With a market cap of $55.1 billion, Valero Energy Corporation (VLO) is a leading global manufacturer and marketer of petroleum-based and low-carbon transportation fuels, operating across North America, the U.K., Ireland, and Latin America. The company runs refining, renewable diesel, and ethanol segments that produce a wide range of fuels and related products sold through wholesale markets and branded retail outlets.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Valero Energy fits this criterion perfectly. Valero also operates renewable diesel and ethanol plants under its Diamond Green Diesel brand.

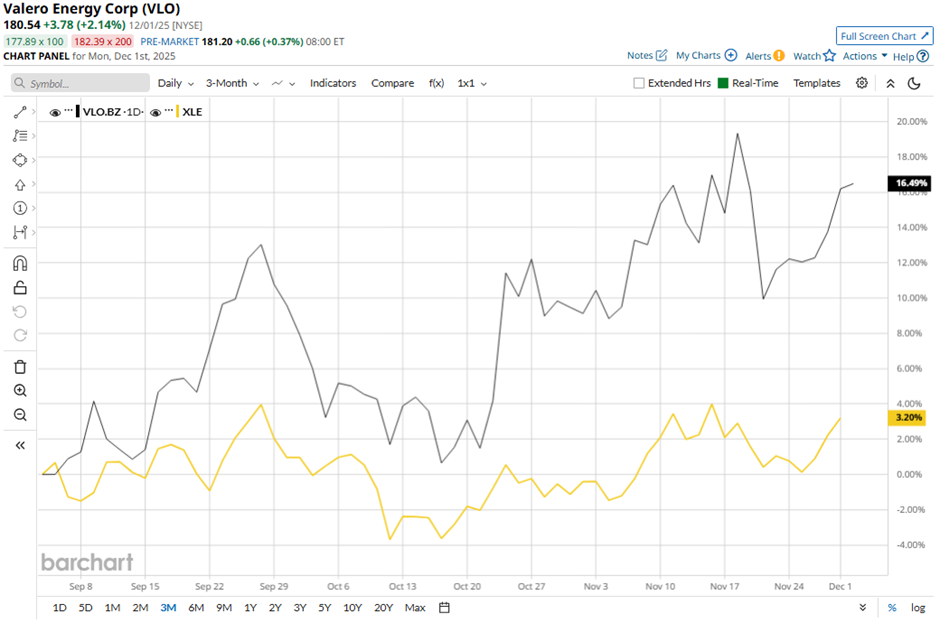

Shares of the San Antonio, Texas-based company have fallen 2.7% from its 52-week high of $185.62. VLO stock has increased 18.8% over the past three months, outpacing the Energy Select Sector SPDR Fund’s (XLE) over 1% rise over the same time frame.

Longer term, VLO stock is up 47.3% on a YTD basis, surpassing XLE's 6.6% gain. Moreover, shares of the oil refiner have surged 29.8% over the past 52 weeks, compared to XLE’s 4.4% drop over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since early May.

Shares of VLO jumped nearly 7% on Oct. 23 after the company reported stronger-than-expected Q3 2025 adjusted EPS of $3.66. The company also beat revenue expectations with $32.17 billion and reported a major rebound in refining performance, including a 44% surge in refining margin per barrel to $13.14 and throughput utilization of 97%.

In comparison, rival Marathon Petroleum Corporation (MPC) has lagged behind VLO stock. MPC stock has climbed 40.6% on a YTD basis and 25.6% over the past 52 weeks.

Despite the stock’s strong performance over the past year, analysts remain cautiously optimistic on VLO. It has a consensus rating of “Moderate Buy” from the 20 analysts in coverage, and the mean price target of $187.61 is a premium of 3.9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart