GE Vernova Inc. (GEV) is a global energy company with its headquarters in Cambridge, Massachusetts. GE Vernova is innovating in power, renewable energy, digital, and energy services businesses. The company operates through three segments: Power, Wind, and Electrification. GE Vernova’s market cap stands around $171.9 billion.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and GE Vernova fits this criterion perfectly. GE Vernova is distinguished by its leadership in renewable energy and power infrastructure. With its large installed base and its ongoing investments in manufacturing, grid infrastructure and technology innovation, GE Vernova is positioned to play a central role in global energy transition and power-generation markets.

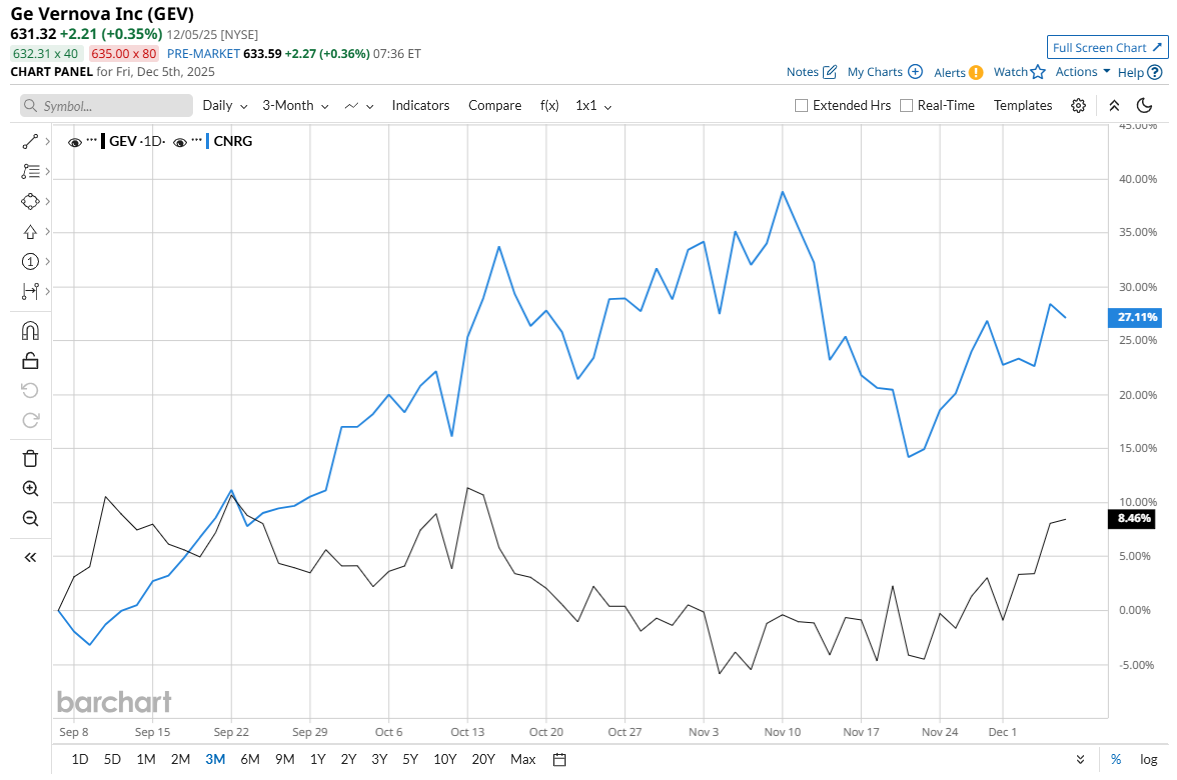

GEV is 6.8% down from its 52-week high of $677.29 reached on July 31. Shares are up 8.5% over the past three months, underperforming the broader SPDR Kensho Clean Power ETF’s (CNRG) 27.1% rise in the same period.

However, the stock has gained 81.4% over the past year and 91.9% on a year-to-date (YTD) basis, outperforming CNRG’s 50.4% returns over the past 52 weeks and 59% YTD.

GEV has been trading largely above the 200-day moving average over the past year. Also, the stock mostly traded above the 50-day moving average except for some fluctuations and trading below the line in October and November.

GE Vernova’s stock has gained momentum in 2025 largely due to strengthening fundamentals and rising demand across multiple segments. Moreover, GE Vernova won its first onshore wind repower contract outside the U.S. (with Taiwan Power Company), signaling potential growth and reinforcing its global footprint.

At the same time, surging demand for electricity especially driven by the expansion of data centers and AI-powered infrastructure, is pushing up demand for power generation and grid equipment, areas where GE Vernova is well positioned.

To emphasize the stock’s outperformance, GEV’s rival, Constellation Energy Corporation (CEG), has delivered 43.4% returns over the past year and 62.6% this year.

The stock has a consensus rating of “Moderate Buy” from the 28 analysts covering it, and the mean price target of $681.96 suggests an upside potential of 8.1%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart