From a price-action perspective, 2025 has been a year of consolidation for Amazon (AMZN) stock. Therefore, as Amazon continues to deliver earnings surprises, it might be a good time for accumulation.

Recently, Oppenheimer raised its price target for AMZN stock from $290 to $305. Oppenheimer opines that the upside potential comes from Amazon Web Services (AWS) doubling its capacity through 2027. With $3 billion in revenue potential per incremental gigawatt, the impact on cash flow is also likely to be meaningful.

About Amazon Stock

Headquartered in Seattle, Amazon is among the largest e-commerce companies with a global presence. Besides the core business of e-commerce, Amazon has established a strong position in the cloud-computing market with AWS. The company’s AWS business happens to be its key cash flow machine.

For Q3 2025, Amazon reported healthy top-line growth of 13% on a year-on-year basis to $180.2 billion. Amazon Web Services was among the key growth drivers, with the segment delivering 20% year-on-year revenue growth to $33 billion.

With strong results and expansion plans, AMZN stock has trended higher by 13% in the last six months.

AWS-Driven Growth

For Q3 2025, Amazon reported sales from North America and international markets at $147.2 billion. These segments reported $6 billion in operating income, implying an operating income margin of 4.1%.

However, AWS reported revenue and operating income of $33 billion and $11.4 billion, respectively. This implies an operating income margin of 34.5%. Therefore, besides being a top-line growth driver, AWS is also the cash flow machine for Amazon.

It’s worth noting that AWS has added more than 3.8 gigawatts in capacity in the last 12 months. With the segment set to double capacity through 2027, stellar growth is likely to be sustained, coupled with company-wide operating margin expansion.

Last month, Amazon announced an investment of $50 billion to expand AI and supercomputing capabilities for AWS U.S. government customers. These investments will translate into growth acceleration in the next 24 to 36 months.

An important point to note is that Amazon has reported operating cash flows of $130 billion in the last 12 months. Additionally, the company reported a cash buffer of $94.2 billion as of Q3 2025. Financing big investments is therefore not a concern. Of course, these investments will also translate into cash flow growth.

Continued Expansion in Global Markets

For Q3 2025, Amazon reported 23% revenue from international markets. It, however, seems likely that international growth will be robust in the coming years.

As an example, Prime Video advertising is yielding results in markets like Brazil, India, Japan, and others.

Further, for the e-commerce business, the company is investing 700 million euros in European logistics and automation to boost delivery speed and lower cost through automation.

Similarly, Amazon will be investing $54 billion in the United Kingdom over the next three years. These investments will focus on building new warehouses and upgrading existing operations.

In emerging markets, Amazon is aggressively investing in India. The company plans to open two new dark stores a day for its quick commerce arm. Overall, these investments are likely to translate into growth and value creation.

What Analysts Say About AMZN Stock

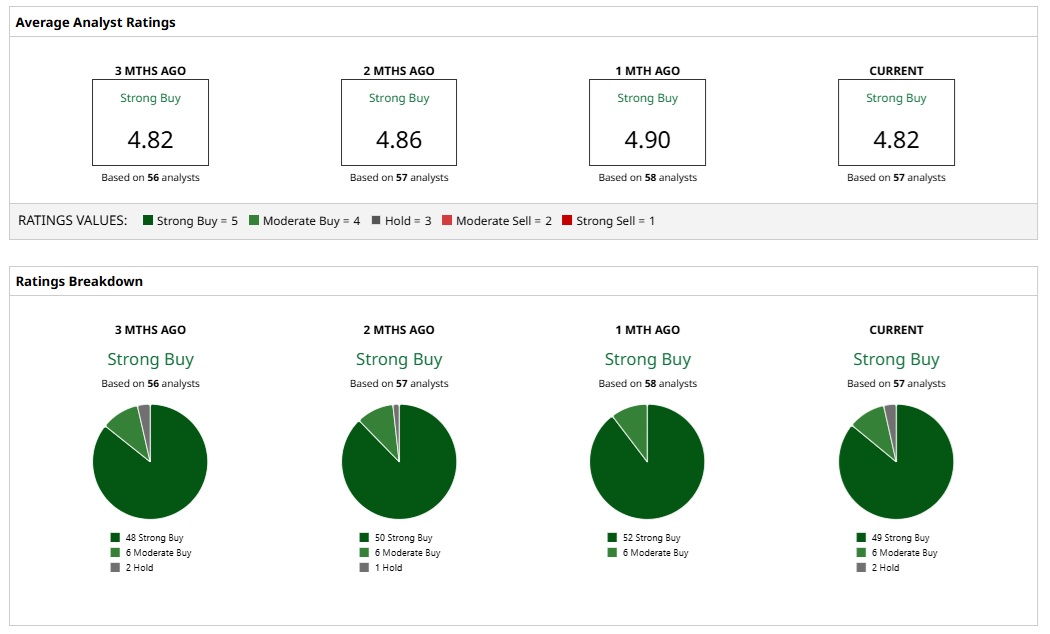

Based on the rating of 57 analysts, AMZN stock is a consensus “Strong Buy.”

An overwhelming majority of 49 analysts have a “Strong Buy” rating for the stock. Further, six and two analysts, respectively, have a “Moderate Buy” and “Hold” rating.

Overall, based on the ratings, analysts have a mean price target of $296.78. This implies an upside potential of 27%. Also, the most bullish price target for AMZN stock is $360 and implies an upside potential of 54%.

This bullish view is underscored by the point that analysts expect Amazon to deliver healthy earnings growth of 29.66% for FY 2025. At the same time, a forward price-earnings ratio of 32.4 is indicative of attractive valuations.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Applied Calculus Says Nutanix (NTNX) Is Mispriced—And the Math Is Hard to Ignore

- Should You Go on Cathie Wood’s ARK ETF Diet?

- Dan Ives Is Betting Big on CoreWeave Stock as an AI Winner. Should You Buy CRWV Too?

- Analysts Say AWS Will Drive ‘Significant Upside’ for Amazon. Should You Buy AMZN Stock Now?