Valued at $41.5 billion by market cap, Entergy Corporation (ETR) is a Louisiana-based integrated energy company engaged in the generation, transmission, and distribution of electricity. It primarily serves customers in Arkansas, Louisiana, Mississippi, and Texas through its utility subsidiaries and operates a portfolio of nuclear, natural gas, and renewable power plants.

Companies worth $10 billion or more are generally described as "large-cap stocks." Entergy fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the regulated electricity industry. Entergy focuses on providing reliable, affordable electricity while investing in grid modernization and cleaner energy solutions, positioning itself as a key player in the regional energy infrastructure and sustainability transition.

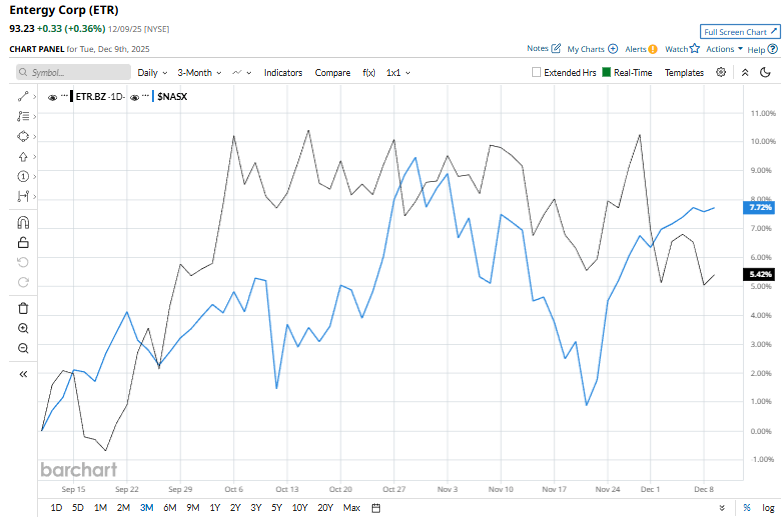

The stock touched its 52-week high of $98.58 on Oct. 6 and is currently trading 5.4% below that peak. Meanwhile, the stock has gained 7.2% over the past three months, slightly underperforming the Nasdaq Composite’s ($NASX) 7.8% rise during the same time frame.

Over the longer term, Entergy’s performance has been strong, with ETR shares up 23% year-to-date and 24.7% over the past 52 weeks, surpassing the NASX’s gains of 22.1% YTD and 19.5% over the year.

While the stock has generally remained above its 200-day moving average over the past year, it has recently slipped below its 50-day moving average.

On Oct. 29, Energy posted its third-quarter earnings, and its shares surged marginally. It reported adjusted earnings of $1.53 per share, up slightly from $1.50 a year earlier, with net income rising to $694 million from $645 million. The utility segment remained the primary earnings driver, supported by higher retail sales and favorable regulatory outcomes. Entergy also narrowed its full-year adjusted EPS guidance to $3.85–$3.95.

When compared to its peer, Entergy has outperformed DTE Energy Company’s (DTE) 7.9% gains on a YTD basis and 6.9% uptick over the past 52 weeks.

Among the 21 analysts covering the ETR stock, the consensus rating is a “Moderate Buy.” Its mean price target of $104.39 implies a modest 12% upside from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Dip Amid Caution Ahead of Fed Rate Decision

- Forget The Fed and Buy This Dividend Stock for 2026

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?