The slump in the U.S. electric vehicle (EV) industry continued in 2025, and several startups, including Nikola (NKLAQ) and Canoo (GOEVQ), filed for bankruptcy, continuing the spate of bankruptcies from the previous year. Most U.S. EV startups that went public between 2020 and 2021 have already gone out of business or become inconsequential.

Rivian (RIVN) and Lucid Motors (LCID) are the only two EV startups of some consequence still standing, even as they trade at a fraction of their all-time highs. Both companies have tried to copy U.S. EV market leader Tesla’s (TSLA) playbook at various points, and Lucid’s former CEO, Peter Rawlinson, famously said in a 2021 interview that the EV industry would be a “two-horse race” between Tesla and Lucid.

EV Industry Slump Has Worsened

Cut to 2025, and the EV landscape is much different and looks set to worsen further following the withdrawal of the EV tax credit. Amid the EV industry’s persistent woes, Morgan Stanley recently downgraded Tesla, Rivian, and Lucid Motors while upgrading General Motors (GM).

Meanwhile, while Lucid once pitched itself as the “next Tesla,” I find Rivian as an aspirant, too. Like Tesla, it too started with premium models and is now pivoting to affordable ones. Moreover, it is an integrated player like Tesla and has built its own sales network, bypassing dealers.

Rivian’s Strategy Is Similar to That of Tesla

More recently, from giving its CEO, RC Scaringe, an Elon Musk-like compensation, albeit a much-stripped-down version of the $1 trillion that Tesla shareholders approved for Musk, to holding an Autonomy & AI Day, Rivian yet again seems to be borrowing a leaf or two from Tesla’s playbook. At the AI Day, among others, Rivian announced a new chip, robotaxi ambitions, and the new Autonomy+ driver-assistance package priced at $2,500. The pivot is not much different from Tesla, which offers its full self-driving for $8,000 and has commenced robotaxi operations. Meanwhile, even as both Rivian and Tesla are positioning themselves as AI plays, both are plagued by similar issues—sagging EV sales—and look set to report an annual decline in their 2025 deliveries.

Rivian and Tesla: So Similar, Yet So Different

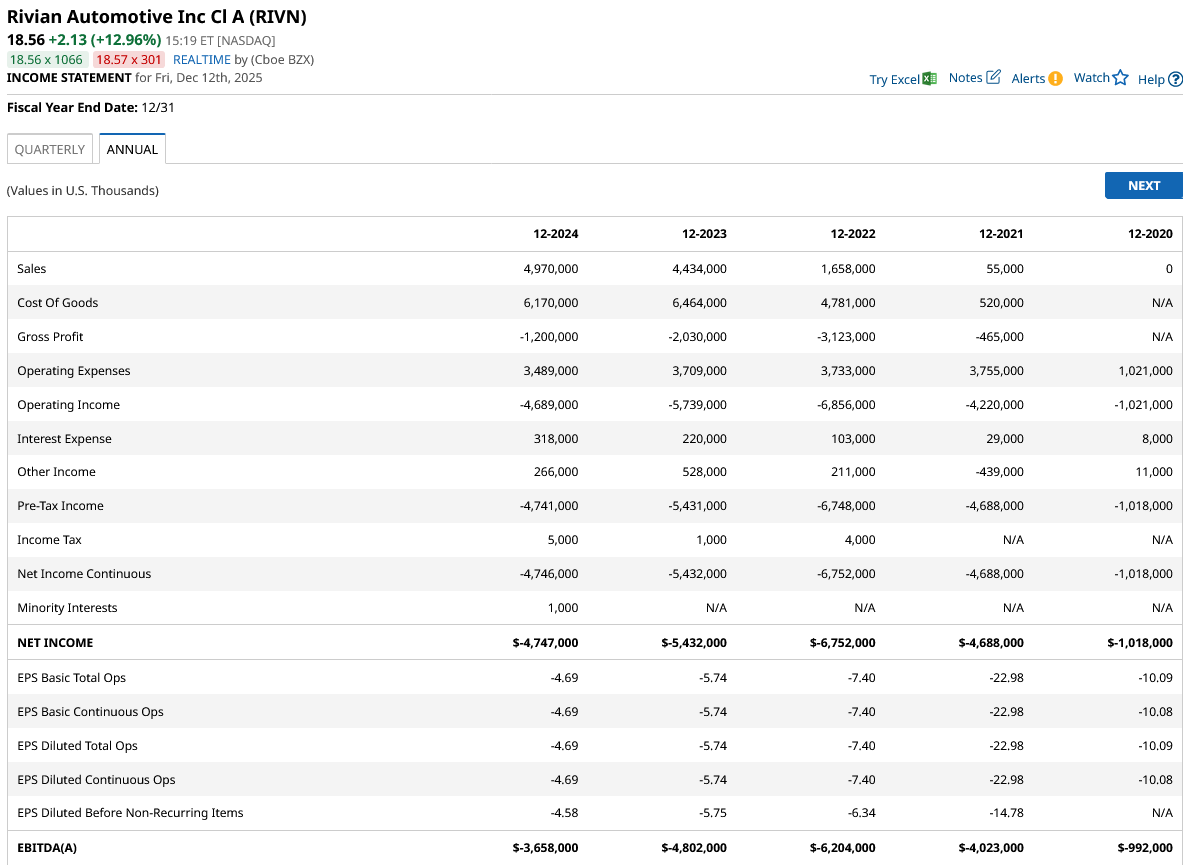

While Rivian and Tesla’s strategies might sound similar, the comparison perhaps ends here. Firstly, their CEOs' personalities are quite different, and Scaringe's personality is in stark contrast to the flamboyant (and controversial) Musk. In terms of scale and size, Tesla is on a much higher pedestal and is a sustainable company, unlike Rivian, which, like fellow EV companies, needs frequent dosages of fresh capital to fund the burgeoning losses.

This gap between the two companies is also reflected in their respective valuations. Rivian’s forward price-to-sales multiple of 3.5x is less than a fourth of Tesla’s. While Rivian has always traded at a discount to Tesla, barring a brief period following its listing, the current gap is quite higher than historical standards, thanks to the divergent price actions.

Tesla investors have been willing to ignore the company’s sagging EV sales and revenues, as the company has successfully sold the physical AI story; Rivian does not have that privilege. While it has also doubled down on AI like Tesla, the company would also simultaneously need to turn into a sustainable business with positive cash flows.

To be sure, Rivian has shown much improvement on metrics like gross margins and cash burn and is also backed by German auto giant Volkswagen (VWAGY), which has a joint venture with the EV startup. However, it is still far from being a sustainable venture, and while the revenues from the Volkswagen partnership mask the overall cash burn, a breakeven point does not seem in sight.

Both Rivian and Tesla face several challenges in 2026 and look set to have another volatile year. However, if I were to bet on just one of them for the next year, I would put my two cents on the Elon Musk-run company, even though I don’t find it a compelling buy either, given the rich valuations.

On the date of publication, Mohit Oberoi had a position in: LCID , TSLA , RIVN , GM . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rivian Is Copying Tesla’s Playbook, but Is RIVN a Better Buy Than TSLA for 2026?

- Kellanova Stock Is No More. Should Consumer Packaged Goods Fans Buy Shares of This Blue-Chip Stock Instead?

- Visa’s Unusual Options Activity on Thursday Signals 3 Smart Profit Moves You Can Make Now

- Gemini Space Station Is Launching a Prediction Markets Business. Should You Buy GEMI Stock Here?