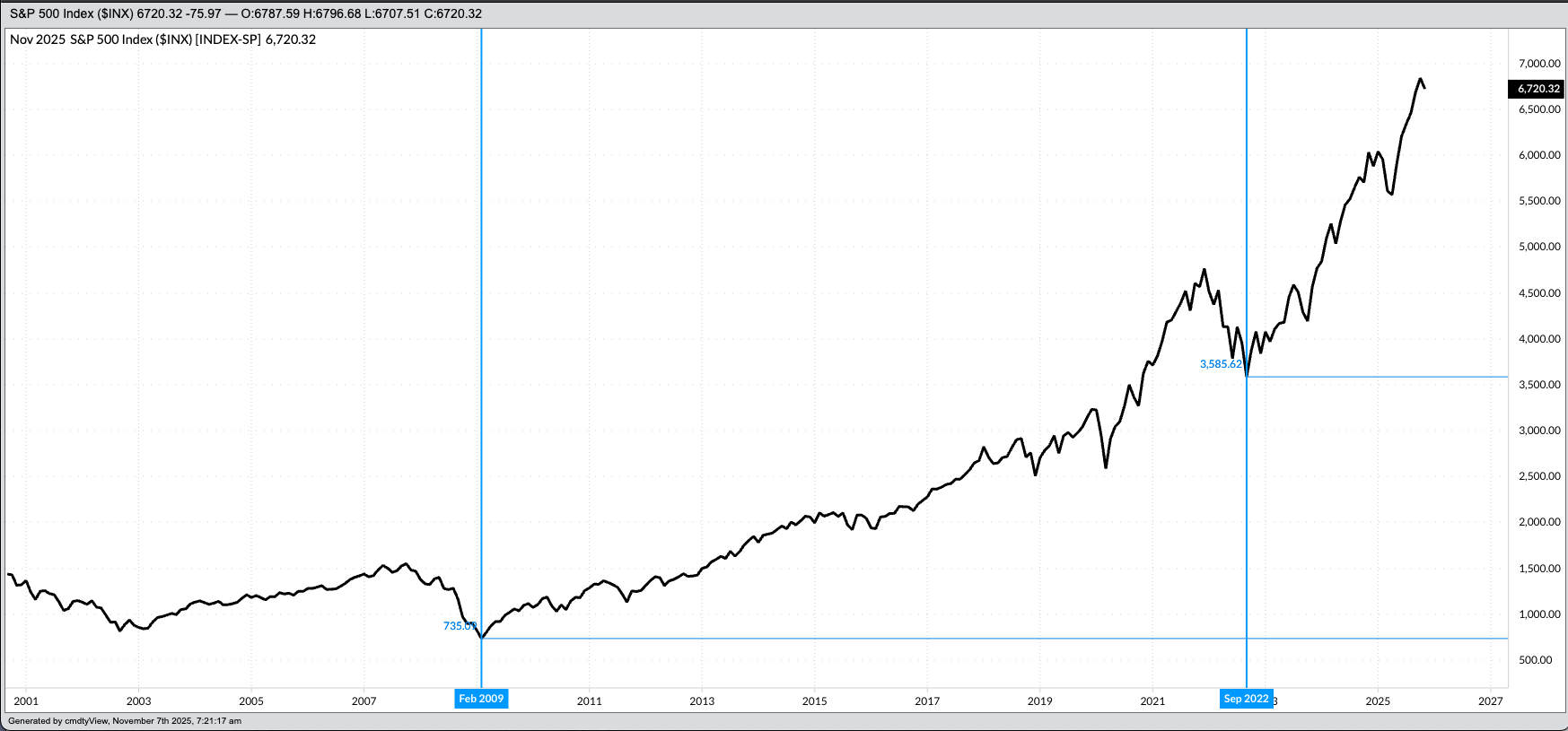

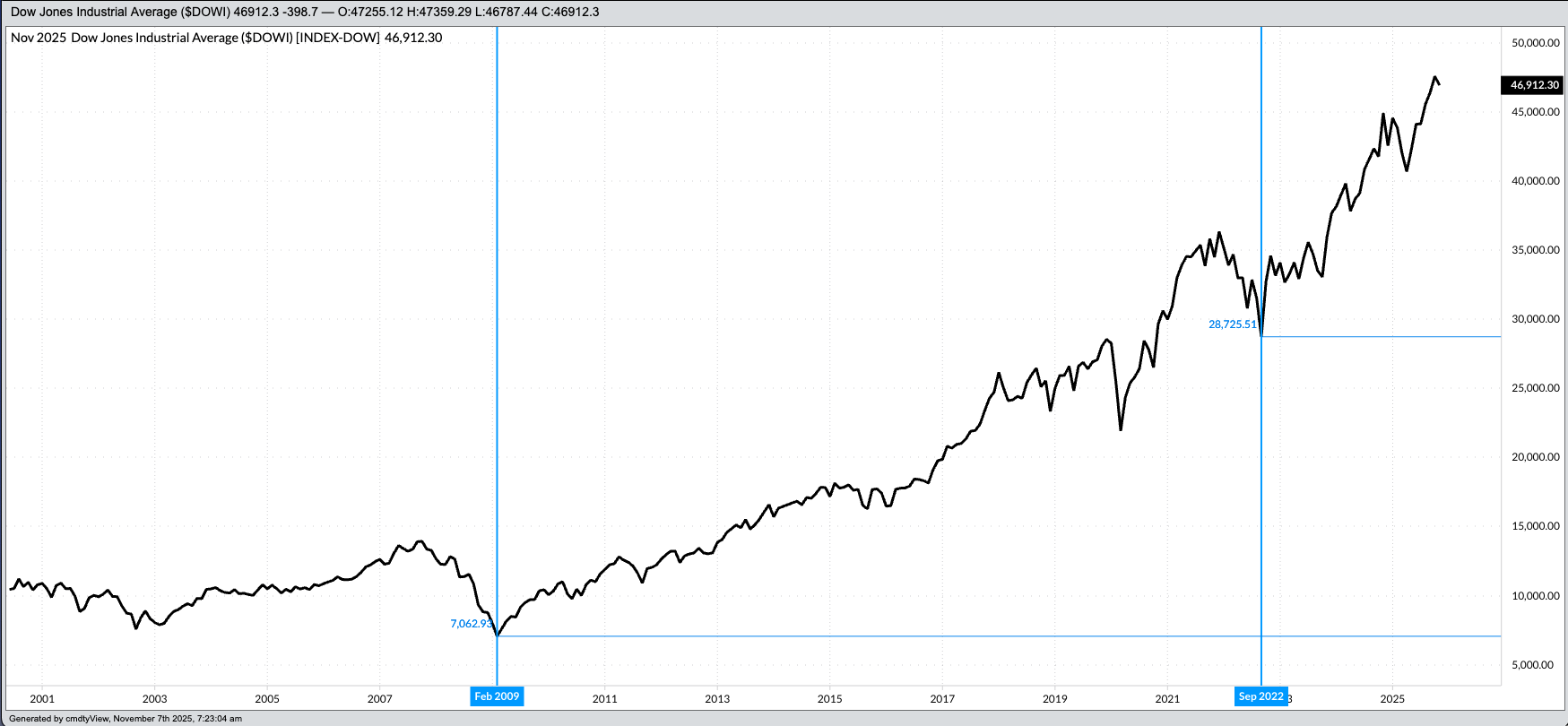

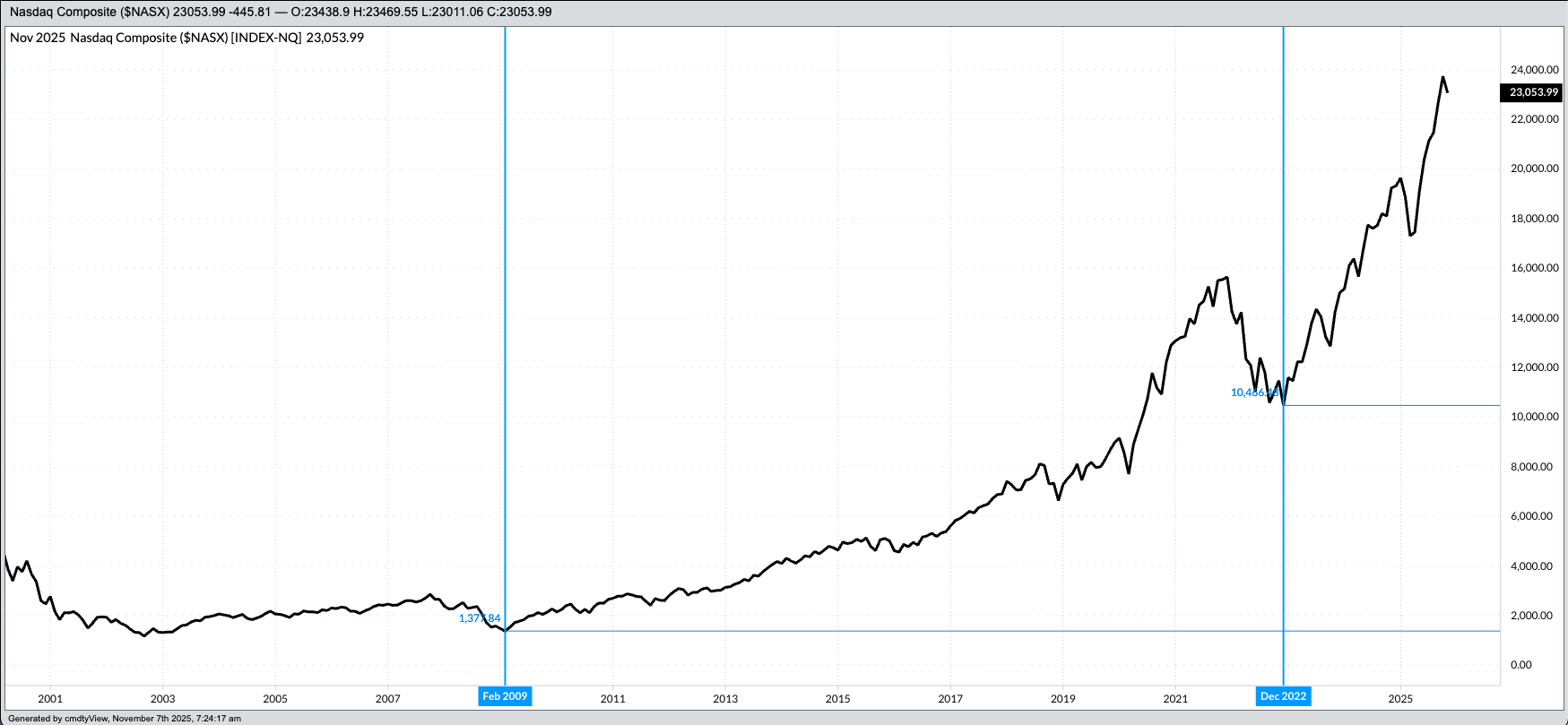

Will US stock indexes ever go down again? And when I say “down”, I mean more than a day or two as we’ve seen since the latest bull run began back in the fall and winter of 2022. (The S&P 500 ($INX) and Dow Jones Industrial Average ($DOWI) both posted low monthly closes at the conclusion of September 2022, with the Nasdaq ($NASX) trailing at December 2022. This was an oddity, as the Nasdaq has led the other major indexes for a number of years.) At the end of October 2025, the three major US indexes were on a string of higher monthly closes:

- S&P 500 = 6 months

- DJIA = 6 months

- Nasdaq = 7 months

The Monthly Analysis I put together in my investment newsletter has been simple the past number of months, needing only 1 sentence to analyze the situation:

- The Index (one of the three major US indexes) extended its major (long-term) uptrend to a new all-time high of (whatever price is applicable to the index) during October (or other month) before closing at (whatever price is applicable to the index), up (X points, Y%) for the month.

Theoretical Positions have been similarly simple:

- Long-term investors are likely still long despite bearish technical patterns this past spring.

What else needs to be said? Can be said? However, despite Market Rule #7 (Stock markets go up over time.), we know this bull run can’t last forever. Right? Or maybe we don’t know this, but rather just think it.

It’s interesting to apply my other rules to stock indexes as they raise more questions than they answer.

- Rule #1: Don’t get crossways with the trend.

- My take on Newton’s First Law of Motion applies to markets: A trending market will stay in that trend until acted upon by an outside force, with this outside force usually fund and/or investment activity.

- Given the structure of the investment industry, with funds providing new money coming into stocks every month, it takes something dramatic – like a pandemic – to spark a withdrawal of funds.

- Rule #6: Fundamentals win in the end.

- But what counts as fundamentals when it comes to individual stocks and/or larger indexes?

- Price to Earnings is an antiquated view that seems to be largely ignored these days.

- Interest rates? What happens if the US Federal Open Market Committee (FOMC) makes a hike before Chairman Powell steps down during May 2026. Between now and then the FOMC is scheduled to have four meetings: December 2025, January, March, and April 2026.

From a seasonal analysis point of view (Rule #3 says to use filters (including seasonality and volatility) to manage risk), we know US indexes tend to trend up from the last weekly close of September through the end of the calendar year.

- The S&P 500 tends to gain roughly 5% during Q4 (October through December)

- While the DJIA tends to see about the same Q4 gain on average

- I thought I had the Nasdaq, but can’t find my study as of this writing

During October 2025 the three major indexes posted solid gains based on monthly closes only:

- The S&P 500 = 2.27%

- DJIA = 2.51%

- Nasdaq = 4.7%

However, the first week of November has seen US stock indexes come under pressure. As of this writing:

- The S&P 500 is down 1.75% (120 points)

- DJIA is down 1.37% (650 points)

- Nasdaq is down 2.83% (670 points)

Is this the end of latest and greatest bull run? Probably not. It’s still early in the month and much will be said, done, or posted before we next turn the monthly calendar page. But the question remains:

Will US stock indexes ever go down again? Yes. And it promises to be a wild ride when the indexes fall victim to the Poseidon Predicament (When everyone is on the same side of the boat, the boat tends to roll over).

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart