As cloud computing enters its next growth phase driven by artificial intelligence (AI) workloads, investors are becoming more selective about where value truly lies. While most attention gravitates toward hyperscalers like Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL), some mid-sized cloud platforms are quietly strengthening their competitive position. One such $50 cloud stock is DigitalOcean (DOCN) which is delivering faster growth, rising profit and surging AI-driven demand.

Here's what investors may want to know about DOCN stock.

AI Momentum Is Fueling DigitalOcean's Business

DigitalOcean is a cloud computing company that helps developers and businesses run applications and websites on the internet without having to own or manage physical servers. It is especially popular with developers, startups, and digital-native businesses because its platform is simple and more affordable than large cloud providers.

In the third quarter of 2025, DigitalOcean reported revenue of $230 million, up 16% year-over-year (YOY) and marking its “highest growth since Q3 2023.” The company also generated its highest organic incremental annual recurring revenue (ARR) ever at $44 million, bringing total ARR to $919 million. Furthermore, profitability improved, with a 60% gross margin and a 43% adjusted EBITDA margin. Management pointed out that this performance exceeded internal revenue and profitability targets, reflecting strong execution across the business.

DigitalOcean's largest clients are rapidly expanding, which is a critical driver of growth. Revenue from clients paying more over $100,000 per year increased 41% YOY and now accounts for 26% of total revenue. Growth accelerates further at the high end, with customers with an annual run rate of more than $500,000 growing 55% and those with an ARR of more than $1 million growing 72% to $110 million in ARR. Notably, many customers signed eight-figure committed contracts after the quarter ended, significantly improving revenue visibility and boosting confidence about future growth.

DigitalOcean's unified Gradient AI agentic cloud is gaining popularity among AI- and digital-native enterprise customers. For the fifth quarter in a row, AI revenue more than doubled YOY, thanks to customers expanding inference workloads on the platform.

Management emphasized significant adoption at both the AI infrastructure and AI platform layers, with customers adopting GPU droplets, inference-optimized performance, and integrated tools that blend AI and general-purpose cloud workloads. Over 19,000 AI agents have been generated on the platform to date, with over 7,000 already in production. Furthermore, new product launches such as Network File Storage, Spaces Cold Storage, and automated database storage scaling are resonating with larger customers, driving revenue. More than 35% of customers with more than $100,000 in ARR have adopted at least one new product offered in the previous year. Net dollar retention was stable at 99%, up from 97% a year ago, indicating stronger customer expansion trends.

The Outlook Is Moving Higher

Demand for DigitalOcean's agentic cloud has surpassed present capacity, leading management to increase investment. The company has ordered extra GPU capacity and acquired around 30 megawatts (MWs) of new data center capacity that will go online in 2026. The company ended the quarter with cash and cash equivalents totaling $237 million and generated $85 million in adjusted free cash flow.

Due to these investments, management now expects 18% to 20% revenue growth in 2026, meeting its previously stated 2027 growth target a full year early, while sustaining 38% to 40% adjusted EBITDA margins and mid-to-high teens free cash flow margins. For the full-year 2025, DigitalOcean raised its guidance to $896 million to $897 million in revenue, representing approximately 15% growth, with adjusted free cash flow margins of 18% to 19%. Looking ahead, management remains confident in comfortably sustaining high-teens growth into 2026, supported by signed contracts, expanding capacity, and strong customer demand.

DigitalOcean appears to be entering a stronger growth phase in 2026 driven by AI adoption, expanding enterprise relationships, rising commitments from large customers and disciplined profitability. Analysts expect revenue and earnings to climb by 14.8% and 6.6%, respectively, for the full-year 2025.

Is DOCN Stock a Buy on Wall Street?

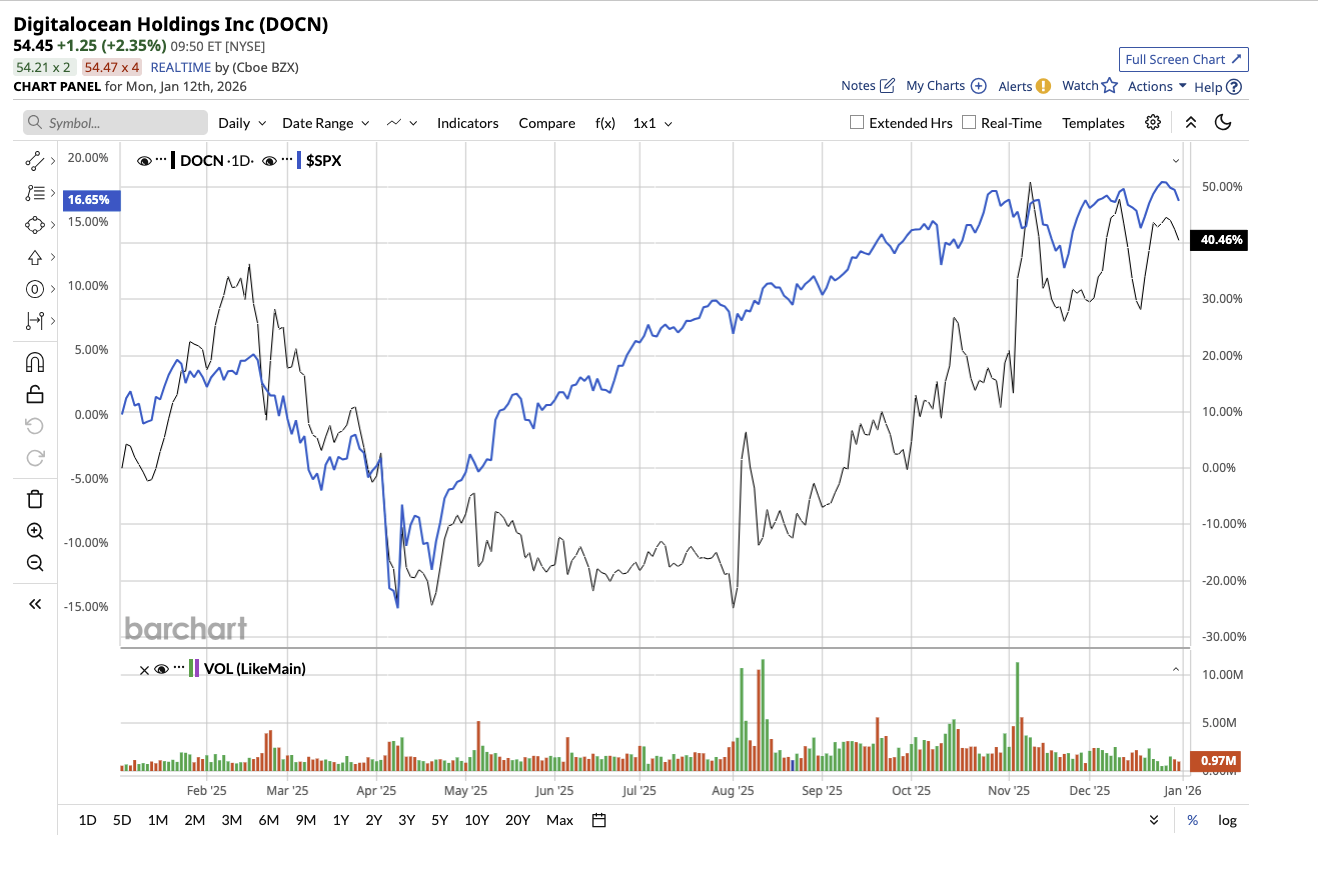

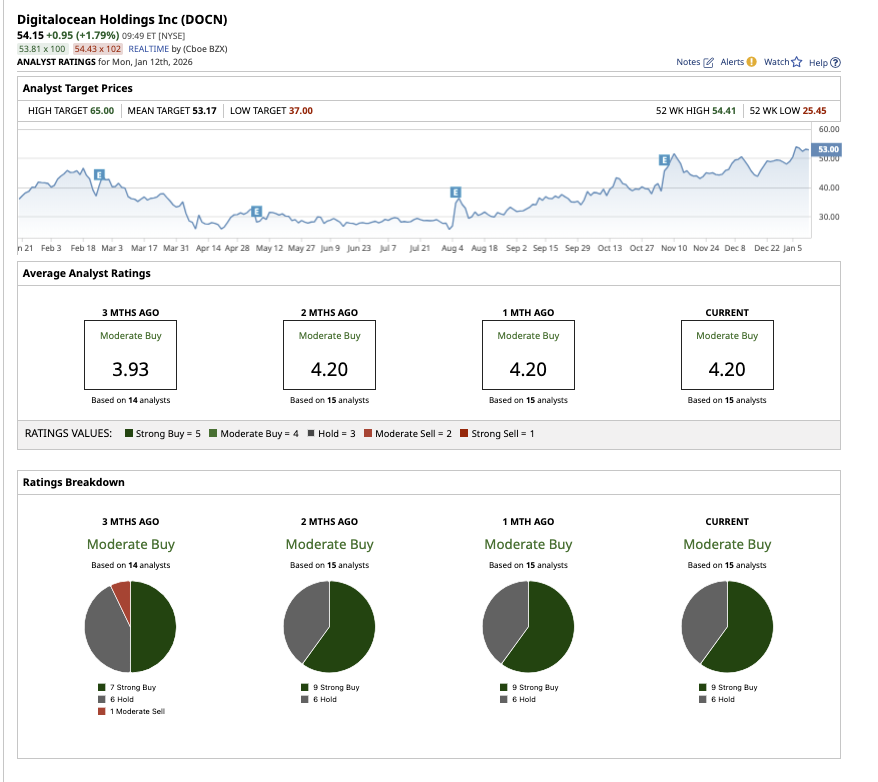

DOCN stock has surged by 63% in the last 52 weeks, outperforming the broader market. Shares are also up nearly 14% so far this year. Overall, Wall Street has a “Moderate Buy" consensus rating for DOCN stock. Out of the 15 analysts covering DigitalOcean, nine have a “Strong Buy” recommendation, and six suggest a “Hold.”

DOCN stock has already surpassed the average analyst price target of $53.17. However, the Street-high price estimate of $65 implies 19% potential upside over the next 12 months.

The Bottom Line on This $50 Growth Stock

The most interesting thing to note about DigitalOcean is that it is not trying to outmatch Amazon’s AWS, Google Cloud, or Microsoft Azure. Instead, it is competing with hyperscalers by focusing on what those platforms often lack — simplicity, transparent pricing, and a streamlined developer experience. The company is promoting its unified agentic cloud as a simple, cost-effective option for developers, AI-native startups, and digital-native companies. Its platform is intended to be straightforward, simple to start, administer, and scale, without the high learning curve associated with hyperscaler clouds. This is probably why investors are paying attention to this $50 growth stock.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Goldman Sachs Issues a Warning on Super Micro Computer Stock, Should You Risk Buying the Dip?

- This Analyst Still Thinks Apple Stock Is a Top Pick for 2026

- Nvidia Stock Could Be Just a Few Weeks Away from a Major Downside Catalyst. How to Play NVDA Here.

- Ignore the Apple Noise and Consider Buying Qualcomm Stock for 2026