With a market cap of $50.3 billion, MetLife, Inc. (MET) is a global financial services company offering insurance, annuities, employee benefits, and asset management solutions. It operates through six major segments, including Group Benefits, Retirement and Income Solutions, and international regions such as Asia and Latin America.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks and MetLife fits this criterion perfectly. The company provides a wide range of products, from life and health insurance to pension risk transfers and capital markets investment offerings.

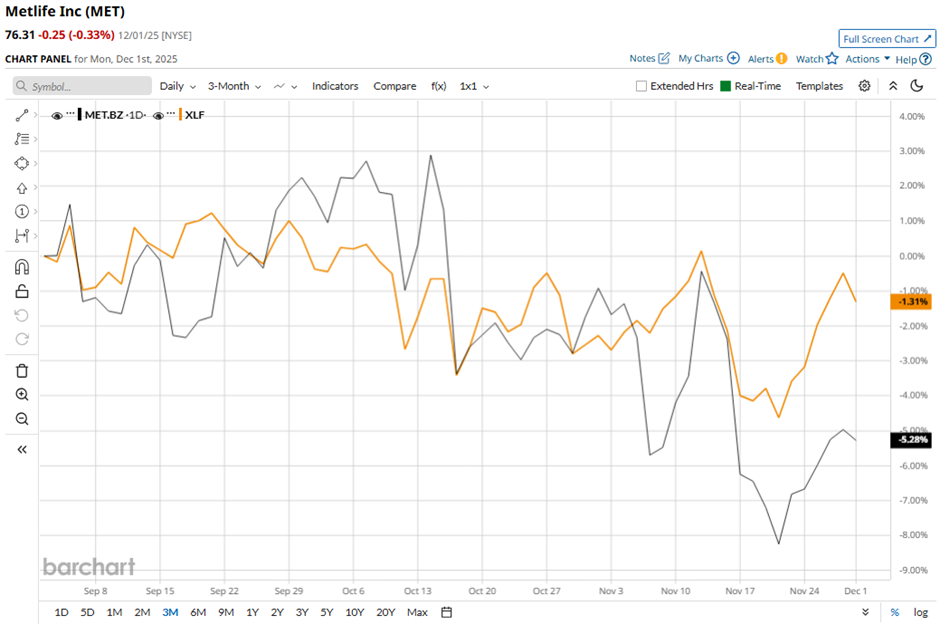

The New York-based company's stock has dipped 13.9% from its 52-week high of $88.59. Shares of MetLife have decreased 6.2% over the past three months, a more pronounced decline than the Financial Select Sector SPDR Fund’s (XLF) over 2% drop over the same time frame.

In the longer term, MET stock is down 6.8% on a YTD basis, underperforming XLF’s 9.4% gain. Moreover, shares of the company have fallen 13.5% over the past 52 weeks, outpacing XLF’s over 3% return over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since mid-October.

MetLife reported strong 3Q 2025 results on Nov. 5, including net income of $818 million and adjusted EPS up 21% to $2.34. The company also delivered robust investment income, solid underwriting performance, and strong sales momentum across key regions like Asia. It further announced $875 million returned to shareholders and $12 billion in new pension risk transfer mandates. However, the stock fell 3.4% the next day.

In comparison, rival Aflac Incorporated (AFL) has outpaced MET stock. Shares of Aflac have gained 5.9% on a YTD basis and dropped 3.9% over the past 52 weeks.

While MET stock has underperformed over the past year, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 19 analysts' coverage, and the mean price target of $93.38 is a premium of 22.4% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart