Headquartered in San Francisco, California, Prologis, Inc. (PLD) dominates global logistics real estate by targeting high-barrier, high-growth markets. With a market capitalization of nearly $118.2 billion, it leases modern distribution facilities to nearly 6,500 customers, directly supporting global business-to-business supply chains and fast-growing retail e-commerce fulfillment networks.

As of Sept. 30, Prologis controlled roughly 1.3 billion square feet of logistics space across 20 countries, underscoring unmatched global scale. Investors now look ahead to the company’s Q4 fiscal 2025 earnings release, scheduled for Wednesday, Jan. 21, at 12:00 p.m. ET, a key checkpoint for near-term performance.

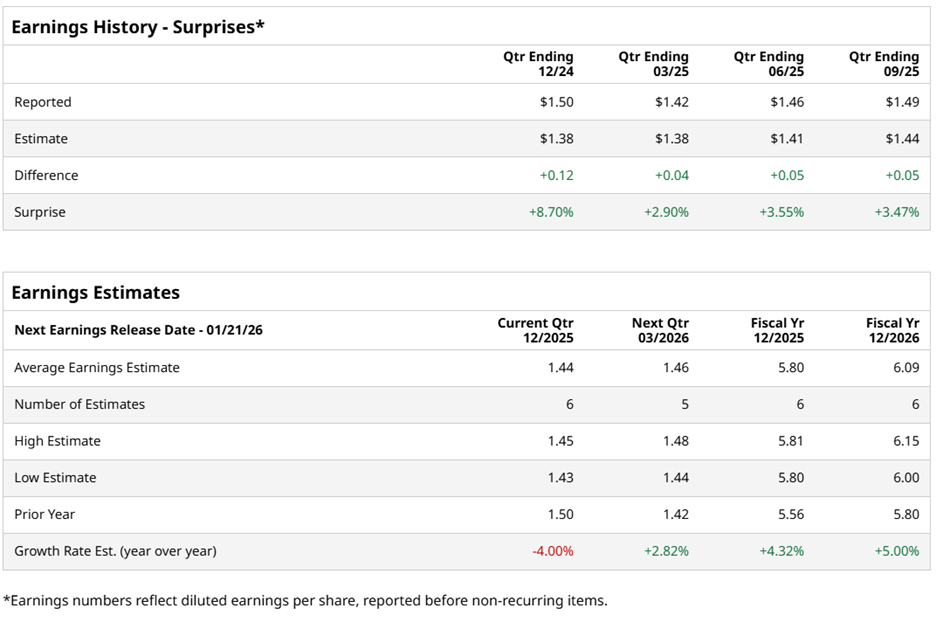

Ahead of the results, Wall Street expects diluted EPS of $1.44 for the quarter, down 4% from last year’s $1.50, signaling modest near-term pressure. Still, Prologis has exceeded EPS estimates in each of the past four quarters, reinforcing confidence in management’s ability to navigate cyclical pressures.

Operational momentum remains evident as on Oct. 15, Prologis reported fiscal 2025 third-quarter results that drove shares up nearly 6.3% intra-day. The company posted EPS of $0.82 and core FFO of $1.49, up 4.2% year over year, while revenue climbed 8.7% to $2.2 billion, reflecting durable demand.

Moreover, strong industrial demand lifted portfolio occupancy to 95.3%, while same-store NOI rose 3.9% on a net-effective basis and 5.2% on a cash basis.

Analysts project the strength to persist. Diluted EPS for fiscal 2025 is forecasted to rise 4.3% year over year to $5.80, followed by another 5% increase in fiscal 2026 to $6.09.

The market has rewarded Prologis’ consistency. Over the past 52 weeks, PLD stock advanced 25.5%, while year-to-date (YTD) gains reached 20.4%. By comparison, the S&P 500 Index ($SPX) rose 16.5% over the last year and 16.2% YTD, leaving PLD stock firmly ahead.

The outperformance looks even sharper against the State Street Real Estate Select Sector SPDR ETF (XLRE). The ETF delivered only marginal gains over the past 52 weeks and slipped slightly YTD, underscoring how decisively PLD has outpaced both its sector peers and the wider equity market.

Portfolio optimization further strengthens Prologis’ story. On Dec. 10, PLD shares rose 1.8% intraday after FIBRA Prologis, a leading owner and operator of Class-A industrial real estate in Mexico, acquired three Prologis properties in Monterrey, Toluca, and Ciudad Juarez for $67.1 million, including closing costs.

The fully occupied properties serve tenants in the sporting goods, consumer packaged goods, and logistics sectors, allowing Prologis to unlock value from mature assets, redeploy capital into higher-growth opportunities, and enhance portfolio returns while preserving exposure to key logistics markets.

Analyst sentiment remains steady, with a consensus rating of “Moderate Buy” holding strong for the past three months. Among 23 analysts, 13 rate PLD a “Strong Buy,” one maintains a “Moderate Buy” rating, and nine recommend “Hold.”

PLD’s mean price target of $131.58 represents potential upside of 3.4%. Meanwhile, the Street-high target of $146 implies a 14.8% upside, highlighting meaningful appreciation potential if execution and leasing momentum remain intact.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Google Launches Gemini 3 Flash, Should You Buy, Sell, or Hold GOOGL Stock?

- Amazon Could Invest $10 Billion in OpenAI. Should You Invest in AMZN Stock First?

- Holiday Trading, Inflation Data and Other Key Things to Watch this Week

- Analysts Are Hot on the Foldable iPhone. Should You Buy AAPL Stock Before Apple’s Next Big Product Launch?