The rapid rise of artificial intelligence (AI) has sparked serious doubts about the future of Adobe's (ADBE) business model and that of many software as a service (SaaS) companies. Traditionally, these firms charged based on user “seats.” Think of it like buying tickets for a movie theater: more people means more seats, which means more revenue for the company. This model worked well because as businesses grew and hired more employees, they needed more software licenses, leading to steady growth for the software providers.

However, AI upends this by automating tasks. Tools powered by AI, like smart assistants or automated systems, can handle more work without requiring extra human users. A company might use AI to automate tasks that used to take 10 employees, but now only needs two people to oversee the AI. This means fewer seats are needed, even as the company's output increases dramatically.

Investors are re-rating these SaaS stocks lower, fearing slower growth as AI efficiency replaces headcount-based scaling. Yet, is this truly the end for Adobe as an investment, if not as a company?

About Adobe Stock

Adobe is a leading software company specializing in creative and digital experience tools, including Photoshop, Illustrator, and Acrobat. Headquartered in San Jose, Calif., it primarily makes money through subscriptions to its Creative Cloud suite, charging based on user seats or licenses, which has driven consistent revenue from businesses expanding their teams. But AI has disrupted this by enabling automated content creation—generating images or videos with minimal human input—potentially reducing the need for multiple seats even as productivity soars.

Its stock has struggled, down 17% year-to-date (YTD), underperforming the S&P 500's 0.25% gain, and also 38% below its 52-week high of $465.70, reflecting the market's pessimism. Valuation metrics show Adobe trading at a trailing price-to-earnings (PE) ratio of 17.7, well below its three-year historical average of 38.2 and the technology sector average of 32. This suggests the market sees less growth potential.

The PEG ratio, which factors in expected earnings growth (PE divided by growth rate), is 0.95—lower than Adobe's historical median of 1.42, indicating better value when growth is considered. Forward price-to-sales stands at about 4.7, down from historical highs around 10 to 14, compared to the S&P median of 3.3 but below industry peers averaging 6 to 8 for software firms.

Overall, the stock appears undervalued relative to its history and sector, but this discount stems from AI eroding the premium once justified by reliable seat-based growth. The business may no longer command those multiples without adaptation.

Is There a Future for Adobe?

Adobe could stage a comeback by pivoting from seat-based pricing to models that capture AI's value, such as charging for outcomes like generated assets or usage metrics. The company is already integrating AI through tools like Firefly, its generative AI for images and videos, which enhances user productivity within its ecosystem. This positions Adobe to benefit from AI rather than just suffer disruption, turning potential threats into revenue streams via premium AI features or enterprise solutions.

To meet the AI challenge, Adobe is investing heavily in “control points”—critical areas like data security, identity verification, and AI orchestration—where it can maintain dominance. For example, by ensuring ethical AI use and seamless integration across creative workflows, Adobe aims to become indispensable in an AI-driven world. It's also exploring hybrid models combining software with physical infrastructure, such as AI-powered data centers, inspired by ideas from investors like Peter Thiel, who emphasize bridging digital and real-world gaps.

Bulls argue Adobe will prove bears wrong because its moat in creative software remains strong; AI amplifies rather than replaces human creativity, and Adobe's vast data trove from users fuels superior AI training. As companies adopt AI, demand for Adobe's tools could surge for oversight and refinement, leading to new growth. Recent earnings show revenue up despite stock woes, with AI adoption boosting margins. If Adobe successfully shifts to outcome-based pricing, scaling with AI efficiency, it could rebound strongly, rewarding patient investors in a transformed industry.

What Do Analysts Expect for ADBE Stock?

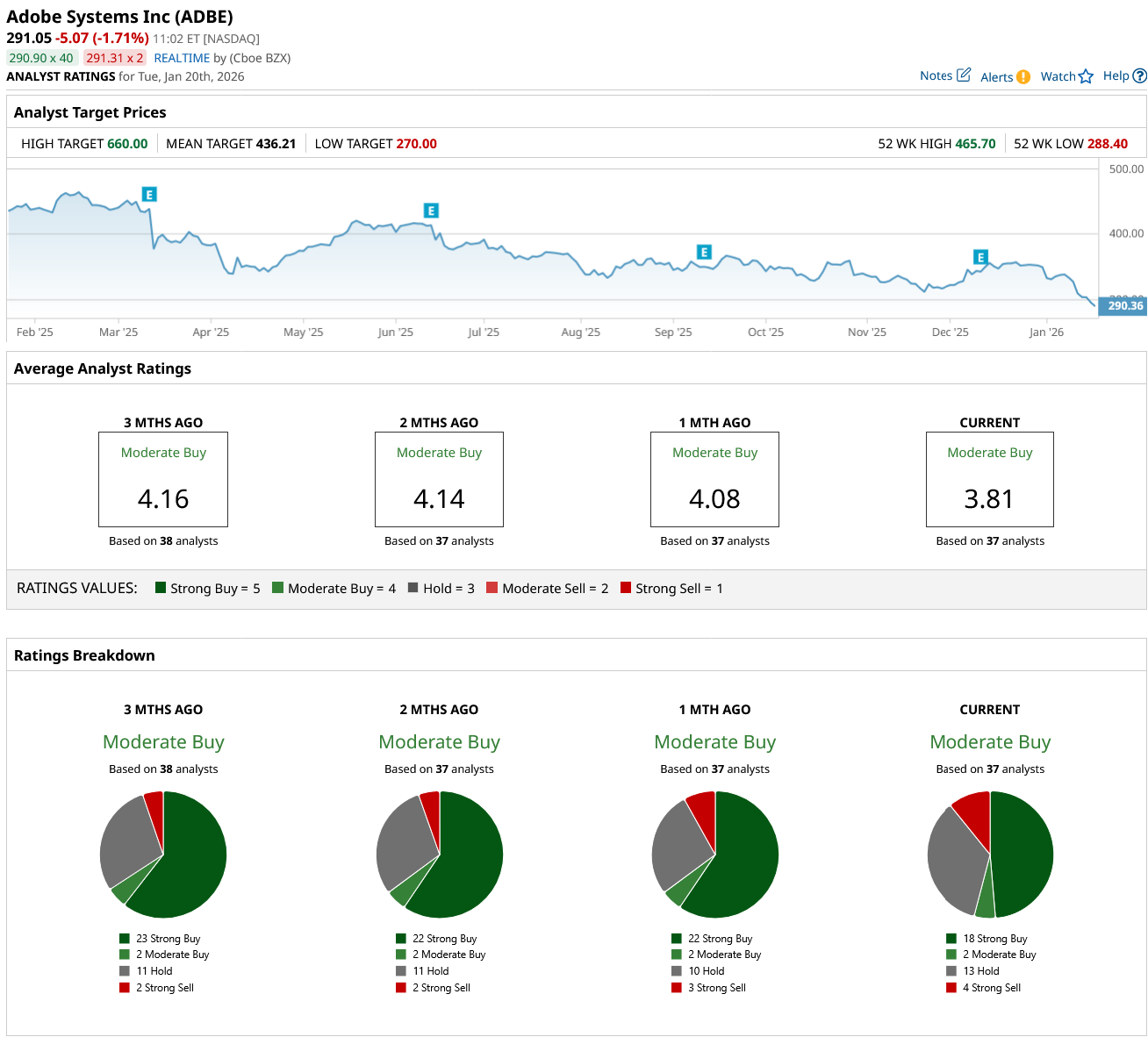

Analysts maintain a consensus “Moderate Buy” rating on ADBE stock, based on coverage from 37 analysts. There are 18 “Strong Buy” ratings, two “Moderate Buy,” 13 “Hold,” and four “Strong Sell” ratings, fairly reflecting the uncertainty the market as a whole has about its stock.

The overall score of 3.81 reflects optimism, with more buys than holds or sells, though over the past three months, the consensus has softened slightly, dropping from 4.16 amid AI concerns that prompted some downgrades.

Its mean price target of $436.21 represents a potential upside of 50% from its current price of $291, implying significant recovery potential as analysts bet on Adobe's AI adaptations driving future earnings growth.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Amazon Too Cheap Ahead of Earnings? Put Yields are High, Implying AMZN Stock Could Rally

- Cathie Wood May Be Trimming Her Tesla Stake, But She Still Thinks the Company Is on Track for 70%-80% Gross Margins

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up

- Trump Bought CoreWeave’s Debt. What Does That Mean for CRWV Stock?