Headquartered in Memphis, Tennessee, AutoZone, Inc. (AZO) operates about 7,353 stores, positioning itself as a leading retailer and distributor of automotive parts for cars, SUVs, vans, and light-duty trucks. With a market capitalization of roughly $65.7 billion, the company sits in “large-cap” territory and supports a wide customer base through a strong digital and commercial distribution network.

The company’s ecosystem spans autozone.com for retail customers, autozonepro.com for commercial buyers, ALLDATA repair and shop-management software, and detailed product resources via duralastparts.com.

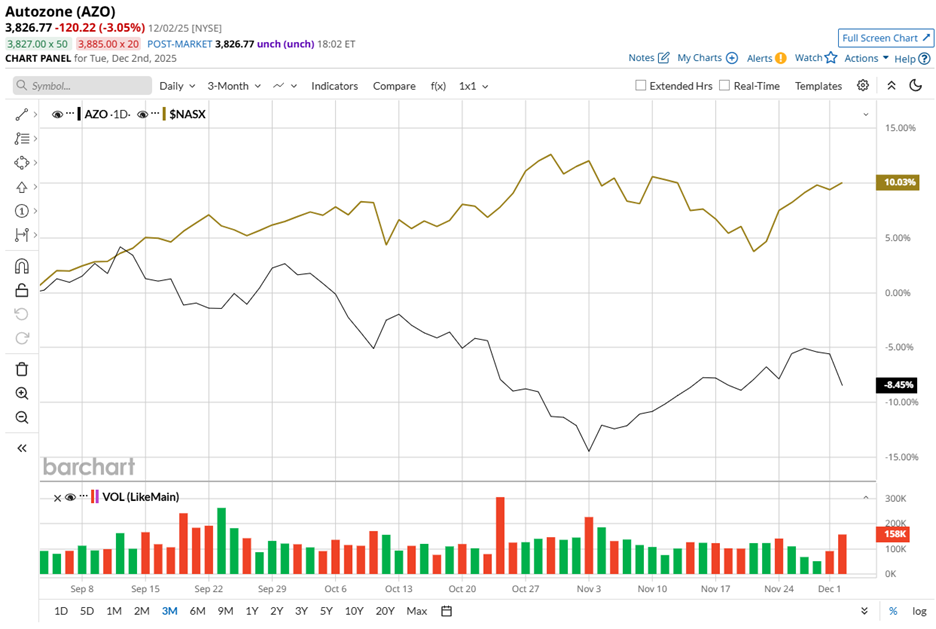

AZO shares currently trade 12.8% below their September high of $4,388.11, reflecting a period of near-term pressure. In fact, the stock has declined 8.5% over the past three months, noticeably lagging the Nasdaq Composite’s ($NASX) 10% gain.

However, AZO’s longer-term trend remains solid. The stock has surged 20.4% over the past 52 weeks, closely paralleling the Nasdaq’s 20.7% advance. Year-to-date (YTD), AZO is up 19.5%, nearly matching the Nasdaq’s 21.3% rise and demonstrating the company’s ability to maintain competitive momentum across broader cycles.

The stock has stayed below its 50-day moving average of $3,935.71 since mid-Oct, with only a brief lift at Nov-end. It also dipped under the 200-day moving average of $3,818.27 during this period but regained it by Nov-end, indicating strengthening buying interest and early signs of trend stabilization.

AZO shares declined nearly 3.1% on Tuesday, Dec 2, after Morgan Stanley (MS) pointed to margin pressures from tariffs and rising operating expenses. The firm noted that higher imported-goods costs and increased SG&A spending could challenge near-term profitability, though it also recognized that long-term industry trends remain favorable for AutoZone.

Moreover, in Q4 fiscal 2025, the company’s commercial segment outpaced retail growth, supported by stronger inventory availability and faster delivery. Market share gains, beneficial weather, and continued expansion in Mexico and Brazil helped counter tariff-driven costs and a non-cash LIFO charge.

These factors have reinforced management’s confidence, encouraging ongoing investment in stores, inventory, and technology to sustain long-term momentum.

For perspective, AZO’s rival BorgWarner Inc. (BWA) gained 25.9% over the past 52 weeks and approximately 36% YTD, underscoring competitive strength across the broader automotive ecosystem.

Despite the short-term pressure on AZO’s share price, analysts remain decisively positive on the stock. Among 28 analysts, the consensus rating stands at “Strong Buy” and the average price target of $4,537.42 indicates potential upside of 18.6% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.