One of the most interesting things about the stock market these days is the increasing number of ways that investors have to trade. From the launch of predictive markets to spot Bitcoin (BTCUSD) exchange-traded funds, there are many new ways for traders to play the market.

Coinbase Global (COIN) changed the game in 2021 when it went public in a direct listing, becoming the first major U.S. crypto exchange to become a public company. The move signaled increasing acceptance of cryptocurrencies and provided a window for investors to invest in the industry without holding digital currency.

Now Coinbase is at it again, as it’s announced another expansion that allows users to trade U.S.-based stocks on the Coinbase app. Trades are made using USDC, a dollar-backed stablecoin.

The move follows Coinbase’s expansion into predictive markets through its partnership with Kalshi—a space that’s already occupied by DraftKings (DKNG) and Robinhood Markets (HOOD).

Let’s see how this new opportunity may affect COIN stock.

About Coinbase Global Stock

New York-based Coinbase is the largest U.S. cryptocurrency exchange. It currently offers more than 275 digital assets and 340 different trading pairs on Coinbase Prime, although the assets available to specific customers are contingent upon geographic locations. Coinbase currently has more than $516 billion in assets on its platform, with a quarterly trading volume of $295 billion.

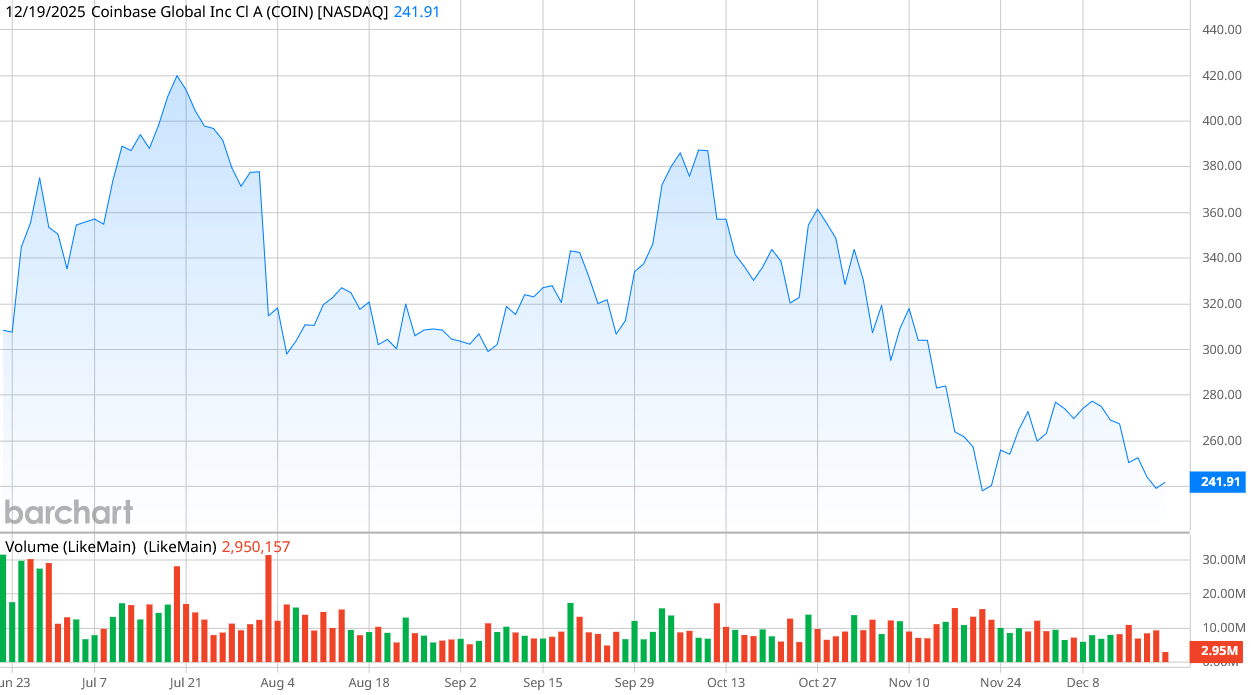

Coinbase, which has a market cap of $64.5 billion, is down 2.5% so far this year, a disappointing performance considering the S&P 500 ($SPX) is up more than 15%.

The price-to-earnings ratio of 20.7 is down sharply this year—earlier this year, the P/E was more than 60. And its price-to-sales ratio of 7.6 is lower than its three-year P/S median of 9.5, indicating that the stock is underpriced compared to its recent history.

Coinbase Global Beats on Earnings

Coinbase had a strong earnings report in the third quarter as the company saw increased retail and institutional crypto trading. Net income of $432.6 million was up from $75.5 million a year ago. Earnings per share were $1.50 versus $0.28 per share a year ago and beat analysts’ expectations of $1.10 per share.

Overall revenue was $1.87 billion, up from $1.21 billion in the third quarter of 2024. And transactions revenue of $1 billion was up 37% on a sequential basis.

The company is benefiting from two tailwinds—the federal government’s efforts to roll back cryptocurrency regulations and the company’s $3 billion purchase of the derivatives exchange Deribit, which helped fuel institutional activity.

“With regulatory clarity accelerating, crypto rails are set to power more of global GDP, and we believe Coinbase is positioned to lead,” management said in its quarterly letter to shareholders.

What Do Analysts Expect from COIN Stock?

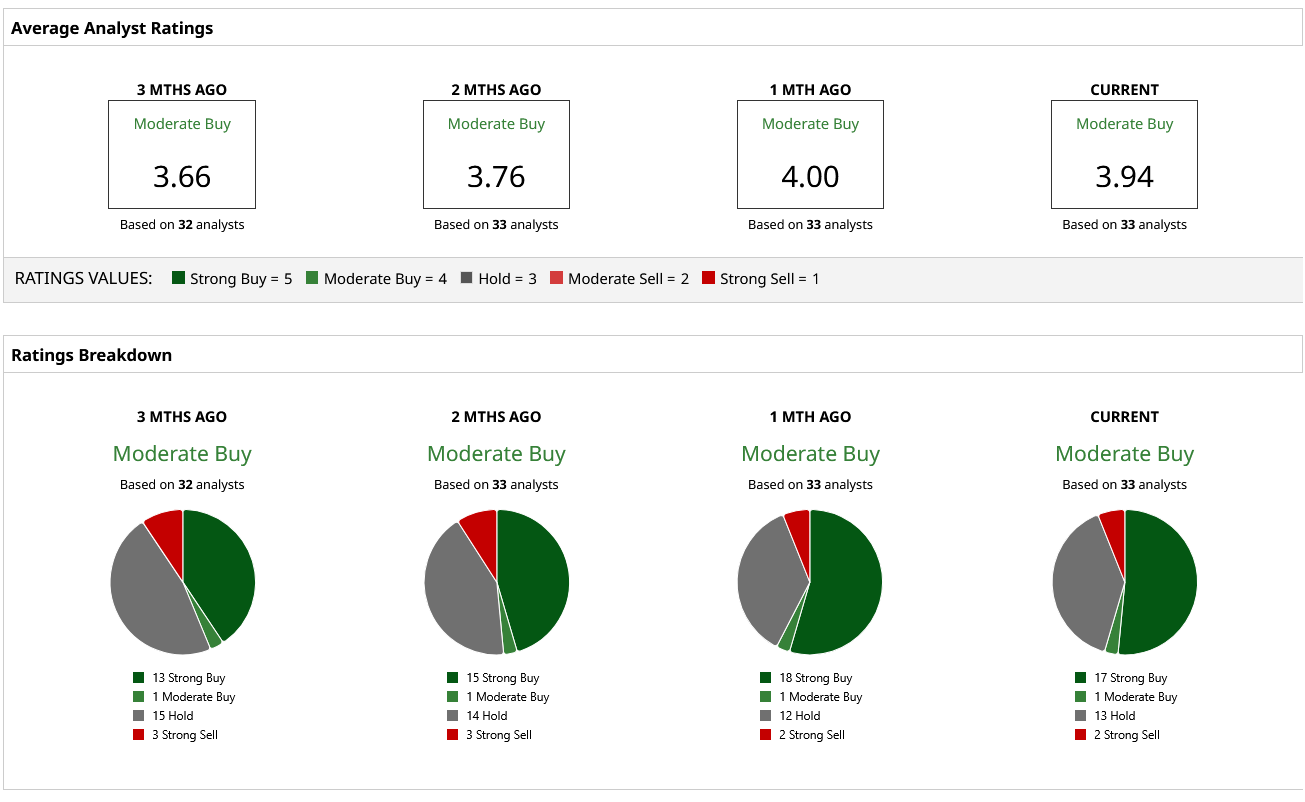

Although COIN stock has struggled to stay in the black this year, analysts generally have a positive view of the company. Of 33 analysts who cover COIN stock, 18 of them have “Buy” ratings and only two have “Sell” ratings—the rest recommend holding the stock.

The mean price target of $377.76 is an impressive 56% increase in the stock price, indicating that Coinbase is overdue for an upward surge. The most aggressive price target of $510 suggests a 110% increase, while the most pessimistic price target is very close to Coinbase’s current stock price of $240.

Will adding stock trading and predictive markets be a game-changer for Coinbase Global? Predictive markets are a fast-growing field, with Grand View Research expecting the market size to grow from $18.89 billion in 2024 to $82.34 billion by 2030—a compound annual growth rate of 28.5%. DraftKings and Robinhood are both moving quickly in the space, and Coinbase Global could lose significant ground if it doesn’t keep pace.

While predictive markets and stock trading will add value to Coinbase stock, I think the biggest tailwind is the Trump administration’s continued efforts to bolster cryptocurrency adoption. COIN stock is cheaper today than it’s been all year, making it a tempting play for 2026.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Is Down More Than 30% Since September. What Happened to the Quantum Computing Leader?

- This Investor Is Betting $1 Billion on a Lululemon Stock Turnaround. Should You Buy the Dip Here in Hopes of Gains to Come?

- CoreWeave Stock Soars 19% on Genesis Mission, but Is It a Buy?

- Should You Buy Medline Stock After the MDLN IPO?