Valued at a market cap of $21 billion, International Paper Company (IP) is a global leader in fiber-based packaging, pulp, and paper products, with operations spanning North America, Latin America, Europe, North Africa, and the Middle East. Headquartered in Tennessee, the company primarily serves industrial and consumer markets through its corrugated packaging and cellulose fibers businesses.

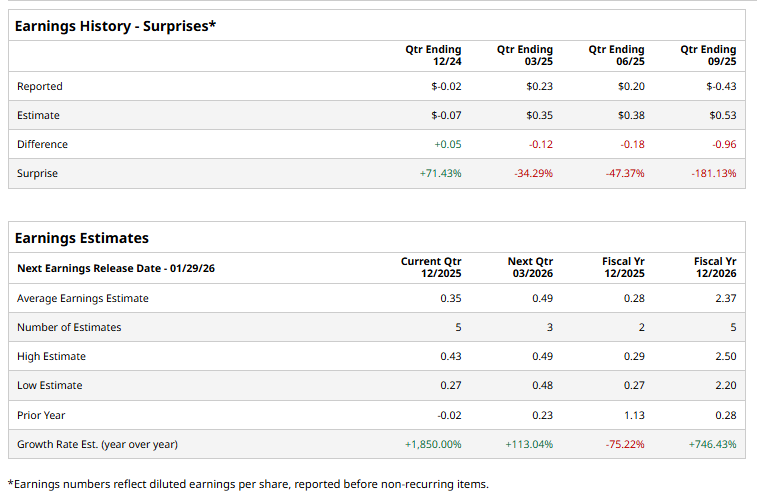

The company is expected to release its fiscal Q4 2025 results before the market opens on Thursday, Jan. 29. Ahead of this event, analysts project International Paper to report an adjusted EPS of $0.35, a significant rise from a loss of $0.02 in the year-ago quarter. However, it has failed to surpass Wall Street's bottom-line estimates in three of the last four quarterly reports while exceeding on another occasion.

For fiscal 2025, analysts forecast the global paper and packaging company to report adjusted EPS of $0.28, down 75.2% from $1.13 in fiscal 2024. On the bright side, its adjusted EPS is expected to surge 746.4% annually to $2.37 in fiscal 2026.

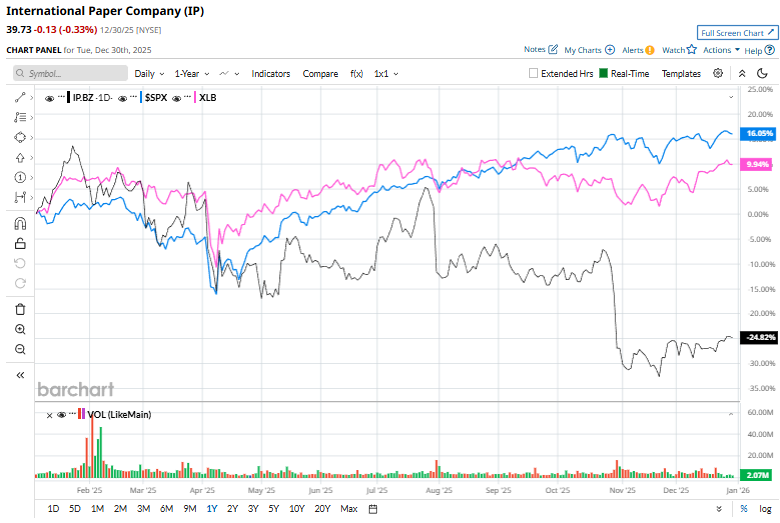

Shares of International Paper have fallen 26% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 16.8% gain and the Materials Select Sector SPDR Fund's (XLB) 9.1% rise over the same time frame.

Over the past year, investors have been discouraged by IP’s sluggish long-term revenue growth, a steady erosion in free cash flow margins that signals rising capital intensity, and declining returns on invested capital, suggesting fewer attractive reinvestment opportunities. Together, these factors have eroded confidence in IP’s ability to deliver sustainable, value-accretive growth, resulting in prolonged underperformance in the stock.

Analysts' consensus view on IP stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 13 analysts covering the stock, eight suggest a "Strong Buy," one gives a "Moderate Buy," three recommend a "Hold," and the last analyst goes with a "Strong Sell." The average analyst price target for International Paper is $48.07, indicating a potential upside of 21% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart