With a market cap of $81.7 billion, Northrop Grumman Corporation (NOC) is a leading U.S.-based aerospace and defense company headquartered in Falls Church, Virginia. It specializes in designing, developing, and manufacturing advanced technology systems for defense, space, and cybersecurity applications. Its core business includes unmanned systems, missile defense, aerospace platforms, cyber solutions, and space systems.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Northrop Grumman fits this criterion perfectly, exceeding the mark. Northrop Grumman serves government and military clients globally, playing a critical role in national security, advanced space exploration, and defense innovation.

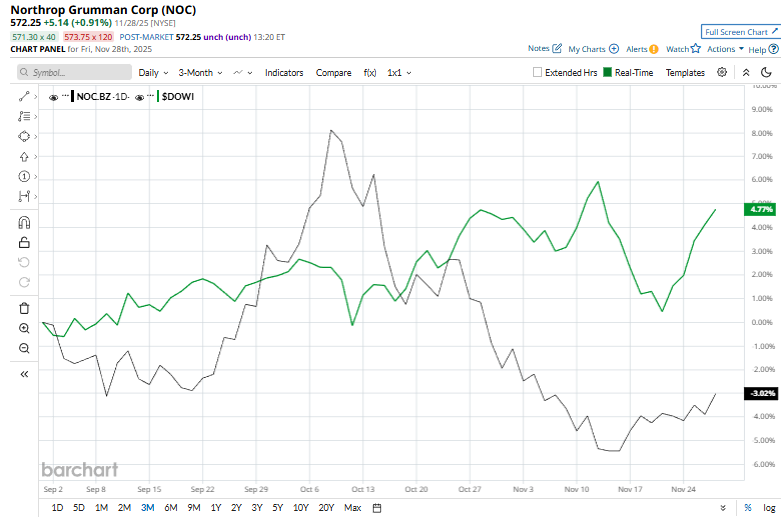

Despite this, shares of the company have declined 10.7% from its 52-week high of $640.90 met on Oct. 10. NOC stock has dipped 2.7% over the past three months, outpacing the broader Dow Jones Industrial Average’s ($DOWI) 4.6% rise over the same time frame.

In the longer term, NOC stock is up 21.9% on a YTD basis, outperforming $DOWI’s 12.2% gain. Additionally, shares of the defense contractor have increased 17% over the past 52 weeks, surpassing $DOWI’s 5.7% rise over the same time frame.

NOC stock has been trading below its 50-day moving average since the end of last month and above its 200-day moving average since early July.

On October 21, Northrop Grumman released its third-quarter earnings, and the stock fell marginally as investors weighed the mixed results. The company delivered a strong earnings beat with adjusted EPS of $7.67, driven by improved margins across several key business segments. However, while revenue rose 4% year over year to $10.42 billion, it fell short of expectations, in part due to softer performance in the Space Systems division, which tempered overall investor enthusiasm.

Nevertheless, rival Howmet Aerospace Inc. (HWM) has outpaced NOC stock. HWM stock has climbed 87.1% on a YTD basis and 75.3% over the past 52 weeks.

NOC stock has a consensus rating of “Moderate Buy” from 21 analysts in coverage, and the mean price target of $658.50 represents a 15.1% premium to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart