With a market cap of $277.8 billion, Morgan Stanley (MS) is a global financial holding company that provides a wide range of financial products and services to governments, institutions, and individuals worldwide. The firm operates through Institutional Securities, Wealth Management, and Investment Management segments, offering services such as capital raising, financial advisory, brokerage, lending, asset management, and research.

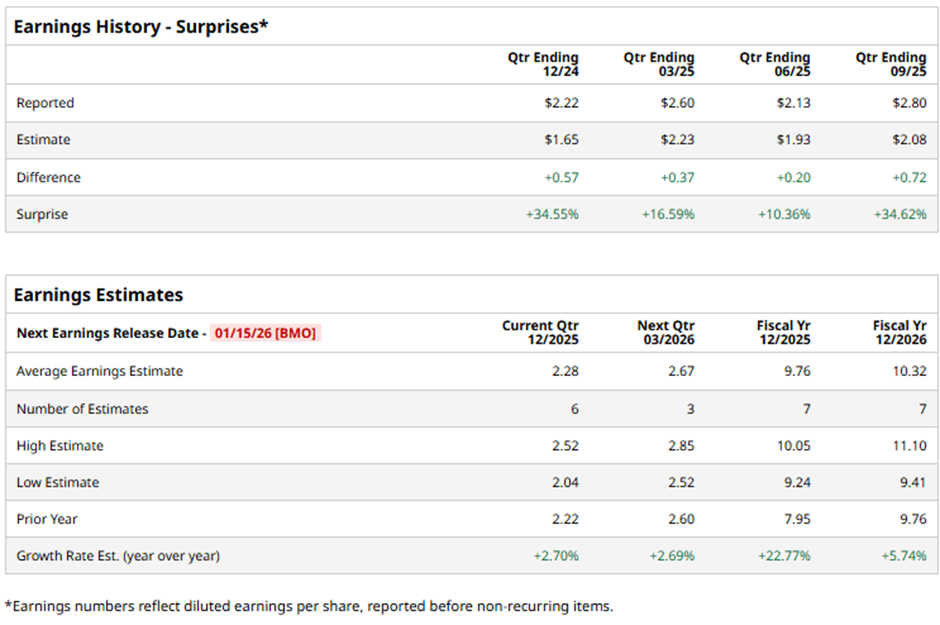

Morgan Stanley is expected to announce its fiscal Q4 2025 earnings results before the market opens on Thursday, Jan. 15. Ahead of this event, analysts predict the New York-based company to report a profit of $2.28 per share, up 2.7% from $2.22 per share in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts forecast the investment bank to report an EPS of $9.76, a surge of 22.8% from $7.95 in fiscal 2024.

Shares of Morgan Stanley have climbed 42.9% over the past 52 weeks, surpassing both the S&P 500 Index's ($SPX) 15.4% increase and the Financial Select Sector SPDR Fund's (XLF) 14.5% return over the same period.

Morgan Stanley shares jumped 4.7% on Oct. 15 after the bank reported better-than-expected Q3 2025 EPS of $2.80, along with record net revenue of $18.22 billion. The surge was driven by a 44% jump in investment banking revenue to $2.11 billion, strong dealmaking activity, and a 35% rise in equities trading revenue to $4.12 billion. Investors were also encouraged by record wealth management revenue of $8.2 billion and assets under management reaching $8.9 trillion.

Analysts' consensus view on MS stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 26 analysts covering the stock, nine recommend "Strong Buy," three "Moderate Buys," and 14 suggest "Hold." This configuration is more bullish than three months ago, with six analysts suggesting a "Strong Buy."

The average analyst price target for Morgan Stanley is $173.41, suggesting a marginal potential upside from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart