Electric vehicle (EV) industry leader Tesla (TSLA) faces weakening demand for its vehicles in Europe, as its November registrations fell significantly from year-ago levels in several key markets, including France and Sweden. Despite the launch of a new Model Y range, the company struggles to maintain its market position on the continent. Major factors behind this market-share loss have been rising competition from new entrants and Tesla’s aging lineup.

Is it time to let go of Tesla stock now?

About Tesla Stock

Headquartered in Austin, Texas, Tesla is a global enterprise that designs, manufactures, and sells EVs and energy storage solutions. Its operations encompass a vast manufacturing network that supports the production of various electric car models, battery packs, and clean energy systems, emphasizing sustainable innovation. Tesla manages an extensive supply chain and a growing network of charging infrastructure to support customers worldwide.

The company integrates cutting-edge technology and automation in its production processes to improve efficiency and scale. However, Tesla is facing increasing competition from established automakers and emerging EV companies worldwide. These are challenging its market dominance and pushing the company to innovate to maintain its lead continually. Tesla has a market capitalization of $1.43 trillion.

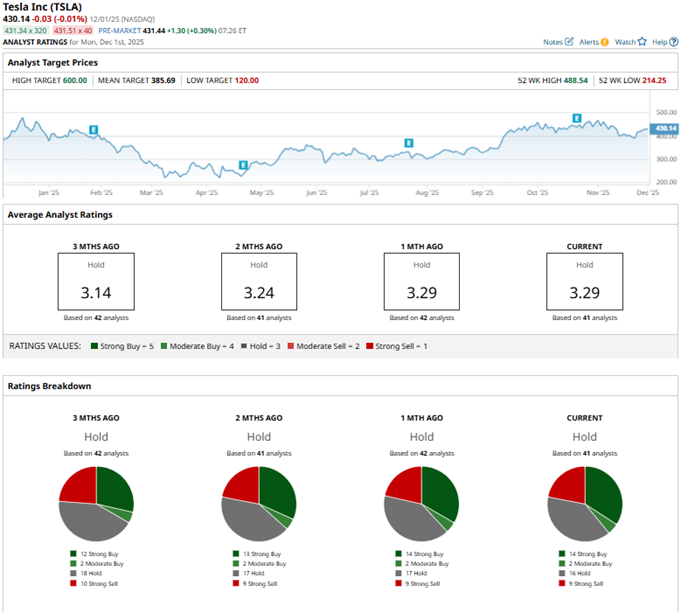

Although Tesla's stock is down 5.7% over the past month, it remains attractive to mid- and long-term investors. Over the past 52 weeks, the stock has gained 20.5%, and over the past six months, it has gained 25.6%. However, Tesla is far from its highs. The stock reached a 52-week high of $488.54 in December 2024 but is down almost 14% from that level.

Tesla’s stock continues to trade at a significant valuation. Its price sits at 296.83 times its trailing earnings, which is considerably higher than the industry average of 19.67 times.

Events Surrounding Tesla

Tesla’s stock has been on a rollercoaster due to a plethora of developments surrounding it. In September, the company launched its much-awaited robotaxi service beyond its early testers, marking a significant step in its transformation from an EV maker to a self-driving transport service provider.

On the other hand, the company has to grapple with the loss of the Federal EV tax credits. The $7,500 tax credit was withdrawn for orders placed after Sept. 30. Tesla tried to offset it with a $6,500 lease credit. The company also released cheaper models, introducing two trimmed-down models at more affordable price points. The entry-level Model 3 was priced at $36,990, and the entry-level Model Y at $39,990.

However, Tesla faces rising competition from EV sellers in the Chinese and European markets, which makes the new models not exactly cheap, especially since they offer only $5,000 in savings over the standard models. Amid all this, shareholders voted to approve a whopping $1 trillion pay package for Tesla CEO Elon Musk.

Tesla’s China sales dropped to a three-year low in October, as the company faces subdued demand in a hyper-competitive market. However, it might be looking at bluer skies, as sales in China rebounded in November, growing 9.9% from the prior year after the EV-maker introduced a longer-range rear-wheel-drive variant of the Model Y, which is its best-selling model in the country.

Additionally, Tesla has placed its bets on semiconductors, planning an aggressive push to produce more chips. Its most recent AI4 chip is used in its vehicles and humanoid robots, while AI5 design is awaiting finalization, and AI6 is in development.

Tesla’s Mixed Third-Quarter Results

Tesla’s third-quarter results had hits and misses, while not alarming. The company set a record for deliveries during the quarter, up 7% year-over-year (YOY) to 497,099 units. On the other hand, its production numbers dropped by 5% annually to 447,450 units.

Tesla’s total revenues increased by 12% from the prior year’s period to $28.10 billion, which was higher than the $26.37 billion that Wall Street analysts had expected. However, automotive revenues grew modestly by 6% YOY to $21.21 billion. The company’s non-GAAP EPS declined by 31% from its year-ago value to $0.50, missing the $0.54 that Street analysts had expected.

Wall Street analysts are not optimistic about Tesla’s bottom line growth trajectory. For Q4, analysts expect the company’s EPS to decline by 50% YOY to $0.33. For the current year, Tesla’s EPS is projected to decrease by 44.1% annually to $1.14, followed by a 64.9% YOY improvement to $1.88 in the following year.

What Do Analysts Think About Tesla Stock?

Recently, Mizuho analyst Vijay Rakesh reiterated an “Outperform” rating on the stock, but lowered the price target from $485 to $475. The analyst cited potential EV subsidy cuts in the U.S. and China in 2026, which could pressure the company’s deliveries.

On the other hand, Stifel analyst Stephen Gengaro increased Tesla’s price target from $483 to $508, while maintaining a “Buy” rating, citing the company’s full self-driving (FSD) and its robotaxi services, which could drive further growth.

Wall Street analysts are taking a cautious stance on Tesla’s stock now, with a consensus “Hold” rating overall. Of the 41 analysts rating the stock, 14 analysts gave a “Strong Buy” rating, two analysts gave a “Moderate Buy” rating, while 16 analysts are playing it safe with a “Hold” rating, and nine analysts gave a “Strong Sell” rating. The consensus price target of $385.69 represents a 10.2% downside from current levels. However, the Street-high price target of $600 indicates a 39.8% upside from current levels.

Key Takeaways

While Tesla’s declining market share in Europe is concerning, it saw an upsurge in its China sales for November. Based on recent developments and mixed third-quarter results, it might be wise to simply observe Tesla for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.

- How Micron Stock Could Be an Even Bigger Winner Than GOOGL from a Google-Meta Deal