Expeditors International of Washington, Inc. (EXPD) is a Fortune 500 logistics powerhouse based in Seattle that specializes in customized, tech-enabled supply chain solutions. Leveraging a seamlessly integrated global network of 331 locations across 109 countries, the company supports businesses with end-to-end logistics coordination across six continents.

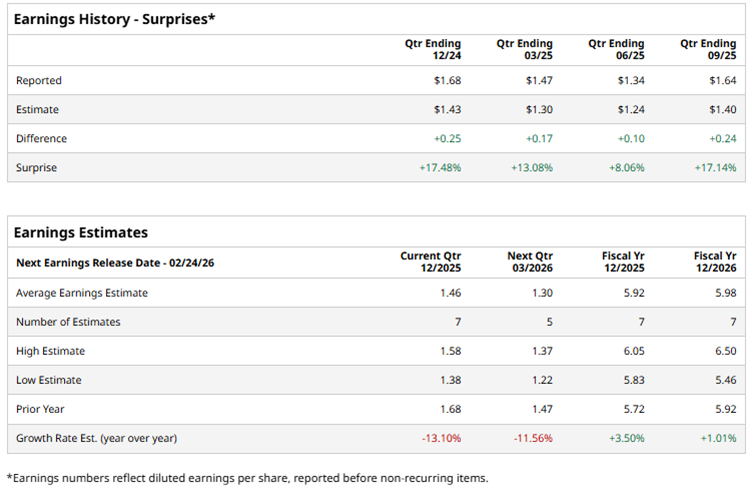

Currently standing at a market capitalization of about $22 billion, Expeditors is scheduled to report its fiscal 2025 fourth-quarter earnings by the end of February. And ahead of this event, Wall Street is projecting a 13.1% year-over-year drop in Q4 earnings to $1.46 per share.

Still, the company enters the results with credibility, having beaten analysts’ bottom-line estimates in each of the past four quarters. Looking further ahead, analysts expect the company’s full-year 2025 EPS to come in at $5.92, up 3.5% year over year, followed by another 1% rise to $5.98 in 2026.

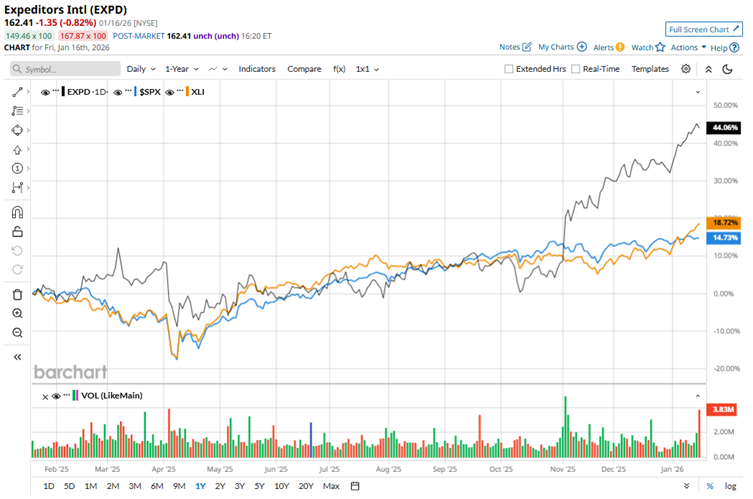

Expeditors captured investors’ attention in 2025 with a powerful rally, benefiting from continued optimism around global freight and logistics demand. Shares have skyrocketed 46% over the past year, delivering a commanding performance compared to the broader S&P 500 Index’s ($SPX) 16.9% return and the Industrial Select Sector SPDR Fund’s (XLI) 21.9% gain over the same period.

Expeditors’ latest quarterly report, posted last year in November, delivered a tale of contrasts. While Q3 revenue fell 4% annually to $2.9 billion, it still managed to beat forecasts of $2.7 billion, signaling resilient demand. Profitability stood out even more. EPS edged higher to $1.64, crushing expectations by over 17%. Adding to the positives, airfreight volumes climbed 4%. The company also rewarded shareholders with $725 million via buybacks and dividends.

Even after its strong price performance, Expeditors has failed to win over most analysts, earning a consensus “Hold” rating. Of the 15 analysts covering the stock, sentiment is split. Two recommend a “Strong Buy,” seven take a neutral “Hold” stance, one suggests a “Moderate Sell,” and five are more bearish with a “Strong Sell” rating.

Although EXPD is already trading above its average analyst price target of $138.85, the Street’s most bullish estimate of $179 implies that the stock could still have roughly 10.2% upside from current levels, leaving room for further gains

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?